filmov

tv

The Untold Truth About Real Estate Investing.

Показать описание

Join this channel to get access to the perks:

The Untold Truth About Money: How to Build Wealth From Nothing.

The Untold Truth of Instagram - The INSANE Full Story

The Untold Truth Of They Live

The Untold TRUTH of Burger King

Untold Truth About African Americans - You Are Not From Africa Nor Are You An African

THE UNTOLD TRUTH 💜 TINY TIM

Discover The Untold Truth

The Untold Truth Of Kitchen Nightmares

The Untold Truth About Donald Trump's Success

The Untold Truth Of Hollywood Medium's Tyler Henry

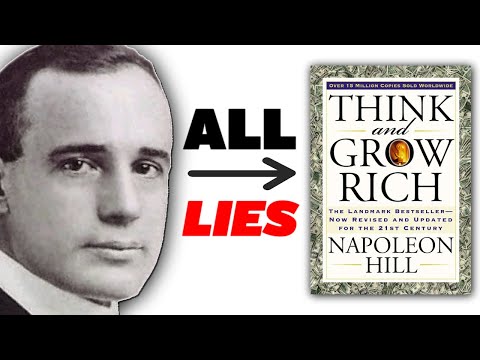

The Untold Truth of Napoleon Hill - History's Most Beloved Con-Man.

The Untold Story of Central Cee

The Untold Truth of Anthony Bourdain with TV Producer Tom Vitale

The Untold Truth Of Sylvia Browne

The Untold Truth Of The Terrifying Nosferatu

The Untold Truth Of Beetlejuice

The Untold Truth Of Bob Ross

🎆 THE UNTOLD TRUTH ABOUT NEW YEAR’S: WHAT THE BIBLE REALLY REVEALS AND HISTORY HIDES ✝️📜

The Untold Truth Of The Hatfield-McCoy Feud

The Untold Truth Of Mary Magdalene

The Untold Truth Of Borat 2

UNTOLD TRUTH about the BEGINNING🤯 #shorts #beginning #supernatural #creation #bible #jesus #god

The Untold Truth Of Madeleine McCann's Parents

The Untold Truth Of Sons Of Anarchy

Комментарии

0:17:26

0:17:26

0:23:17

0:23:17

0:05:23

0:05:23

0:31:16

0:31:16

0:03:58

0:03:58

0:10:51

0:10:51

0:00:31

0:00:31

0:04:58

0:04:58

0:07:38

0:07:38

0:14:39

0:14:39

0:21:20

0:21:20

0:09:30

0:09:30

0:54:38

0:54:38

0:10:51

0:10:51

0:11:36

0:11:36

0:10:13

0:10:13

0:08:19

0:08:19

0:17:00

0:17:00

0:11:54

0:11:54

0:10:08

0:10:08

0:10:11

0:10:11

0:00:59

0:00:59

0:06:17

0:06:17

0:11:27

0:11:27