filmov

tv

What Should My Ratio of Stocks to Bonds be Right Now?

Показать описание

What Should My Ratio of Stocks to Bonds be Right Now?

Did you miss the latest Ramsey Show episode? Don’t worry—we’ve got you covered! Get all the highlights you missed plus some of the best moments from the show. Watch debt-free screams, Dave Rants, guest interviews, and more!

Check out the show at 4pm EST Monday-Friday or anytime on demand. Dave Ramsey and his co-hosts talking about money, careers, relationships, and how they impact your life. Tune in to The Ramsey Show and experience one of the most popular talk radio shows in the country!

Ramsey Network (Subscribe Now!)

• The Ramsey Show (Highlights):

Did you miss the latest Ramsey Show episode? Don’t worry—we’ve got you covered! Get all the highlights you missed plus some of the best moments from the show. Watch debt-free screams, Dave Rants, guest interviews, and more!

Check out the show at 4pm EST Monday-Friday or anytime on demand. Dave Ramsey and his co-hosts talking about money, careers, relationships, and how they impact your life. Tune in to The Ramsey Show and experience one of the most popular talk radio shows in the country!

Ramsey Network (Subscribe Now!)

• The Ramsey Show (Highlights):

Which is the correct Aspect Ratio to use?

Aspect Ratio is VERY important: 3:2, 4:3, 16:9, 9:19.5?!

What is Contrast Ratio?

Video Aspect Ratio Explained – How Different Aspect Ratios Affect Your Video Style

The Ultimate Beginner's Guide to Aspect Ratio

Choosing The Right Aspect Ratio For Your Film

Ratio of Boys to Girls C8

Simplifying Ratios Explained | How to Simplify a Ratio | Math with Mr. J

Ratio & Proportion Class-2 I Deepak Gusain #unacademy #cseet #nov24 #cs #amitvohralawclasses

PE Ratio Explained Simply | Finance in 5 Minutes!

Why the P/S Ratio is My Favorite Valuation Metric

How to Choose the BEST ASPECT RATIO for YouTube? + DaVinci Resolve Tip

COMPRESSION RATIO: HOW to CALCULATE, MODIFY and CHOOSE the BEST one - BOOST SCHOOL #10

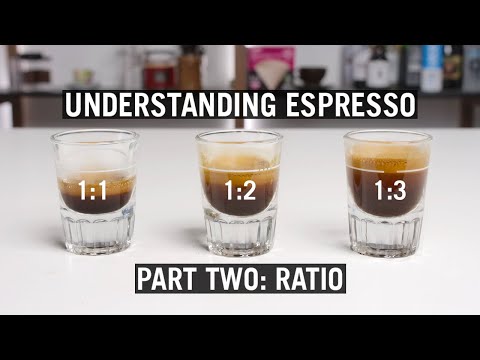

Understanding Espresso - Ratio (Episode #2)

The Risk to Reward Ratio Explained in One Minute: From Definition and 'Formula' to Example...

2:1 is the Best Aspect Ratio for YouTube?

What Aspect Ratio is Best for Your Video?

How to calculate ratio - sharing money GCSE question

Which ASPECT RATIO should you use in your mobile to capture quality images?

Finding Your Perfect Pour-over Brewing Ratio!

This Aspect Ratio Made My Videos 100x BETTER!

Waist Hip Ratio: How to Find Your Measurements

The Perfect Waist Measurement For A Movie Star Body (The Golden Ratio)

What's the BEST Risk to Reward Ratio to use in Forex Trading?

Комментарии

0:06:53

0:06:53

0:07:12

0:07:12

0:05:26

0:05:26

0:04:55

0:04:55

0:04:05

0:04:05

0:12:41

0:12:41

0:02:47

0:02:47

0:06:51

0:06:51

0:54:24

0:54:24

0:05:36

0:05:36

0:08:31

0:08:31

0:10:14

0:10:14

0:15:50

0:15:50

0:08:49

0:08:49

0:01:36

0:01:36

0:03:11

0:03:11

0:03:37

0:03:37

0:04:25

0:04:25

0:05:34

0:05:34

0:07:55

0:07:55

0:11:25

0:11:25

0:00:59

0:00:59

0:00:56

0:00:56

0:15:22

0:15:22