filmov

tv

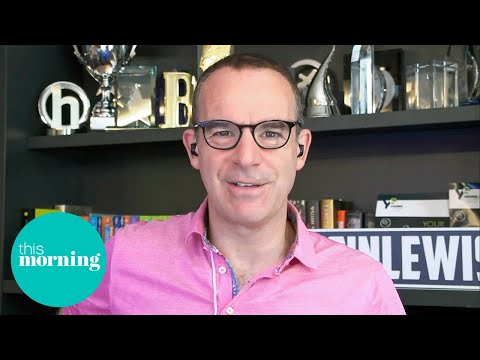

Martin Lewis: How to Make £500 CASH by Bank Switching | £200 Per Bank

Показать описание

In this video, I'll guide you through a process of making up to £500 tax-free in less than an hour by taking advantage of completely legal bank switch offers. Using Martin Lewis' website as a valuable resource, I'll show you how to set up a dummy switch account and direct debits to maximise your earnings. With switch offers refreshing every few years, you can continue to benefit from this income stream over time. Discover the best bank switch deals on MoneySavingExpert and consider Halifax as a recommended dummy switch account for its unlimited current account switching capability. For easy direct debits, explore options like Plum and Moneybox or donate to a registered charity and cancel once the switch is complete.

🔓 JOIN THE PATREON COMMUNITY 🔓

Sign up to QuidCo:

I will show you how to easily setup a dummy switch account and direct debits. The beauty of this income stream is that offers refresh usually within 2-3 years, so you can continue to rinse and repeat over time.

Firstly Martin Lewis' website MoneySavingExpert is a fantastic source for locating current available switch deals.

Dummy Switch Account:

My personal suggestion for a dummy switch account is Halifax, you can open unlimited current accounts and switch them immediately. Plus there's no current switch offer, so that's a win. Other options such as Starling & Monzo, however I personally don't use them for this as I think they are very good as a spending account.

Easy direct debits:

Direct Debits - Plum & Moneybox, you can also ‘donate’ £1 a month to a registered charity via direct debit and then cancel once you’ve finished the switch.

Most charities accept a minimum contribution of £2 a month, RSPCA is one I've used for quite a while and I wasn't spammed with emails.

If you would prefer to keep the direct debit money, you can alternatively sign up to sites like MoneyBox which can set up an automatic direct debit that withdraws money into a savings pot. You can then cash this out as and when.

Top tips:

1. Create a spreadsheet or paper document to track when you last took an offer, this means you won't forget which banks you redeemed two years ago.

2. Keep an eye on cashback sites like QuidCo. Some switch offers have even better bonuses on there. I managed to claim that with my recent HSBC switch offer.

3. I wouldn't suggest switching your main current account as it isn't required to redeem the offer, especially if it's set up for your needs. Instead the dummy account will work well.

4. If you're concerned that you won't be able to pay in £1,250 a month or whatever the banks offer requires, there's actually a hack and it doesn't need to be all in one go. You can actually transfer small sums back and forth between the switch account and another to reach the total goal. So you could transfer £250 five times back and fourth to become eligible for the switch reward.

🔓 JOIN THE PATREON 🔓

Follow:

===============================================

Must Read:

===============================================

*Some of the links and products that appear on this video are forms of paid promotion in which Ozbourne Foreman will earn a referral bonus or commission via an affiliate partnership. Ozbourne Foreman receives compensation for sending traffic to partner sites. This is not investment advice. Investing places capital at risk, please do your own research.

#BankSwitching #MartinLewis #MoneyMakingTips #CashBonuses #TaxFreeEarnings #BankingOffers #FinancialHacks #MoneySavingExpert #SwitchAndEarn #EarnExtraCash #BankRewards #EasyMoney #FinancialFreedom #SmartMoneyMoves #MaximizeEarnings #BankingStrategies #MoneyManagement #PersonalFinanceTips #CashIncentives #ProfitableSwitching

🔓 JOIN THE PATREON COMMUNITY 🔓

Sign up to QuidCo:

I will show you how to easily setup a dummy switch account and direct debits. The beauty of this income stream is that offers refresh usually within 2-3 years, so you can continue to rinse and repeat over time.

Firstly Martin Lewis' website MoneySavingExpert is a fantastic source for locating current available switch deals.

Dummy Switch Account:

My personal suggestion for a dummy switch account is Halifax, you can open unlimited current accounts and switch them immediately. Plus there's no current switch offer, so that's a win. Other options such as Starling & Monzo, however I personally don't use them for this as I think they are very good as a spending account.

Easy direct debits:

Direct Debits - Plum & Moneybox, you can also ‘donate’ £1 a month to a registered charity via direct debit and then cancel once you’ve finished the switch.

Most charities accept a minimum contribution of £2 a month, RSPCA is one I've used for quite a while and I wasn't spammed with emails.

If you would prefer to keep the direct debit money, you can alternatively sign up to sites like MoneyBox which can set up an automatic direct debit that withdraws money into a savings pot. You can then cash this out as and when.

Top tips:

1. Create a spreadsheet or paper document to track when you last took an offer, this means you won't forget which banks you redeemed two years ago.

2. Keep an eye on cashback sites like QuidCo. Some switch offers have even better bonuses on there. I managed to claim that with my recent HSBC switch offer.

3. I wouldn't suggest switching your main current account as it isn't required to redeem the offer, especially if it's set up for your needs. Instead the dummy account will work well.

4. If you're concerned that you won't be able to pay in £1,250 a month or whatever the banks offer requires, there's actually a hack and it doesn't need to be all in one go. You can actually transfer small sums back and forth between the switch account and another to reach the total goal. So you could transfer £250 five times back and fourth to become eligible for the switch reward.

🔓 JOIN THE PATREON 🔓

Follow:

===============================================

Must Read:

===============================================

*Some of the links and products that appear on this video are forms of paid promotion in which Ozbourne Foreman will earn a referral bonus or commission via an affiliate partnership. Ozbourne Foreman receives compensation for sending traffic to partner sites. This is not investment advice. Investing places capital at risk, please do your own research.

#BankSwitching #MartinLewis #MoneyMakingTips #CashBonuses #TaxFreeEarnings #BankingOffers #FinancialHacks #MoneySavingExpert #SwitchAndEarn #EarnExtraCash #BankRewards #EasyMoney #FinancialFreedom #SmartMoneyMoves #MaximizeEarnings #BankingStrategies #MoneyManagement #PersonalFinanceTips #CashIncentives #ProfitableSwitching

Комментарии

0:08:51

0:08:51

0:09:10

0:09:10

0:04:09

0:04:09

0:02:49

0:02:49

0:07:16

0:07:16

0:02:18

0:02:18

0:08:30

0:08:30

0:09:09

0:09:09

0:03:46

0:03:46

0:06:34

0:06:34

0:04:55

0:04:55

0:07:13

0:07:13

0:08:38

0:08:38

0:03:00

0:03:00

0:01:24

0:01:24

0:07:56

0:07:56

0:03:35

0:03:35

0:09:02

0:09:02

0:02:37

0:02:37

0:06:22

0:06:22

0:05:39

0:05:39

0:07:05

0:07:05

0:03:52

0:03:52

0:08:06

0:08:06