filmov

tv

How To Know The Correct Term For A Bridging Loan

Показать описание

How long should you set up a bridging loan for?

The important thing to watch out for is setting a term that is too short, which can be costly if you're unable to pay back the full amount in time.

But what exactly do you need to be aware of when taking out a bridging loan to finance property purchases?

Kevin Wright looks at this in this week's Property Finance Tip video.

- - -

Thank you for watching this YouTube video.

Want more Property Finance Tips?

Stay Connected:

The important thing to watch out for is setting a term that is too short, which can be costly if you're unable to pay back the full amount in time.

But what exactly do you need to be aware of when taking out a bridging loan to finance property purchases?

Kevin Wright looks at this in this week's Property Finance Tip video.

- - -

Thank you for watching this YouTube video.

Want more Property Finance Tips?

Stay Connected:

How to know your scalp type | This helps in choosing correct shampoo | Dermatologist

How to check yourself for correct posture? - Shahnaz Hanif

How to choose the correct tense in English - BBC English Masterclass

How to check for hip alignment and technique to correct

How to find your correct bra size? #shorts #brahacks #fashionhacks #howto #stylehacks

𝐈𝐍𝐓𝐔𝐈𝐓𝐈𝐎𝐍 ; perfect grades ( correct answers only ! )

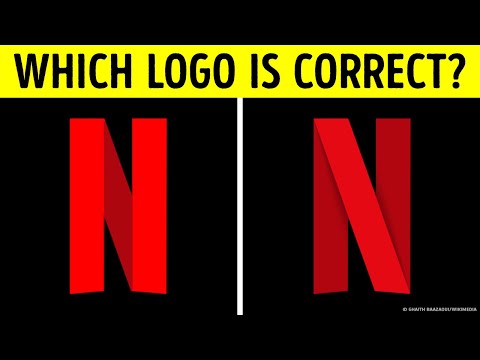

Spot the Correct Logo | Check If You Have a Photographic Memory

How to find your correct FOUNDATION shade for Beginners?! 😉🥵 #makeup #makeuptips

How To Make Correct Decisions | Buddhism In English

How Glasses Correct for Astigmatism! #shorts

How to find correct size Menstrual Cup ? | #menstrualcup

How to Check the Correct Ball Pressure without a Gauge Tutorial /Football/Soccer

How to choose correct Menstrual cup size 🩸⁉️ #youtubeshorts #menstrualcup #indianyoutubers

How to Correct Knock Knees! #kneepain #walking #alignment

How to use check and correct button in Calculator easy way

How To Use ChatGPT To Check & Correct Grammar

If you need braces to correct your teeth, try THESE

Do You Know The Correct Way To Use Adjectives? #Shorts

Correct Mileage / Odometer Reading with Autel MaxiSyS MS906 - Basic Functions Car Diagnostic Scanner

how to check correct hip size ?

Correct way to use Saffron !! Did you know this already

The correct way to breathe in

How To Calculate The Correct Chain Length | Road Bike Maintenance

99% of People DON’T KNOW the Correct Way to Drink Water | Buddhist Teachings

Комментарии

0:00:37

0:00:37

0:01:38

0:01:38

0:03:51

0:03:51

0:01:41

0:01:41

0:00:13

0:00:13

0:01:03

0:01:03

0:10:22

0:10:22

0:01:01

0:01:01

0:05:26

0:05:26

0:00:58

0:00:58

0:00:17

0:00:17

0:00:14

0:00:14

0:00:14

0:00:14

0:00:27

0:00:27

0:02:41

0:02:41

0:01:16

0:01:16

0:00:16

0:00:16

0:00:31

0:00:31

0:00:16

0:00:16

0:00:10

0:00:10

0:00:28

0:00:28

0:02:05

0:02:05

0:05:25

0:05:25

0:27:16

0:27:16