filmov

tv

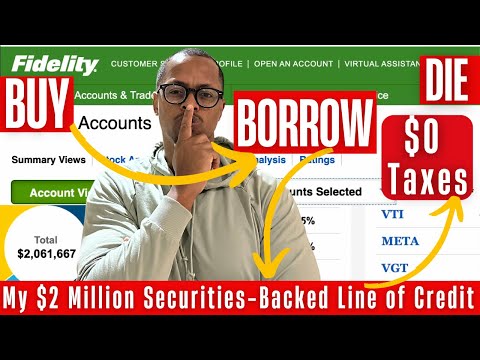

How To Borrow Against Stocks to Buy Real Estate ( Without Paying Taxes ) | Hayden Crabtree

Показать описание

In this video, I go over explaining how the Wealthy uses this Strategy to Avoid Paying Taxes and Buying Real Estate in 2022.

This is a Low-Risk Investment Strategy that will help you buy Real Estate even if you don't have the desired Captial.

⭐ Get Early Access to my 'Self-Storage Success Blueprint' Course

How to Acquire your first Investment Property in the next 90 days FREE Webinar:

Skip The Flip 2: Three Keys to Any Deal - Latest 2021

Get Your Copy of Skip The Flip For Free!

Original Skip the Flip On Amazon:

Chapters:

00:00 How to borrow against your own stocks

00:40 Invest your time into building assets

01:14 Stock Market in 2021

02:08 What the wealthy do and you should too

03:35 What they do instead of selling

04:06 Listen carefully (Secret to Free Money)

05:32 How can you do the same?

06:34 Two ways to borrow against your stock portfolio

08:29 Creating a game plan

10:30 What to do when borrowing against stocks

==== Social Media ===

Hayden Crabtree is the author of the bestselling book Skip the Flip: Secrets the 1% Know About Real Estate Investing. It started with investing in Self Storage Facilities, Hayden now helps individuals participate in the World's Greatest Investment: Cash Flow Producing Real Estate.

This is a Low-Risk Investment Strategy that will help you buy Real Estate even if you don't have the desired Captial.

⭐ Get Early Access to my 'Self-Storage Success Blueprint' Course

How to Acquire your first Investment Property in the next 90 days FREE Webinar:

Skip The Flip 2: Three Keys to Any Deal - Latest 2021

Get Your Copy of Skip The Flip For Free!

Original Skip the Flip On Amazon:

Chapters:

00:00 How to borrow against your own stocks

00:40 Invest your time into building assets

01:14 Stock Market in 2021

02:08 What the wealthy do and you should too

03:35 What they do instead of selling

04:06 Listen carefully (Secret to Free Money)

05:32 How can you do the same?

06:34 Two ways to borrow against your stock portfolio

08:29 Creating a game plan

10:30 What to do when borrowing against stocks

==== Social Media ===

Hayden Crabtree is the author of the bestselling book Skip the Flip: Secrets the 1% Know About Real Estate Investing. It started with investing in Self Storage Facilities, Hayden now helps individuals participate in the World's Greatest Investment: Cash Flow Producing Real Estate.

Комментарии

0:15:53

0:15:53

0:01:53

0:01:53

0:03:37

0:03:37

0:09:21

0:09:21

0:19:16

0:19:16

0:05:08

0:05:08

0:02:01

0:02:01

0:16:13

0:16:13

0:08:10

0:08:10

0:12:06

0:12:06

0:15:46

0:15:46

0:03:23

0:03:23

0:05:31

0:05:31

0:11:08

0:11:08

0:12:24

0:12:24

0:13:37

0:13:37

0:04:31

0:04:31

0:28:00

0:28:00

0:10:17

0:10:17

0:02:45

0:02:45

0:13:53

0:13:53

0:00:58

0:00:58

0:14:49

0:14:49

0:15:23

0:15:23