filmov

tv

Should I Refinance Or Pay Extra On My Mortgage?

Показать описание

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

Should I Refinance Or Pay Extra On My Mortgage?

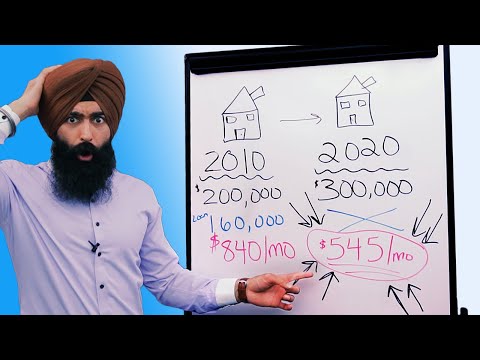

Refinance the Mortgage or Pay Down Debt?

When Does Refinancing Your Mortgage Make Sense?

Mortgage Refinance Explained - When Should You REFINANCE?

Refinance 101 - Mortgage Refinance Explained

Should I Refinance My $13,000 Car?

Should You Refinance Or Pay Extra On Your Mortgage?

What it means to 'refinance' your home 🏡✅

Refinancing in 2024: What's Holding You Back?

Why You Should NOT Refinance Your Mortgage

Should I Refinance to Get Rid of PMI?

Do This To Pay Off Your Mortgage Faster & Pay Less Interest

6 Times When Refinancing Makes Sense! When Should You Refinance Your Mortgage

Property refinancing for beginners

Should I Refinance My Mortgage to Pay Off My Auto Loan?

Should You Refinance or Pay Down Your Mortgage?

Should You Consider a Cash Out Refinance?

Is a Cash-Out Refinances a Good Idea?

Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage

💲Why You Should Refinance Your Car-#3 Will Surprise You🏦

Should I Refinance My Mortgage to Pay Off Debt - Canada Mortgage Advice

Should I Cash Out Refinance In 2024?! | Refinancing Your Home

Should I Refinance My Mortgage? How To Decide! (Full Analysis)

Should I Refinance My Student Loans? And Does It Matter If I Want To Buy a House Soon?

Комментарии

0:07:44

0:07:44

0:03:22

0:03:22

0:06:01

0:06:01

0:15:33

0:15:33

0:13:51

0:13:51

0:08:50

0:08:50

0:02:36

0:02:36

0:00:38

0:00:38

0:00:32

0:00:32

0:12:55

0:12:55

0:07:02

0:07:02

0:10:56

0:10:56

0:12:02

0:12:02

0:07:50

0:07:50

0:04:26

0:04:26

0:03:16

0:03:16

0:09:04

0:09:04

0:05:22

0:05:22

0:13:40

0:13:40

0:04:34

0:04:34

0:01:29

0:01:29

0:11:33

0:11:33

0:14:04

0:14:04

0:02:14

0:02:14