filmov

tv

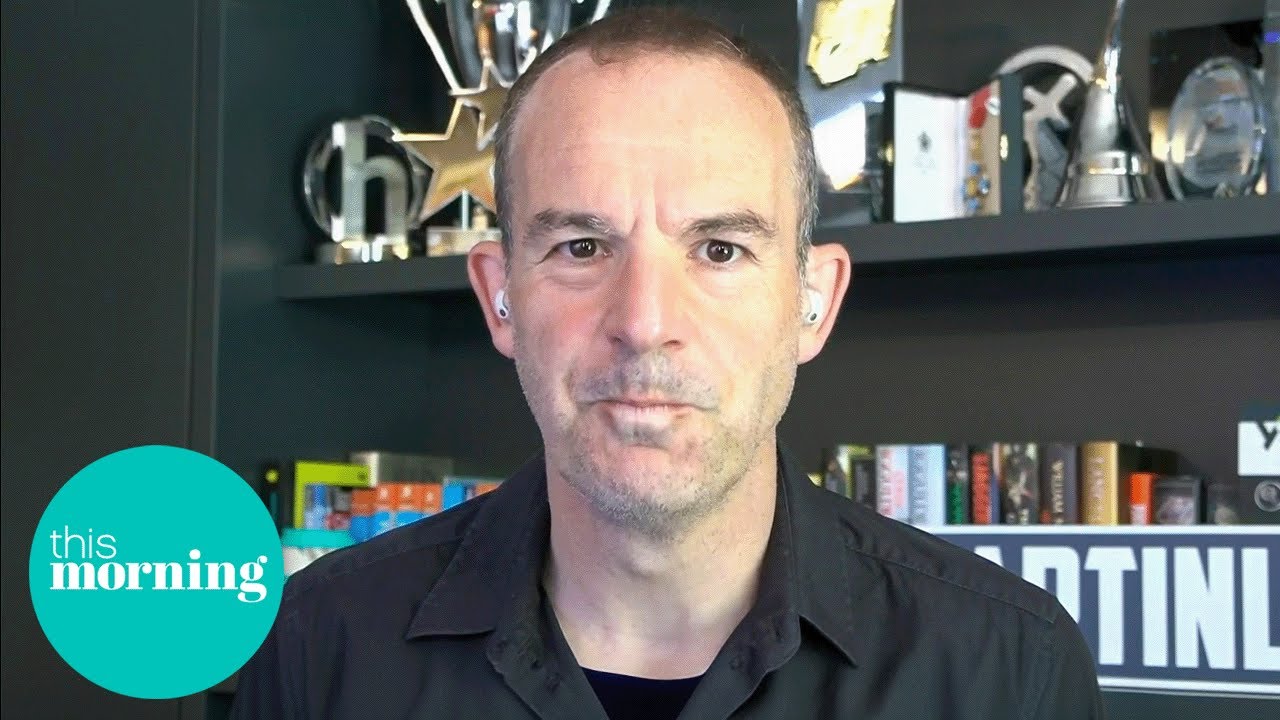

Martin Lewis' Ultimate Guide to Growing Your Money | This Morning

Показать описание

Our money man is back to take your calls. So whether you’re looking to manage your money more effectively, want advice on changing energy suppliers or are confused about your benefit entitlements, Martin Lewis will be here to impart more of his invaluable advice.

Broadcast on 04/07/2024

FOLLOW US:

MORE ABOUT THIS MORNING:

Welcome to the official This Morning Channel! Join us every weekday from 10am on ITV1, ITVX and STV as we discuss the latest news stories, meet the people behind the stories that matter, chat to the biggest names in Hollywood, get the latest fashion & beauty trends, and cook up a storm in our kitchen with your favourite chefs!

#ThisMorning

Broadcast on 04/07/2024

FOLLOW US:

MORE ABOUT THIS MORNING:

Welcome to the official This Morning Channel! Join us every weekday from 10am on ITV1, ITVX and STV as we discuss the latest news stories, meet the people behind the stories that matter, chat to the biggest names in Hollywood, get the latest fashion & beauty trends, and cook up a storm in our kitchen with your favourite chefs!

#ThisMorning

Martin Lewis' Ultimate Guide to Growing Your Money | This Morning

Martin Lewis' Guide to Life Insurance - How Much? | This Morning

Martin Lewis: What Are Premium Bonds and How Do They Work? | This Morning

Martin Lewis' Guide to Life Insurance - Different Types | This Morning

Martin Lewis shares the best ways to save money

Martin Lewis' Urgent Warning For Savers! | Good Morning Britain

Martin Lewis' Top Tips To Boost Your Credit File | This Morning

Money Expert Martin Lewis Reveals How Much You Should Put In Your Pension | This Morning

Martin Lewis Offers Advice on Solar Panels | Good Morning Britain

Martin Lewis: How credit scoring works – a quick game to explain…

5 Student Finance Essentials You Need to Know With Martin Lewis | This Morning

Martin Lewis urgent tip for savers - watch before midnight tonight

Martin Lewis Shares His Advice on Mortgages | Good Morning Britain

Money Expert Martin Lewis Reveals Top Tips on Maximising Your State Pension | This Morning

Martin's Guide to Topping Up the Pension Pot | This Morning

Martin Lewis: How To Get The Best Remortgage Deals

After I Read 40 Books on Investing - Here's What Will Make You Rich

Martin Lewis: How to get the best holiday money deals

How I’d Invest £20,000 In a Stocks & Shares ISA (in 2024)

Martin Lewis: Inheritance tax will you pay it? A quick myth-buster to explain how it really works

Martin Lewis' Ultimate Borrowing Money Masterclass | This Morning

Martin Lewis Reveals Which Bank Has The Best Interest Rates | This Morning

The Ultimate Guide to House Buying in 2021 | This Morning

Martin Lewis on How to Choose Home Insurance

Комментарии

0:08:51

0:08:51

0:00:55

0:00:55

0:02:18

0:02:18

0:02:37

0:02:37

0:11:32

0:11:32

0:08:36

0:08:36

0:02:49

0:02:49

0:07:13

0:07:13

0:01:23

0:01:23

0:03:00

0:03:00

0:08:38

0:08:38

0:01:36

0:01:36

0:07:05

0:07:05

0:09:04

0:09:04

0:05:39

0:05:39

0:04:55

0:04:55

0:14:48

0:14:48

0:03:55

0:03:55

0:15:45

0:15:45

0:04:09

0:04:09

0:07:36

0:07:36

0:08:12

0:08:12

0:06:18

0:06:18

0:04:49

0:04:49