filmov

tv

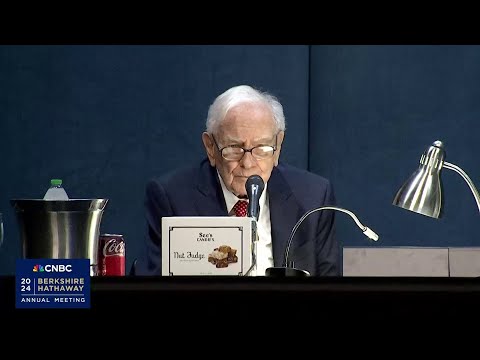

Should You Copy Warren Buffett?

Показать описание

Yes, you absolutely should if you've done your homework and believe in the same companies that Warren Buffett has invested in. Same goes for Charlie Munger. No shame in being a copycat! Add me on Instagram: michellemarki

A lot of times in investing, we feel lucky and happy if we can manage to get a 10x (10 bagger) or 100x (100 bagger) on our investments. But if were so lucky to have invested in Berkshire Hathaway in the early 1960s, we would have had a multi-thousand bagger! That was some incredible hockey stick compounding!

Pretty much no other company's performance can compare to Berkshire's long term investing track record. To put the power of compounding in perspective, for 55 years between 1965 and 2020, Berkshire compounded at 20% per year on average versus only 10.2% per year on average for the S&P 500. Berkshire returned over 2,800,000%+ while the S&P 500 returned 23,500%+.

All this amazing stock market performance begs the question, so why not copy Warren Buffett?

We could all look at Berkshire's 13F quarterly report of all of its publicly traded US equity holdings that is filed with the SEC and is publicly accessible.

The 13F filings could be a gold mine of stock ideas that we may want to consider as potential investments we'd also like to make, but of course we need to do our own research and not just blindly copy what any other investor is also in.

Although there's been some under-performance in recent years, I still think for the long term Berkshire Hathaway could be really strong.

Warren Buffett and Charlie Munger have many disciples, including Mohnish Pabrai and Phil Town who encourage people to clone these legendary GOAT investors Buffett & Munger.

While the Internet is busy debating "should you copy Warren Buffett?" -- Buffett is busy cloning himself!

Buffett is wasting no time repurchasing Berkshire Hathaway, so it makes you wonder if it's good enough for him, why isn't it good enough for other people?

Evidence for potentially copying Buffett is in this study called "Imitation is the Sincerest Form of Flattery: Warren Buffett and Berkshire Hathaway." This study found that contrary to the popular belief that Buffett is a "value stock investor," Berkshire actually primarily invests in large-cap growth stocks rather than value stocks.

If you made a copycat portfolio and invested in the same equities in the month after Berkshire's holdings were publicly disclosed, you still beat the S&P 500! By mimicking Buffett's investments and buying either Berkshire shares (11.4% over the S&P's return) or Berkshire's equity holdings (10.75% over the S&P's return), you still outperformed the S&P 500 from 1976-2006.

There are many naysayers who give you many reasons not to copy Buffett or Berkshire Hathaway, but I provide facts and studies to show why it could be a good idea if something like Berkshire Hathaway or any of its equity holdings is on sale in the stock market.

Some of these naysayers say "it's impossible to replicate" what Buffett did. I strongly disagree. We could buy other under-valued stocks and do our homework to figure out if companies we're interested in buying have durable, competitive advantages (aka moats).

One of the naysayers' arguments is about how Buffett wasn't planning for retirement or an annual vacation. To this I say, he didn't have to because he had already reached financial independence and could have retired early by his 20s.

Aside from Berkshire Hathaway stock itself, consider if you are also interested in some of the same companies within the top holdings of Buffett (Berkshire) and Munger (Daily Journal Corporation), these are the picks that they really believe in. Ted Weschler and Todd Combs are like Buffett's sidekick investors who tend to manage the smaller holdings of Berkshire while Buffett controls the top holdings.

But don't force it if they don't resonate with you. And past performance is no guarantee of future performance.

In conclusion: looking at 13F filings might give us some potential ideas of stocks we might want to copy from some of these legendary GOATs of investing.

I look forward to making more investor friends! Please like and subscribe if you learned something or enjoyed my video. Thank you! :)

---

---

Disclaimers: This content is for entertainment, information, education purposes only. Michelle is not a financial advisor and is not providing financial, investment, trading, tax advice, or recommendations. Please consult with a professional financial advisor with a fiduciary duty if you need help in your situation. All trademarks, logos, and brand names belong to their respective owners.

