filmov

tv

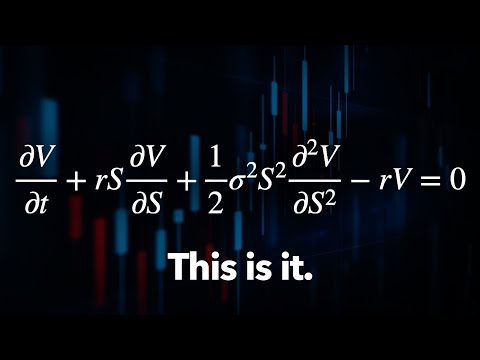

The Black-Scholes Formula Explained

Показать описание

★★ Save 10% on All Quant Next Courses with the Coupon Code: QuantNextYoutube10 ★★

★★ For students and graduates, we offer a 50% discount on all courses, please contact us if you are interested ★★

In this video, I will give an intuitive explanation of the famous Black-Scholes formulas used to price European call and put options through the decomposition of the payoff and the expected value of the option.

I will give a simple explanation of the different components of the Black-Scholes formula: N(d2), the probability that the option will be exercised, and N(d1) which incorporates as well by how far the option can be in-the-money.

0:00 Introduction

0:12 Black-Scholes Formula for European Calls and Puts

0:20 Option Payoff Decomposition

2:15 Stock Price Diffusion Process

2:36 Probability of being Exercised

3:31 N(d1) vs N(d2)

4:09 Expected Value Decomposition

#optionpricing, #quantitativefinance, #financeeducation, #derivatives, #quant, #quantnext

★★ For students and graduates, we offer a 50% discount on all courses, please contact us if you are interested ★★

In this video, I will give an intuitive explanation of the famous Black-Scholes formulas used to price European call and put options through the decomposition of the payoff and the expected value of the option.

I will give a simple explanation of the different components of the Black-Scholes formula: N(d2), the probability that the option will be exercised, and N(d1) which incorporates as well by how far the option can be in-the-money.

0:00 Introduction

0:12 Black-Scholes Formula for European Calls and Puts

0:20 Option Payoff Decomposition

2:15 Stock Price Diffusion Process

2:36 Probability of being Exercised

3:31 N(d1) vs N(d2)

4:09 Expected Value Decomposition

#optionpricing, #quantitativefinance, #financeeducation, #derivatives, #quant, #quantnext

Introduction to the Black-Scholes formula | Finance & Capital Markets | Khan Academy

Black Scholes Formula explained simply

Black Scholes Explained - A Mathematical Breakdown

The Black-Scholes Model EXPLAINED

The Easiest Way to Derive the Black-Scholes Model

Warren Buffett: Black-Scholes Formula Is Total Nonsense

Black Scholes Option Pricing Model Explained In Excel

The Trillion Dollar Equation

An intuitive explanation the Black Scholes' formula

The Black-Scholes Formula Explained

19. Black-Scholes Formula, Risk-neutral Valuation

Is the Black Scholes Actually Used in the Real World

Black-Scholes Option Pricing Model -- Intro and Call Example

Mastering the Black-Scholes Model: Essential Knowledge for Options Traders

How to interpret N(d1) and N(d2) in Black Scholes Merton (FRM T4-12)

Implied volatility | Finance & Capital Markets | Khan Academy

Black Scholes Model | What ist the Black Scholes Formula? | explained

Black Scholes Analysis for dummies - Understanding Nd2

Unlocking the Black-Scholes Model: Visualizing the Power of Options Trading in 60 Seconds

Black-Scholes Model of Option Pricing Explained - NY Institute of Finance

Black-Scholes in Python: Option Pricing Made Easy

Demystifying Finance The Black Scholes Formula Explained

Black-Scholes-Merton Model | NSE Option Pricing Strategy Simplified

What is the Black Scholes Model

Комментарии

0:10:24

0:10:24

0:03:40

0:03:40

0:14:03

0:14:03

0:10:40

0:10:40

0:09:53

0:09:53

0:15:54

0:15:54

0:09:23

0:09:23

0:31:22

0:31:22

0:05:48

0:05:48

0:05:52

0:05:52

0:49:52

0:49:52

0:08:29

0:08:29

0:13:39

0:13:39

0:00:59

0:00:59

0:14:12

0:14:12

0:05:00

0:05:00

0:05:55

0:05:55

0:19:02

0:19:02

0:00:59

0:00:59

0:02:58

0:02:58

0:12:22

0:12:22

0:00:54

0:00:54

0:05:26

0:05:26

0:04:20

0:04:20