filmov

tv

Understanding Paycheck | US Payroll | HCM Simplified

Показать описание

This video explains all the elements in a US Paycheck and how they are calculated.

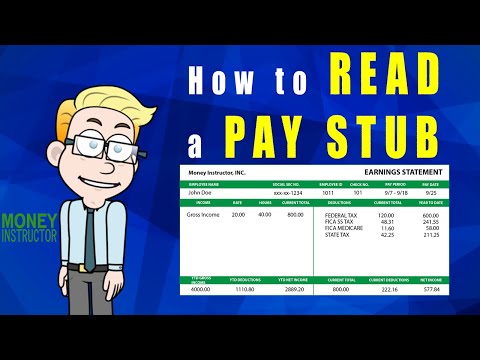

Gross salary

Your gross salary is the salary amount provided to you in your job offer. That amount is then divided by the number of pay periods — weekly, biweekly or monthly.

Net salary

Ultimately, what you receive is your net salary — your gross salary less taxes, benefits and retirement and/or dependent care contributions (if elected).

What's the net net?

The amount on your actual paycheck may be less than you expect. A number of factors go into this.

What is FICA?

FICA stands for the Federal Insurance Contributions Act and funds Social Security and Medicare.

The amount you pay to FICA depends on your income.

What is Social Security?

Social Security is a federal insurance program that provides benefits to retired people and those who are unemployed or disabled

Currently, the Social Security tax rate is 6.2% of gross salary with an annual maximum tax of $8,618.

What is Medicare?

Medicare is the federal health insurance program for:

People who are 65 years or older

Younger people with certain disabilities

The Medicare tax rate is 1.45% of all income with no annual maximum.

You may also have an additional 0.9% Medicare surtax if your salary is above $200,000 and you're single (or $250,000 for married, filing jointly).

Chapters:

0:24 Earnings

5:40 Taxes

6:30 Benefit Deductions Overview

7:20 Pre-Tax Deduction

9:52 Calculating Net Pay

How COBRA Act works in US

How Self-Service Works in TLM

What is Human Capital Management

Gross salary

Your gross salary is the salary amount provided to you in your job offer. That amount is then divided by the number of pay periods — weekly, biweekly or monthly.

Net salary

Ultimately, what you receive is your net salary — your gross salary less taxes, benefits and retirement and/or dependent care contributions (if elected).

What's the net net?

The amount on your actual paycheck may be less than you expect. A number of factors go into this.

What is FICA?

FICA stands for the Federal Insurance Contributions Act and funds Social Security and Medicare.

The amount you pay to FICA depends on your income.

What is Social Security?

Social Security is a federal insurance program that provides benefits to retired people and those who are unemployed or disabled

Currently, the Social Security tax rate is 6.2% of gross salary with an annual maximum tax of $8,618.

What is Medicare?

Medicare is the federal health insurance program for:

People who are 65 years or older

Younger people with certain disabilities

The Medicare tax rate is 1.45% of all income with no annual maximum.

You may also have an additional 0.9% Medicare surtax if your salary is above $200,000 and you're single (or $250,000 for married, filing jointly).

Chapters:

0:24 Earnings

5:40 Taxes

6:30 Benefit Deductions Overview

7:20 Pre-Tax Deduction

9:52 Calculating Net Pay

How COBRA Act works in US

How Self-Service Works in TLM

What is Human Capital Management

Комментарии