filmov

tv

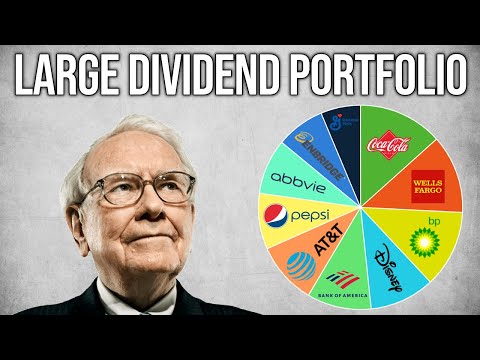

How to Build a Dividend Stock Portfolio With $100 (Free Course)

Показать описание

In this video, I go over how you can start a dividend stock portfolio and begin earning passive income. This is a free course that will go over everything you need to know about dividend stocks, as well as how you can do research and buy dividend stocks.

Attend my daily FREE Stock Investing Webinar (I'll teach you how to invest in stocks):

Free stuff 💰:

^This offer expires April 30th, 2024 so get it while you can!!

► Join my FREE newsletter:

VettaFi Dividend ETF List:

Be sure to watch through until the very end of the video for a full explanation and walkthrough on all the concepts I talk about. My goal with this video is to give you guys a basic understanding of how the game of investing for dividends works and how you can make a profit from it!

If you found some value, please SHARE this video with a friend who could benefit, and LIKE and subscribe for more videos like this! Thanks for watching and remember to always do your due diligence. I recommend doing at least 1 hour of research prior to investing in anything whether it be stocks, crypto, real estate, etc.

Happy investing and stay safe!

-Charlie

#DIVIDENDS #STOCKS #PASSIVEINCOME

Timeline:

0:00 - Intro

0:14 - What Is A Dividend Stock?

0:38 - How Do They Work?

1:06 - Why Dividend Investing?

1:42 - The Pros

3:05 - The Cons

3:55 - Examples

4:07 - The Process

4:28 - How To Open A Brokerage Account

4:44 - WeBull Walkthrough

5:03 - Robinhood Walkthrough

5:17 - MooMoo Walkthrough

5:49 - VettaFi Walkthrough

7:29 - WeBull App Walkthrough

8:19 - Safety

9:04 - Other Things To Consider...

9:18 - 10-Year Average Return

9:42 - Dividend Yield

10:19 - Diversification

10:49 - The Costs

11:34 - Total Return

11:48 - Earnings Per Share

12:09 - Setting Up Your Portfolio

12:29 - Buying Good Stocks

13:05 - Targeting Several Industries

13:39 - Financial Stability Over Growth

14:05 - Dividend Payout Ratios

15:06 - Dividend History

15:32 - Reinvesting Dividends

15:53 - Dividend Investing Strategies

16:42 - Dividend Traps

17:16 - Price To Earnings Ratio

17:48 - Free Cash Flow

18:05 - Debt To Equity Ratio

18:24 - Things To Remember

19:23 - Conclusion

We will cover topics like: best way to invest in dividend stocks, dividend stocks for beginners, guide for investing in dividend stocks, how to start a dividend portfolio, how to start investing in dividend stocks

Disclaimer: Some of the links above may be affiliate links, which means that if you click on them I may receive a small commission. The commission is paid by the retailers, at no cost to you, and this helps to support our channel and keep our videos free. Thank you!

In addition, I am not a financial advisor. Charlie Chang does not provide tax, legal or accounting advice. The ideas presented in this video are for entertainment purposes only. Please do your own due diligence before making any financial decisions.

Attend my daily FREE Stock Investing Webinar (I'll teach you how to invest in stocks):

Free stuff 💰:

^This offer expires April 30th, 2024 so get it while you can!!

► Join my FREE newsletter:

VettaFi Dividend ETF List:

Be sure to watch through until the very end of the video for a full explanation and walkthrough on all the concepts I talk about. My goal with this video is to give you guys a basic understanding of how the game of investing for dividends works and how you can make a profit from it!

If you found some value, please SHARE this video with a friend who could benefit, and LIKE and subscribe for more videos like this! Thanks for watching and remember to always do your due diligence. I recommend doing at least 1 hour of research prior to investing in anything whether it be stocks, crypto, real estate, etc.

Happy investing and stay safe!

-Charlie

#DIVIDENDS #STOCKS #PASSIVEINCOME

Timeline:

0:00 - Intro

0:14 - What Is A Dividend Stock?

0:38 - How Do They Work?

1:06 - Why Dividend Investing?

1:42 - The Pros

3:05 - The Cons

3:55 - Examples

4:07 - The Process

4:28 - How To Open A Brokerage Account

4:44 - WeBull Walkthrough

5:03 - Robinhood Walkthrough

5:17 - MooMoo Walkthrough

5:49 - VettaFi Walkthrough

7:29 - WeBull App Walkthrough

8:19 - Safety

9:04 - Other Things To Consider...

9:18 - 10-Year Average Return

9:42 - Dividend Yield

10:19 - Diversification

10:49 - The Costs

11:34 - Total Return

11:48 - Earnings Per Share

12:09 - Setting Up Your Portfolio

12:29 - Buying Good Stocks

13:05 - Targeting Several Industries

13:39 - Financial Stability Over Growth

14:05 - Dividend Payout Ratios

15:06 - Dividend History

15:32 - Reinvesting Dividends

15:53 - Dividend Investing Strategies

16:42 - Dividend Traps

17:16 - Price To Earnings Ratio

17:48 - Free Cash Flow

18:05 - Debt To Equity Ratio

18:24 - Things To Remember

19:23 - Conclusion

We will cover topics like: best way to invest in dividend stocks, dividend stocks for beginners, guide for investing in dividend stocks, how to start a dividend portfolio, how to start investing in dividend stocks

Disclaimer: Some of the links above may be affiliate links, which means that if you click on them I may receive a small commission. The commission is paid by the retailers, at no cost to you, and this helps to support our channel and keep our videos free. Thank you!

In addition, I am not a financial advisor. Charlie Chang does not provide tax, legal or accounting advice. The ideas presented in this video are for entertainment purposes only. Please do your own due diligence before making any financial decisions.

Комментарии

0:20:16

0:20:16

0:43:04

0:43:04

0:17:08

0:17:08

0:24:11

0:24:11

0:03:38

0:03:38

0:31:47

0:31:47

0:15:22

0:15:22

0:13:15

0:13:15

0:13:21

0:13:21

0:15:47

0:15:47

0:11:17

0:11:17

0:09:02

0:09:02

0:17:48

0:17:48

0:08:59

0:08:59

0:17:58

0:17:58

0:10:48

0:10:48

0:16:58

0:16:58

0:32:51

0:32:51

0:09:54

0:09:54

0:13:54

0:13:54

0:36:03

0:36:03

0:09:51

0:09:51

0:12:56

0:12:56

0:12:16

0:12:16