filmov

tv

The Simple 'Borrow til you Die' Tax Strategy

Показать описание

The quickest and easiest way to avoid payroll taxes is through buying investment properties. We call it the "borrow until you die" tax strategy. Virtually anyone with a W2, or steady taxable income, can take advantage of it and it allows you to avoid paying the IRS and build out your real estate portfolio. It personally has saved me millions and allowed me to acquire more properties. Real estate pros use this on EVERY deal, but novices are missing out simply because they don't know about it.

In today's video I take you through the 'borrow until you die' tax strategy and give you an example of how I'm doing it with my most recent project.

Other ways to connect and work with me:

----------------------------------------------------

📷 Follow me:

Instagram: @KaiJAndrew

----------------------------------------------------

Credit:

Ayush Rai

The Simple 'Borrow til you Die' Tax Strategy

Buy, Borrow, Die: How America's Ultrawealthy Stay That Way

Buy. Borrow. Die. | How The Rich Stay Rich

How To Make Money With Debt (2024)

Michael Jackson’s Reaction When Chris Tucker Came Out 😂

How I Borrow FREE Money

Rust for TypeScript devs : Borrow Checker

Sickick - Mind Games (Lyrics)

$150,000 Navy Federal Personal Loan Hacks! Don’t Apply Until You Watch This Video!

Why Does Everyone Love This Game? | Cascadia Review | BUY, BORROW, or BUST

Easy Business Loan $1,000-$150,000 - The New American Express Kabbage Business Loan

HOW TO BORROW 50,000Ugx FROM YOUR MOBILE MONEY IN LESS THAN A MINUTE ANYTIME

Justin Bieber - Ghost (Lyrics)

How to get a 0% car 🚘 loan

Don't file an LLC until you do THIS! (Business Credit Loan Mistakes)

5 Minute Licks - Fake it 'til you make it

Borrowing Against Your Life Insurance Policy : EXPLAINED!

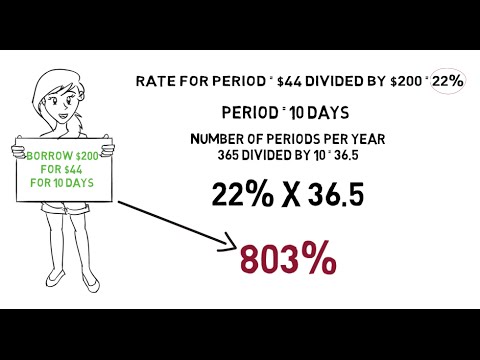

Payday Loan Interest Rates

Back-to-School Fashion Shopping Hacks Shop Til You DROP

How Principal & Interest Are Applied In Loan Payments | Explained With Example

Smith & Thell - Hotel Walls (Lyric Video)

MacBook Air M1 in 2024: Why you should get it (4 years later)

Drop shop...or Shop til you drop #BoxyCharm #Shoppingaddiction #BoxyCharmDropShop

No Interest Home Loans? | Smart Investing & Borrowing Explained | Warikoo Hindi

Комментарии

0:10:17

0:10:17

0:01:53

0:01:53

0:09:21

0:09:21

0:10:11

0:10:11

0:00:36

0:00:36

0:16:13

0:16:13

0:08:49

0:08:49

0:04:14

0:04:14

0:10:33

0:10:33

0:18:29

0:18:29

0:06:03

0:06:03

0:05:11

0:05:11

0:02:34

0:02:34

0:00:59

0:00:59

0:13:31

0:13:31

0:06:15

0:06:15

0:04:32

0:04:32

0:03:17

0:03:17

0:12:35

0:12:35

0:03:49

0:03:49

0:03:27

0:03:27

0:16:43

0:16:43

0:20:34

0:20:34

0:10:10

0:10:10