filmov

tv

What is Cash Value Life Insurance Good for?

Показать описание

Cash Value Life Insurance can be so good for certain situations. Watch to learn whether you might be in one of those situations and if Cash Value Life is a good fit for you now or in the future.

Key Points:

Introduction to Cash Value Life Insurance: The video begins with an introduction to the concept of leveraging cash value life insurance for financial planning, highlighting the primary reasons people inquire about these policies.

Tax Benefits of Cash Value Life Insurance: The main attraction of cash value life insurance is outlined as its tax advantages. It's explained how the policy allows for interest earnings without issuing 1099 forms, similar to tax-deferred accounts like IRAs and 401(k)s, but with the added benefit of tax-free withdrawals through policy loans.

No Income or Contribution Limits: Unlike Roth IRAs, cash value life insurance policies are noted for having no income restrictions or limits on contributions, making them an attractive option for high-income earners seeking tax-advantaged growth and withdrawals.

Self-Completing Plan with Tax-Free Death Benefit: The death benefit of cash value life insurance is emphasized as tax-free and provides a self-completing aspect to financial planning, immediately leveraging premiums into a larger death benefit.

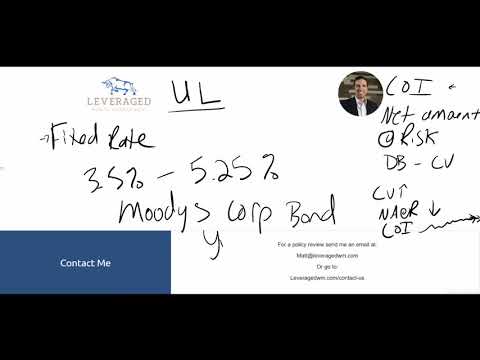

Alternative Asset Class with Reduced Risk: Cash value life insurance is positioned as an alternative investment that offers stock market-like returns with reduced risk, appealing to individuals already exposed to market risk and seeking diversification.

Ideal for Medium to Long-Term Financial Goals: The policy is presented as a suitable option for individuals nearing retirement who need a medium to long-term vehicle to grow their savings without additional market risk, serving as a complement to existing stock and bond investments.

Short-Term Investments Disclaimer: A clear disclaimer is made that cash value life insurance is not suitable for short-term financial goals, emphasizing that the policy is designed for long-term growth and tax advantages.

Invitation for Personalized Consultation: The video concludes with an invitation for viewers to reach out for a personalized consultation to explore whether cash value life insurance aligns with their financial goals and circumstances.

This summary encapsulates the key points discussed in the video, focusing on the unique benefits of cash value life insurance, including its tax advantages, suitability for long-term financial planning, and role as an alternative asset class.

Комментарии

0:12:49

0:12:49

0:02:46

0:02:46

0:04:28

0:04:28

0:07:41

0:07:41

0:09:07

0:09:07

0:10:54

0:10:54

0:05:29

0:05:29

0:02:00

0:02:00

0:59:12

0:59:12

0:07:51

0:07:51

0:11:23

0:11:23

0:00:57

0:00:57

0:02:07

0:02:07

0:07:10

0:07:10

0:22:57

0:22:57

0:06:38

0:06:38

0:14:23

0:14:23

0:12:12

0:12:12

0:20:13

0:20:13

0:17:24

0:17:24

0:07:08

0:07:08

0:17:34

0:17:34

0:12:57

0:12:57

0:16:15

0:16:15