filmov

tv

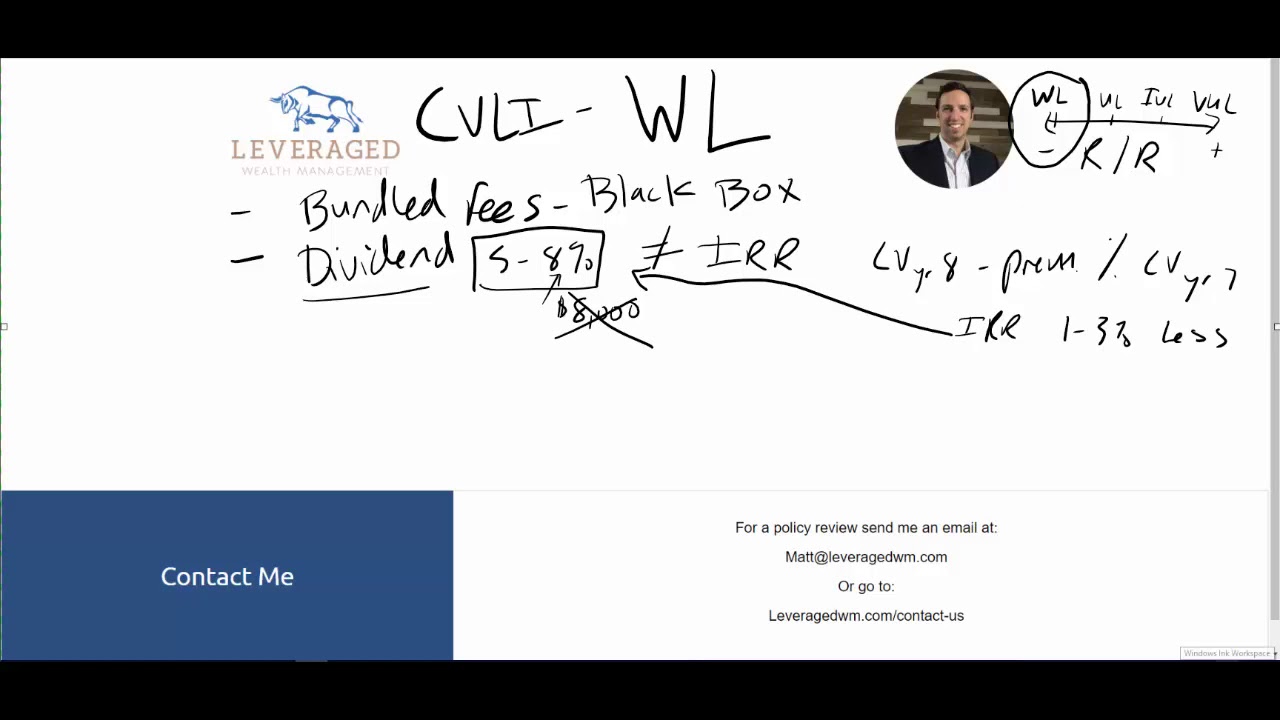

Cash Value Life Insurance - Whole Life insurance Explained

Показать описание

Cash Value Life Insurance comes in all forms. Understanding how Cash Value life works can be tough, and Whole Life Insurance might be the toughest to decipher. This cash value life insurance series comes to a a close looking at some benefits and draw backs (or pros and cons ) to whole life insurance. Whole life and infinite banking are often paired together, but after watching this video tell me why you think that might not be the best idea.

Make sure you check out the entire series on cash value Life insurance!

Cash value life insurance is often misunderstood and sold by agents who know far less about their own products than they should.

This series on cash value life insurance is meant to explore tax free retirement, 770 accounts, indexed universal life, variable universal life, and whole life in order to better educate you on what is available. Don't be confused by the whole life insurance dividends!

I don't come out and say exactly why infinite banking wont work with whole life, but you should be able to read between the lines.

What is Cash Value Life Insurance Good for?

Life Insurance Explained | What is Cash Value Life Insurance?

Should You Use Cash Value Life Insurance as an Investment?

Life Insurance as Investment Tool | Cash Value Life Insurance

Check This Out!!! 401k vs. Cash Value Life Insurance

How to use Whole Life Insurance to Get Rich (Become your own Bank)

How to find the best Cash Value Life Insurance policy

What Exactly is the CASH VALUE in Your Life Insurance Policy?

Part 2: Maximizing Your Life Insurance – Unlocking Cash Value and Benefits

Understanding Whole Life Insurance: Cash Value vs. Death Benefit Explained

Cash Out My Whole Life Policy?

How The Wealthy Use Whole Life Insurance... For The Cash Value! | IBC Global

Cash Value Life Insurance Explained | Life Insurance Reviews

Why Dave Ramsey HATES Whole Life Insurance!

Cash Value Life Insurance

The Whole Life Insurance Scam - What Salesmen Won't Tell You

Understanding The Cash Value In A Whole Life Policy | IBC Global

How Does Cash Value In Whole Life Insurance Work?

Is Whole Life Insurance Ever A Good Idea?

How We Use The Cash Value Inside Our Whole Life Insurance Policy | Wealth Nation

A Whole Life High Cash Value Policy: What It SHOULD Look Like! | IBC Global

What is Cash Value in Whole Life Insurance? #infinitebankingconcept #infinitebanking #cashvalue

I was wrong about Whole Life Insurance...

Life Insurance as an Investment - Dave Ramsey Rant

Комментарии

0:12:49

0:12:49

0:02:46

0:02:46

0:09:07

0:09:07

0:07:41

0:07:41

0:02:00

0:02:00

0:10:54

0:10:54

0:20:13

0:20:13

0:04:28

0:04:28

0:59:12

0:59:12

0:05:29

0:05:29

0:07:51

0:07:51

0:22:57

0:22:57

0:06:38

0:06:38

0:09:23

0:09:23

0:08:18

0:08:18

0:11:23

0:11:23

0:14:23

0:14:23

0:02:07

0:02:07

0:07:08

0:07:08

0:17:34

0:17:34

0:09:08

0:09:08

0:03:29

0:03:29

0:21:56

0:21:56

0:09:46

0:09:46