filmov

tv

What makes a good dividend stock?

Показать описание

These techniques could help you find dividend stocks you can keep in your portfolio for years to come.

Our Dividend investing series is here to help give you the knowledge you need to feel empowered to build wealth and income through the stock market.

⌚ Timestamps:

0:00 - Intro

0:57 - Qualitative characteristics

4:53 - Quantitative characteristics

6:06 - Dividend growth rate

7:07 - Payout ratio

8:16 - Price-to-earnings ratio

----------------------------------------------

🍿 Enjoyed the video? There’s more:

----------------------------------------------

📲 Trading 212 on Social Media:

----------------------------------------------

Download our free mobile apps for iOS or Android:

#Stocks #Investing #dividend #Trading212 #Trading #Equities #dividends

When investing, your capital is at risk. Investments can fall and rise and you may get back less than you invested. The information contained within the video was correct at the time of recording but may have since changed.

Our Dividend investing series is here to help give you the knowledge you need to feel empowered to build wealth and income through the stock market.

⌚ Timestamps:

0:00 - Intro

0:57 - Qualitative characteristics

4:53 - Quantitative characteristics

6:06 - Dividend growth rate

7:07 - Payout ratio

8:16 - Price-to-earnings ratio

----------------------------------------------

🍿 Enjoyed the video? There’s more:

----------------------------------------------

📲 Trading 212 on Social Media:

----------------------------------------------

Download our free mobile apps for iOS or Android:

#Stocks #Investing #dividend #Trading212 #Trading #Equities #dividends

When investing, your capital is at risk. Investments can fall and rise and you may get back less than you invested. The information contained within the video was correct at the time of recording but may have since changed.

What makes a good dividend stock?

Are Dividend Investments A Good Idea?

The Dangers of Dividend Investing: 5 MUST KNOWS Before Buying Dividend Stocks!

8 Dividend Stocks That Pay Me $660+ Per Month

How to make dividend income | 5 great assets to own

7 Top Dividend Stocks That Pay Me $1,100 Per Month

How To Build A Monster Dividend Portfolio | Ep. 325

How Much I Made From Dividend Investing (1 Year Update)

How I’m Playing New Roundhill Fund RDTE | High Yield Dividend Investing QDTE XDTE | #Margin #FIRE

How Much I Make In Dividend Income from my $13,000 Portfolio

What are dividends? | Ankur Warikoo Hindi video| Dividend Stocks and Investing | Stock market basics

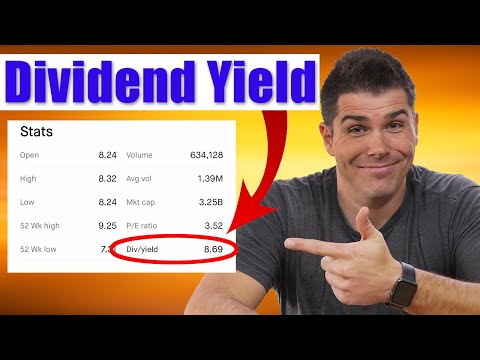

Dividend Yield Explained (For Beginners)

How to Build a Dividend Stock Portfolio With $100 (Free Course)

I Wish I Knew This BEFORE Investing in Dividend Stocks

The Power Of Dividend Growth

7 Dividend Stocks That Pay Me $1,000 Per Month | Do This Now

The Dividend Snowball ➜ Living off Dividends fast! (faster than you think)

How To Choose Profitable Dividend Stocks [Under 60 Seconds]

The Problem With Dividend Stocks 🤯

Why I Invest for High Dividend Income Over Growth

How to make 1L in dividends?

2 GREAT Monthly Dividend Income Strategies | 12 HIGH Dividend Stocks In 2023 | Rahul Jain

The good, the bad and the ugly of dividend investing 🤠

7 Dividend Stocks That Pay Me $500+ Per Month

Комментарии

0:10:03

0:10:03

0:03:38

0:03:38

0:11:39

0:11:39

0:13:18

0:13:18

0:18:12

0:18:12

0:20:05

0:20:05

0:43:04

0:43:04

0:11:54

0:11:54

0:10:36

0:10:36

0:00:53

0:00:53

0:16:44

0:16:44

0:04:42

0:04:42

0:20:16

0:20:16

0:13:39

0:13:39

0:08:38

0:08:38

0:13:12

0:13:12

0:13:54

0:13:54

0:10:03

0:10:03

0:00:48

0:00:48

0:11:15

0:11:15

0:13:03

0:13:03

0:12:52

0:12:52

0:01:00

0:01:00

0:15:07

0:15:07