A lot of times in investing, we feel lucky and happy if we can manage to get a 10x (10 bagger) or 100x (100 bagger) on our investments. But if were so lucky to have invested in Berkshire Hathaway in the early 1960s, we would have had a multi-thousand bagger! That was some incredible hockey stick compounding!

Pretty much no other company's performance can compare to Berkshire's long term investing track record. To put the power of compounding in perspective, for 55 years between 1965 and 2020, Berkshire compounded at 20% per year on average versus only 10.2% per year on average for the S&P 500. Berkshire returned over 2,800,000%+ while the S&P 500 returned 23,500%+.

All this amazing stock market performance begs the question, so why not copy Warren Buffett?

We could all look at Berkshire's 13F quarterly report of all of its publicly traded US equity holdings that is filed with the SEC and is publicly accessible.

The 13F filings could be a gold mine of stock ideas that we may want to consider as potential investments we'd also like to make, but of course we need to do our own research and not just blindly copy what any other investor is also in.

Although there's been some under-performance in recent years, I still think for the long term Berkshire Hathaway could be really strong.

Warren Buffett and Charlie Munger have many disciples, including Mohnish Pabrai and Phil Town who encourage people to clone these legendary GOAT investors Buffett & Munger.

While the Internet is busy debating "should you copy Warren Buffett?" -- Buffett is busy cloning himself!

Buffett is wasting no time repurchasing Berkshire Hathaway, so it makes you wonder if it's good enough for him, why isn't it good enough for other people?

Evidence for potentially copying Buffett is in this study called "Imitation is the Sincerest Form of Flattery: Warren Buffett and Berkshire Hathaway." This study found that contrary to the popular belief that Buffett is a "value stock investor," Berkshire actually primarily invests in large-cap growth stocks rather than value stocks.

If you made a copycat portfolio and invested in the same equities in the month after Berkshire's holdings were publicly disclosed, you still beat the S&P 500! By mimicking Buffett's investments and buying either Berkshire shares (11.4% over the S&P's return) or Berkshire's equity holdings (10.75% over the S&P's return), you still outperformed the S&P 500 from 1976-2006.

There are many naysayers who give you many reasons not to copy Buffett or Berkshire Hathaway, but I provide facts and studies to show why it could be a good idea if something like Berkshire Hathaway or any of its equity holdings is on sale in the stock market.

Some of these naysayers say "it's impossible to replicate" what Buffett did. I strongly disagree. We could buy other under-valued stocks and do our homework to figure out if companies we're interested in buying have durable, competitive advantages (aka moats).

One of the naysayers' arguments is about how Buffett wasn't planning for retirement or an annual vacation. To this I say, he didn't have to because he had already reached financial independence and could have retired early by his 20s.

Aside from Berkshire Hathaway stock itself, consider if you are also interested in some of the same companies within the top holdings of Buffett (Berkshire) and Munger (Daily Journal Corporation), these are the picks that they really believe in. Ted Weschler and Todd Combs are like Buffett's sidekick investors who tend to manage the smaller holdings of Berkshire while Buffett controls the top holdings.

But don't force it if they don't resonate with you. And past performance is no guarantee of future performance.

In conclusion: looking at 13F filings might give us some potential ideas of stocks we might want to copy from some of these legendary GOATs of investing.

I look forward to making more investor friends! Please like and subscribe if you learned something or enjoyed my video. Thank you! :)

---

---

Disclaimers: This content is for entertainment, information, education purposes only. Michelle is not a financial advisor and is not providing financial, investment, trading, tax advice, or recommendations. Please consult with a professional financial advisor with a fiduciary duty if you need help in your situation. All trademarks, logos, and brand names belong to their respective owners.

Комментарии

0:14:24

0:14:24

0:13:38

0:13:38

0:21:39

0:21:39

0:01:52

0:01:52

0:05:34

0:05:34

0:05:20

0:05:20

0:04:40

0:04:40

0:16:17

0:16:17

0:08:56

0:08:56

0:00:39

0:00:39

0:05:14

0:05:14

0:10:56

0:10:56

0:01:42

0:01:42

0:12:34

0:12:34

0:09:30

0:09:30

0:11:12

0:11:12

0:09:41

0:09:41

0:00:26

0:00:26

0:08:53

0:08:53

0:13:40

0:13:40

0:10:11

0:10:11

0:08:43

0:08:43

0:13:51

0:13:51

0:12:32

0:12:32