filmov

tv

How Much Car Insurance Do I Need?

Показать описание

How much car insurance do you actually need? What do all of the different coverages mean? Bodily injury or personal injury, what's the difference?

This is a pretty boring video that we tried to make better by adding cute kids. It sort of worked...

Sign up for monthly income, expenses, and net worth reports!

Check out our blog:

Follow us:

This is a pretty boring video that we tried to make better by adding cute kids. It sort of worked...

Sign up for monthly income, expenses, and net worth reports!

Check out our blog:

Follow us:

How Much Car Insurance Do I Actually Need?

How much car insurance do I actually need?

How Much Car Insurance Do You Need | 4 EASY STEPS

Understanding Auto Insurance: What’s ‘Full Coverage’ Car Insurance?

What Car Insurance Do I Need | How much Auto Insurance you need today - Basic

How much insurance do you need

7 mistakes people make when purchasing car insurance

Car Insurance Explained - 101 | Everything you NEED to know!

Car thefts impacting insurance rates

How much does car insurance cost and how can you lower your rates

Car Insurance explained + Useful Tips [2024]

The 5 BEST Auto Insurance Companies

Paying Monthly vs. Yearly for Insurance Explained! | Car Insurance 101

Liability Auto Insurance 101

How much car insurance do you really need? Car insurance explained

Car insurance explained | What you need to know

The Cheapest Car Insurance in 2023

GAP Insurance | Buy from dealer or Insurance company?

CAR INSURANCE DEDUCTIBLE EXPLAINED

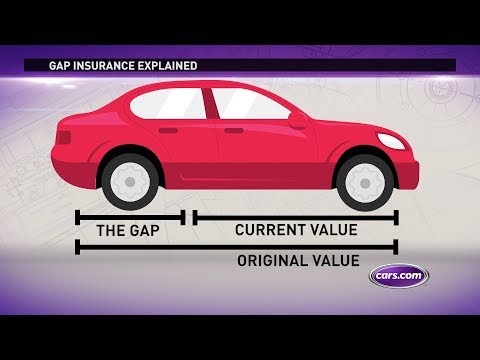

What is Gap Insurance?

The Truth About AAA Car Insurance

How much does your insurance go up after an accident

5 Cheapest 🚗 Insurance in the US

7 things you should tell your car insurance company

Комментарии

0:04:49

0:04:49

0:10:53

0:10:53

0:16:25

0:16:25

0:01:46

0:01:46

0:05:36

0:05:36

0:10:20

0:10:20

0:12:02

0:12:02

0:13:19

0:13:19

0:02:35

0:02:35

0:08:15

0:08:15

0:11:57

0:11:57

0:00:19

0:00:19

0:00:53

0:00:53

0:05:51

0:05:51

0:00:59

0:00:59

0:07:17

0:07:17

0:14:39

0:14:39

0:06:20

0:06:20

0:02:32

0:02:32

0:01:45

0:01:45

0:09:57

0:09:57

0:13:00

0:13:00

0:00:29

0:00:29

0:10:26

0:10:26