filmov

tv

My Husband and I Still Keep Our Finances Separated

Показать описание

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

My husband feels ATTACKED when I share my FEELINGS

My Husband and I Still Keep Our Finances Separated

How To Train Your Husband! 🧔🏾♂️ II STEVE HARVEY

she thought her husband wasn't home🤣#ongoing manga #the top couple is a bit sweet

A present for your CHEATING HUSBAND😳🎁 #shorts #couples

Telling my husband i'm pregnant 5 months postpartum #shorts

This girl Caught Her Husband Cheating On Her wedding day 😭❤️ #shorts

Telling my husband 'I feel sad' to see how he reacts #shorts

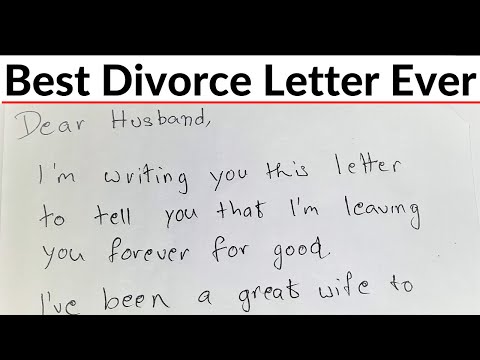

Wife Demands Divorce In Letter,Husband's Brilliant Reply Makes Her Regret Every Word|Revenge Le...

Here's What To Do If Your Husband Is Messaging His Ex

Mitski - Me And My Husband (Lyrics)

MY HUSBAND STEALS BREAST MILK

How Can I Regain My Husband's Trust After My Affair?

Mitski - Me and My Husband (Lyric Video)

How Can I Disagree with My Husband and Still Submit?

How I knew he was my husband | Married in 3 months

Pregnant wife turns around and sees her military husband for the first time in 8 months!❤️ #shorts...

His wife thought the husband was dead! #shorts

Lazy Husband & What To Do About It

“My Husband Chooses His Family Over Me” | Dr. Renu Kishore x Bonobology

I Divorced My Husband, This is How God is Helping Me Heal... (Testimony)

My Husband Doesn't Touch Me | 3 Reasons He Won't Touch You Anymore

Asking my Italian husband if he’d still love me if I was a toad 😂

Meet These Four Polyandrous Couples | Seeking Brother Husband | TLC

Комментарии

0:09:54

0:09:54

0:08:52

0:08:52

0:08:21

0:08:21

0:00:21

0:00:21

0:01:00

0:01:00

0:00:46

0:00:46

0:00:19

0:00:19

0:00:54

0:00:54

0:03:59

0:03:59

0:01:57

0:01:57

0:02:57

0:02:57

0:05:08

0:05:08

0:12:22

0:12:22

0:02:18

0:02:18

0:13:48

0:13:48

0:28:39

0:28:39

0:01:00

0:01:00

0:01:00

0:01:00

0:06:23

0:06:23

0:03:55

0:03:55

0:26:25

0:26:25

0:09:26

0:09:26

0:00:58

0:00:58

0:16:59

0:16:59