filmov

tv

Efficient portfolio frontier in Python

Показать описание

How to efficiently construct the efficient portfolio frontier using real-world data? And how to find minimum variance, tangency, and target return portfolios? Today we are building together from scratch a Python script that downloads the data for the investable universe and builds both the efficient portfolio frontier and the securities market line.

Don't forget to subscribe to NEDL and give this video a thumbs up for more videos in Python!

Don't forget to subscribe to NEDL and give this video a thumbs up for more videos in Python!

Efficient Frontier in Python p.1

Efficient portfolio frontier in Python

How to make an Efficient Frontier Using Python

Stock Market Analysis & Markowitz Efficient Frontier on Python | Python # 11

Efficient Frontier in Python p.2

How to build an Efficient Portfolio Frontier in Python with 3 stocks

Efficient Frontier and Portfolio Optimization Explained | The Ultimate Guide

Modern portfolio theory in Python: Efficient Frontier and minimum-variance portfolio

DeFi Portfolio Optimization Masterclass | IPOR Labs

Efficient Frontier Python

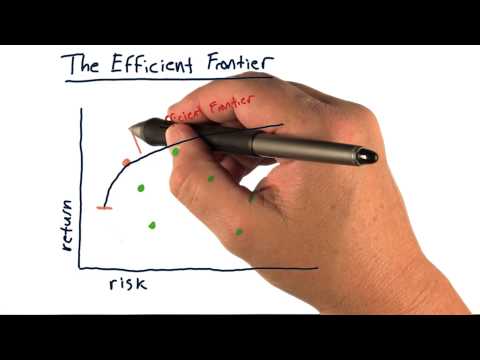

The efficient frontier

Efficient Frontier in Python p.3

Portfolio Optimization in Python: Boost Your Financial Performance

Markowitz portfolio optimization - Python

Efficient Frontier in Python p.4

Markowitz Bullet in Python (Code Tutorial) | Efficient Frontier

How to Maximize Investments: Efficient Frontier & Monte Carlo Simulation |Algorithmic Trading Py...

Efficient Frontier in Python p.5

Py 85 Obtaining the Efficient Frontier in Python Part I

How to construct an efficient frontier of risky assets in Python?

Modern Portfolio Theory Explained!

Graph The Efficient Frontier And Capital Allocation Line In Excel

Py 87 Obtaining the Efficient Frontier in Python Part III

Modern Portfolio Theory “has no utility” - Warren Buffett

Комментарии

0:16:22

0:16:22

0:27:08

0:27:08

0:10:06

0:10:06

0:33:58

0:33:58

0:18:00

0:18:00

0:10:16

0:10:16

0:13:05

0:13:05

0:25:17

0:25:17

1:03:01

1:03:01

0:06:48

0:06:48

0:02:54

0:02:54

0:07:30

0:07:30

0:23:07

0:23:07

0:14:24

0:14:24

0:28:57

0:28:57

0:06:50

0:06:50

0:05:22

0:05:22

0:16:58

0:16:58

0:05:36

0:05:36

0:07:42

0:07:42

0:16:31

0:16:31

0:08:47

0:08:47

0:02:08

0:02:08

0:01:56

0:01:56