filmov

tv

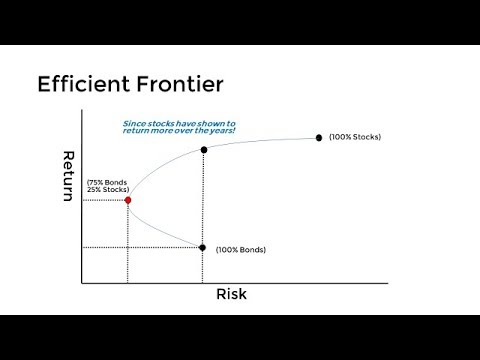

Efficient Frontier in Python p.1

Показать описание

Part 1: Building the Efficient Frontier in Python

In this series we are building the Efficient Frontier in Python with Dash as a web application over multiple tutorials.

★ ★ QuantPy GitHub ★ ★

★ ★ Discord Community ★ ★

★ ★ Support our Patreon Community ★ ★

Get access to Jupyter Notebooks that can run in the browser without downloading python.

★ ★ ThetaData API ★ ★

ThetaData's API provides both realtime and historical options data for end-of-day, and intraday trades and quotes. Use coupon 'QPY1' to receive 20% off on your first month.

★ ★ Online Quant Tutorials ★ ★

★ ★ Contact Us ★ ★

Disclaimer: All ideas, opinions, recommendations and/or forecasts, expressed or implied in this content, are for informational and educational purposes only and should not be construed as financial product advice or an inducement or instruction to invest, trade, and/or speculate in the markets. Any action or refraining from action; investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied in this content, are committed at your own risk an consequence, financial or otherwise. As an affiliate of ThetaData, QuantPy Pty Ltd is compensated for any purchases made through the link provided in this description.

In this series we are building the Efficient Frontier in Python with Dash as a web application over multiple tutorials.

★ ★ QuantPy GitHub ★ ★

★ ★ Discord Community ★ ★

★ ★ Support our Patreon Community ★ ★

Get access to Jupyter Notebooks that can run in the browser without downloading python.

★ ★ ThetaData API ★ ★

ThetaData's API provides both realtime and historical options data for end-of-day, and intraday trades and quotes. Use coupon 'QPY1' to receive 20% off on your first month.

★ ★ Online Quant Tutorials ★ ★

★ ★ Contact Us ★ ★

Disclaimer: All ideas, opinions, recommendations and/or forecasts, expressed or implied in this content, are for informational and educational purposes only and should not be construed as financial product advice or an inducement or instruction to invest, trade, and/or speculate in the markets. Any action or refraining from action; investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied in this content, are committed at your own risk an consequence, financial or otherwise. As an affiliate of ThetaData, QuantPy Pty Ltd is compensated for any purchases made through the link provided in this description.

Комментарии

0:16:22

0:16:22

0:18:00

0:18:00

0:05:36

0:05:36

0:10:06

0:10:06

0:06:48

0:06:48

0:28:57

0:28:57

0:07:30

0:07:30

0:27:08

0:27:08

0:16:58

0:16:58

0:25:17

0:25:17

0:07:42

0:07:42

0:08:47

0:08:47

0:06:50

0:06:50

0:33:58

0:33:58

0:10:16

0:10:16

0:03:05

0:03:05

0:23:07

0:23:07

0:03:41

0:03:41

0:33:18

0:33:18

0:32:47

0:32:47

0:14:24

0:14:24

0:03:40

0:03:40

0:02:08

0:02:08

0:05:20

0:05:20