filmov

tv

What is VAT in the UK?

Показать описание

Here's some affiliate links to services I use or would consider using. If you think they would be a good match for your business please use these links - many include offers exclusive to this channel. Read more about affiliate links at the bottom of this description:

⚠️ Disclaimer ⚠️

#VAT #UK #SmallBiz

What is VAT? | Back to Basics

(VAT) Value Added Tax - Whiteboard Animation Explanation

VAT FOR BUSINESS EXPLAINED!

VAT Value Added Tax explained

What is VAT? - Introduction to Value Added Tax (VAT) - 2020/21

How does the VAT system work?

Value added tax (VAT)

VAT / GST and Sales tax. How are they different?

For Sale: 2022 Fairline Targa 50GT - £950,000 UK VAT Paid

VAT in UAE : What is VAT?

What is VAT?

What is a VAT Number?

All you wanted to know about VAT in the UAE

VAT Value Added Tax Explained - The Basics

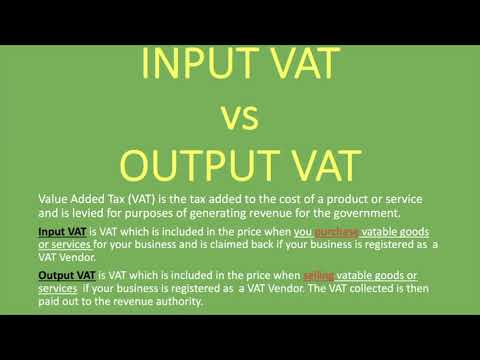

Input VAT vs Output VAT | Explained

what is VAT and how it works in the UK?

The Problems With Value Added Tax | VAT RANT

VAT For Businesses - Explained In 60 Seconds - A UK Business Owners Guide

VAT explained 💡

Sales Tax Vs. VAT. How they both work!

WHAT IS MOMS (VAT) IN SWEDEN, basic information about VAT when running a company in Sweden

VAT in the Digital Age

FTA | What is VAT?

VAT Registration Explained By A Real Accountant - Value Added Tax UK

Комментарии

0:04:34

0:04:34

0:04:35

0:04:35

0:08:29

0:08:29

0:07:33

0:07:33

0:09:28

0:09:28

0:01:34

0:01:34

0:04:49

0:04:49

0:01:42

0:01:42

0:11:09

0:11:09

0:02:31

0:02:31

0:01:20

0:01:20

0:03:44

0:03:44

0:01:16

0:01:16

0:12:11

0:12:11

0:07:46

0:07:46

0:12:05

0:12:05

0:15:14

0:15:14

0:00:50

0:00:50

0:07:41

0:07:41

0:12:10

0:12:10

0:09:19

0:09:19

0:04:49

0:04:49

0:00:47

0:00:47

0:06:56

0:06:56