filmov

tv

Cash Value Life Insurance - Universal Life Explained

Показать описание

Universal Life insurance is one of the easier cash value life insurance policies to explain because the options are relatively limited! This product focuses on protection and additional riders for things like Long Term Care.

Make sure you check out the entire series on cash value Life insurance!

Cash value life insurance is often misunderstood and sold by agents who know far less about their own products than they should.

This series on cash value life insurance is meant to explore tax free retirement, 770 accounts, indexed universal life, variable universal life, and whole life in order to better educate you on what is available.

Key Points:

Introduction to Universal Life Insurance: This video is part of a series on cash value life insurance, focusing on Universal Life (UL) insurance, the simplest form of cash value life insurance. It builds on concepts from previous discussions on Variable Universal Life and Indexed Universal Life.

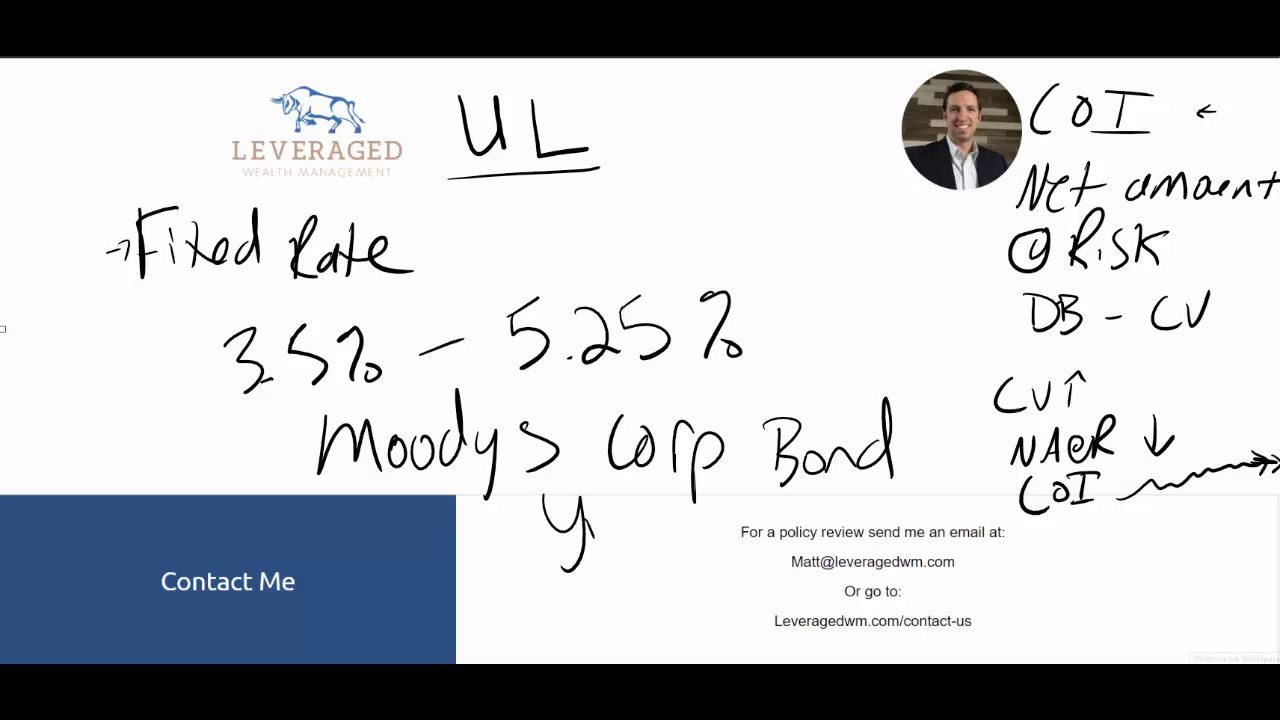

Key Concept - Net Amount at Risk: The cost of insurance (COI) in UL policies is based on the net amount at risk, calculated as the death benefit minus the cash value. As cash value increases, the net amount at risk decreases, affecting the COI charges.

Fixed Rate of Return: UL policies offer a fixed rate of return, typically between 3.5% and 5.25%, based on the current interest rate environment. This rate, potentially adjusted annually, follows the Moody's corporate bond yield, providing a simple cash accumulation method.

Protection-Focused Products: UL insurance is primarily for those seeking maximum death benefit protection rather than maximum cash accumulation. It often comes with limited pay scenarios, meaning premiums are paid over a set period (e.g., 10, 15, 20 years) with the hope that the death benefit lasts indefinitely.

Additional Features: Many UL policies include long-term care riders, adding value through additional protection. While offering a fixed rate of return and being positioned as a safer option, most UL policies are not fully guaranteed, indicating potential risk if interest rates drop significantly.

This summary captures the essential points discussed in the video, outlining the simplicity, focus on protection, and the limited pay scenarios associated with Universal Life insurance, along with its positioning in the risk-reward spectrum of cash value life insurance products.

Комментарии

0:12:49

0:12:49

0:09:07

0:09:07

0:02:46

0:02:46

0:20:13

0:20:13

0:07:41

0:07:41

0:04:28

0:04:28

0:10:54

0:10:54

0:09:23

0:09:23

0:02:30

0:02:30

0:00:57

0:00:57

0:05:29

0:05:29

0:07:51

0:07:51

0:11:23

0:11:23

0:00:57

0:00:57

0:22:57

0:22:57

0:01:00

0:01:00

0:14:18

0:14:18

0:19:37

0:19:37

0:07:08

0:07:08

0:14:23

0:14:23

0:16:15

0:16:15

0:03:37

0:03:37

0:17:34

0:17:34

0:01:00

0:01:00