filmov

tv

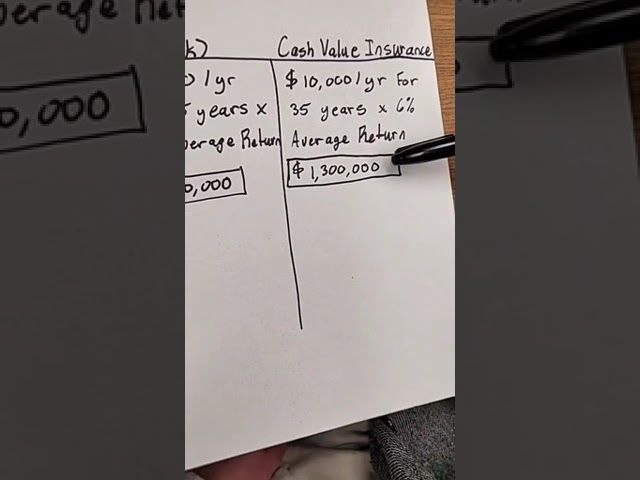

Check This Out!!! 401k vs. Cash Value Life Insurance

Показать описание

You really thought 401k’s were the best way to save for retirement? Check out this skit with Tax Free Mike

#401k #401ktrap #taxtrap #cashflow #cashvaluelifeinsurance #IUL #infinitebanking #smartmoney #money #wealth #lifeinsurance #becomeyourownbank #retirementplanning

#401k #401ktrap #taxtrap #cashflow #cashvaluelifeinsurance #IUL #infinitebanking #smartmoney #money #wealth #lifeinsurance #becomeyourownbank #retirementplanning

Check This Out!!! 401k vs. Cash Value Life Insurance

IRA or 401K what’s best for you? Check out the full video now! #roth401k

Never Endorse a 401k Rollover Check. Here’s Why. #shorts

INVESTORS MUST DO BEFORE 2025 (end of the year checklist)

If You Don't Have a 401(k), Check Out These 4 Types Of IRAs

Who can cash a 401k check?

The 5 Biggest Financial REGRETS Of Retirees

Some 401(k) plans may cut you a monthly check

Why Gen X Can't Afford to Retire: Gen X Retirement Crisis?

Automatically Investing Money from Your Check to 401k (Investing) | Inspire Educate | Dave Ramsey

Are you interested in a 401k or IRA? Check this video out first.

Patrick Bet-David Explains Why America Is Entering A Terrifying Financial Crisis...

ADP 401K : Test & Review in 2024 (Is this reliable? Benefits, Cons, Score..)

Transfer Tuesday | 401(k) + Support ❤️

How to check 401(k) balance?

How long does it take to get a 401k loan check from John Hancock?

TRANSAMERICA 401K : Test & Review in 2024 (Is this reliable? Benefits, Cons, Score..)

Why does having money come out of your check for your 401k work so well? #shorts

PRINCIPAL 401K : Test & Review in 2024 (Is this reliable? Benefits, Cons, Score..)

T. ROWE PRICE 401K : Test & Review in 2024 (Is this reliable? Benefits, Cons, Score..)

How to Produce a Zero Net Check with 401k Deduction

Why you should check your 401K, long-term saving plans amid inflation

Can you take money out of your 401K without penalties? | VERIFY

what is Roth IRA || Roth IRA vs 401K which is better check in description 🤑👌 #rothira

Комментарии

0:02:00

0:02:00

0:00:22

0:00:22

0:00:15

0:00:15

0:09:00

0:09:00

0:02:18

0:02:18

0:01:05

0:01:05

0:10:26

0:10:26

0:03:50

0:03:50

0:09:37

0:09:37

0:00:28

0:00:28

0:24:40

0:24:40

0:22:51

0:22:51

0:02:50

0:02:50

0:06:09

0:06:09

0:01:25

0:01:25

0:03:30

0:03:30

0:02:41

0:02:41

0:00:42

0:00:42

0:02:41

0:02:41

0:02:33

0:02:33

0:05:30

0:05:30

0:05:29

0:05:29

0:02:18

0:02:18

0:00:14

0:00:14