filmov

tv

Efficient portfolio frontiers with allocation constraints (Excel)

Показать описание

It is very common for unconstrained efficient portfolio frontiers to recommend sizeable short positions or unrealistically high exposures to individual stocks. Therefore, in practice it is quite often mandated that some constraints on minimum and maximum allocations are maintained. However, this makes building the frontier itself quite computationally and conceptually challenging. Today we are investigating a simple, flexible, and efficient procedure to construct optimal portfolios and frontiers with arbitrary allocation constraints in Excel and discuss the impact allocation constraints has on their shapes and feasible investment opportunities.

Don't forget to subscribe to NEDL and give this video a thumbs up for more videos in Finance!

Don't forget to subscribe to NEDL and give this video a thumbs up for more videos in Finance!

Graph The Efficient Frontier And Capital Allocation Line In Excel

Efficient portfolio frontiers with allocation constraints (Excel)

Efficient Frontier and Portfolio Optimization Explained | The Ultimate Guide

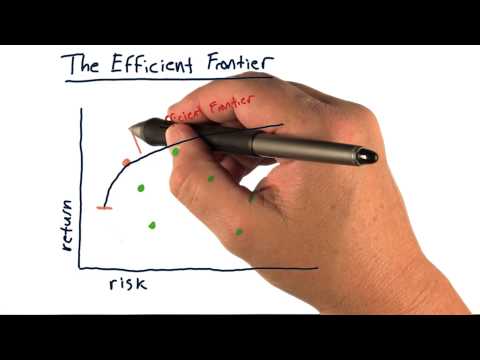

The efficient frontier

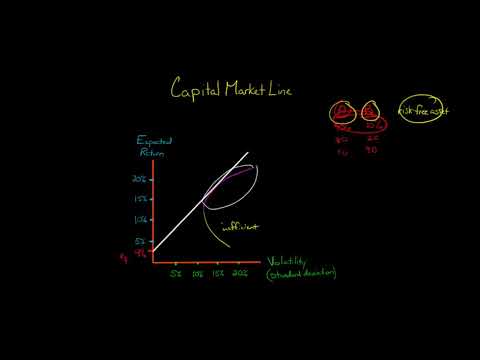

The Capital Market Line

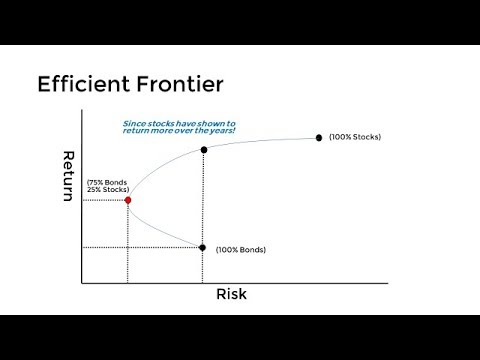

The Efficient Frontier - Explained in 3 Minutes

Evolution of Portfolio Theory – From Efficient Frontier to CAL to SML (For CFA® and FRM® Exams)

Efficient Frontier Explained in Excel: Plotting a 3-Security Portfolio

Four Stock Portfolio and Graphing Efficient Portfolio Frontier

CFA® Level I Portfolio Management - Minimum Variance Portfolios and Efficient Frontier

Modern Portfolio Theory “has no utility” - Warren Buffett

Portfolio Theory 8: The Efficient Frontier with a Risk-Free Asset

Modern Portfolio Theory and the Efficient Frontier Explained

Use Excel to graph the efficient frontier of a three security portfolio

Portfolio Optimization Seven Security Example with Excel Solver

Efficient Frontier, Indifference Curve, Capital Allocation Line

Efficient Frontier, Sharpe Ratio and Capital Market Line (CML)

Efficient Portfolio Frontier explained: Solver (Excel)

Graph the efficient frontier and capital allocation line for a three stock portfolio using Excel.

How To Graph The Efficient Frontier For A Two-Stock Portfolio In Excel

The Capital Allocation Line and The Efficient Frontier Explained

Plotting Efficient Frontier for Four Securities in Excel

Calculating the Optimal Portfolio in Excel | Portfolio Optimization

13. Graphing the efficient frontier for Multiple Stock portfolio in Excel #Finance

Комментарии

0:08:47

0:08:47

0:29:23

0:29:23

0:13:05

0:13:05

0:02:54

0:02:54

0:05:45

0:05:45

0:03:05

0:03:05

0:21:35

0:21:35

0:14:43

0:14:43

0:35:01

0:35:01

0:07:51

0:07:51

0:01:56

0:01:56

0:18:15

0:18:15

0:03:49

0:03:49

0:32:47

0:32:47

0:17:10

0:17:10

0:40:21

0:40:21

0:16:05

0:16:05

0:28:00

0:28:00

0:34:57

0:34:57

0:04:27

0:04:27

0:09:48

0:09:48

0:15:38

0:15:38

0:08:46

0:08:46

0:15:32

0:15:32