filmov

tv

Loan Basics

Показать описание

It's a Money Thing: Loan Basics 💵

Loans 101 (Loan Basics 1/3)

Loan Basics

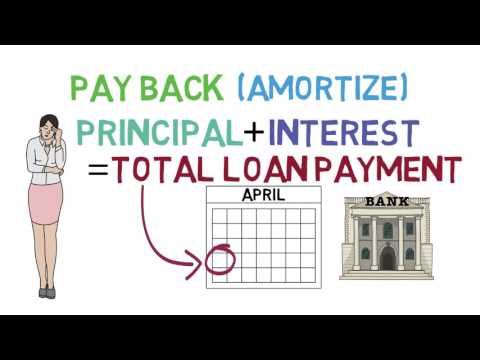

How Principal & Interest Are Applied In Loan Payments | Explained With Example

Loans: Mistakes and Best Practices (Loan Basics 3/3)

It's A Money Thing: Loan Basics

Credit Scores and Reports 101 (Credit Card and Loan Basics 2/3)

Introduction to Mortgage Loans | Housing | Finance & Capital Markets | Khan Academy

The 3 Parts of Notary Loan Signing Education

Everything You Need To Know About Student Loans

Home Loan Basics [Mortgage Explained Simply]

10 Commercial Banking Terms You Should Know - Part 1, Loan Basics

Student Loan Basics

What is a Loan? A Simple Explanation for Kids and Beginners

How Much Car Can You Really Afford? (Car Loan Basics)

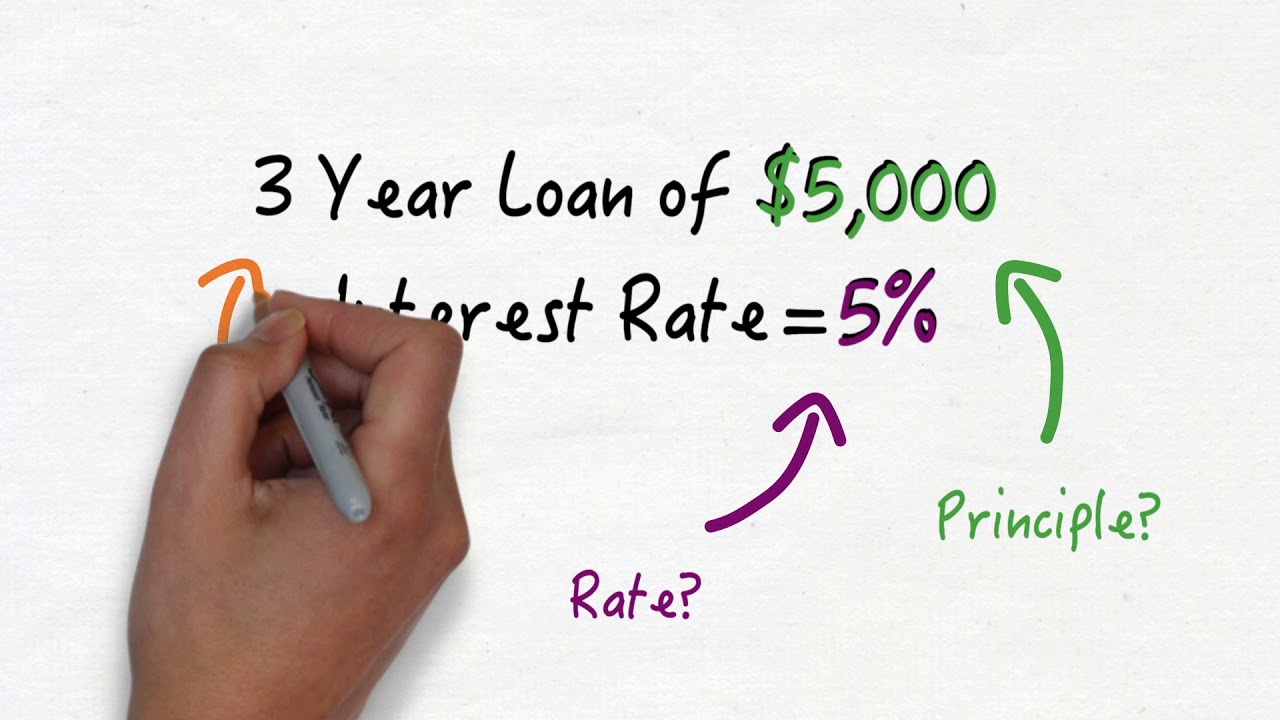

Student Loan Basics: Terms to know - The 3 parts of a loan

Student Loan Basics: How interest accrual works

Home Mortgages 101 (For First Time Home Buyers)

How Much House Can You REALLY Afford (Home Loan Basics)

Banking Explained – Money and Credit

VA Loan Basics: How VA Entitlement Works

Top 5 Student Loans To Consider & Student loan basics - Parent Plus, NJ Class loans Financial Ai...

CRE Financing Basics: Lender and Loan Types

Car Loan Interest Rates Explained (For Beginners)

Комментарии

0:03:52

0:03:52

0:03:43

0:03:43

0:02:35

0:02:35

0:03:49

0:03:49

0:03:14

0:03:14

0:03:52

0:03:52

0:04:05

0:04:05

0:18:07

0:18:07

0:09:42

0:09:42

0:08:25

0:08:25

0:09:44

0:09:44

0:38:36

0:38:36

1:29:15

1:29:15

0:02:23

0:02:23

0:06:33

0:06:33

0:01:24

0:01:24

0:01:14

0:01:14

0:19:43

0:19:43

0:06:04

0:06:04

0:06:10

0:06:10

0:03:47

0:03:47

0:11:43

0:11:43

0:06:19

0:06:19

0:06:53

0:06:53