filmov

tv

Home Loan Basics [Mortgage Explained Simply]

Показать описание

Hunter Galloway - Home Loans Made Easy! If you're looking for a mortgage broker and live in Australia, we can help!

Visit us online

Or call us on

1300 088 065

Mortgage Explained Simply

00:26 - What is a mortgage and how does it work?

02:03 - How does a home loan / mortgage work?

03:19 - What does a 95% mortgage mean?

04:27 - What is loan to value ratio?

04:58 - What is lenders mortgage insurance?

06:18 - What does principle and interest mean with mortgages?

08:18 - Can I buy a property without a mortgage?

08:45 - How much money should I save before I buy a house?

09:15 - Conclusion.

Topics we cover in this video.

What even is a mortgage. Home loan jargon explained simply. A beginners guide to mortgages in Australia. A mortgage is a residential home loan secured against a residential property. We look at what loan to value ratio is. How the banks facilitate lending.

DISCLAIMER:

This video offers no Legal, Financial and Taxation advice, and the information contained is general and does not take into account your personal situation. The Listener acknowledges, consents and agrees to the viewing of the content presented on the Channel is subject to the full Disclaimer (below) and agrees to be unconditionally bound by this Disclaimer.

Visit us online

Or call us on

1300 088 065

Mortgage Explained Simply

00:26 - What is a mortgage and how does it work?

02:03 - How does a home loan / mortgage work?

03:19 - What does a 95% mortgage mean?

04:27 - What is loan to value ratio?

04:58 - What is lenders mortgage insurance?

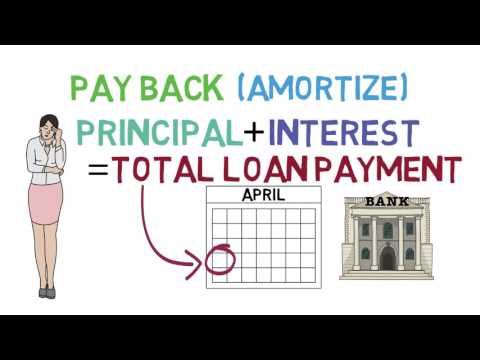

06:18 - What does principle and interest mean with mortgages?

08:18 - Can I buy a property without a mortgage?

08:45 - How much money should I save before I buy a house?

09:15 - Conclusion.

Topics we cover in this video.

What even is a mortgage. Home loan jargon explained simply. A beginners guide to mortgages in Australia. A mortgage is a residential home loan secured against a residential property. We look at what loan to value ratio is. How the banks facilitate lending.

DISCLAIMER:

This video offers no Legal, Financial and Taxation advice, and the information contained is general and does not take into account your personal situation. The Listener acknowledges, consents and agrees to the viewing of the content presented on the Channel is subject to the full Disclaimer (below) and agrees to be unconditionally bound by this Disclaimer.

Комментарии

0:09:44

0:09:44

0:19:43

0:19:43

0:02:57

0:02:57

0:18:07

0:18:07

0:10:32

0:10:32

0:02:36

0:02:36

0:08:00

0:08:00

0:05:10

0:05:10

0:03:49

0:03:49

0:09:45

0:09:45

0:12:21

0:12:21

0:02:22

0:02:22

0:12:32

0:12:32

0:03:43

0:03:43

0:01:16

0:01:16

0:03:44

0:03:44

0:02:22

0:02:22

0:06:02

0:06:02

0:01:01

0:01:01

0:24:12

0:24:12

0:07:47

0:07:47

0:02:16

0:02:16

0:04:23

0:04:23

0:16:10

0:16:10