filmov

tv

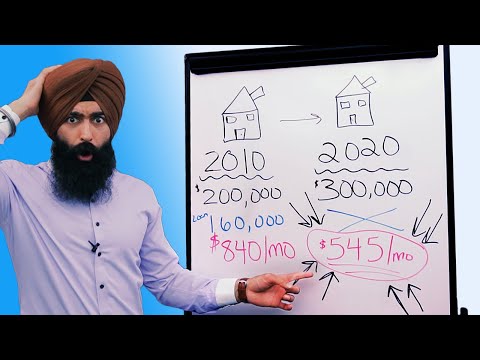

Should I Refinance My Mortgage to Pay Off My Auto Loan?

Показать описание

An auto loan is typically the second highest monthly payment after your mortgage, so it is common to want to get rid of it. Many homeowners with built-up equity in their properties ask, Does it make sense to roll my auto loa into my mortgage? There are some specific things you need to look at to determine if this strategy makes sense for you, and in this lesson I will break it all down.

#CashOutRefi #DebtConsolidation #Mortgage

Weinberg Mortgage | Rob Weinberg Lending Team

Expert Home Buying | Refinance | Wealth Building Videos:

Robert Weinberg | Your Mortgage Advisor & Financial Coach:

I empower people to take control of their Financial Future through expert Mortgage and Financial Strategies. My hope is for you to implement these tips I’ve learned over my extensive Mortgage career to create wealth in your own life. I’m giving you all of the tools and resources I personally use to help my clients achieve a brighter financial future.

Please Subscribe to my Channel for more! Like and Share

To Call or Text my Office Directly: (860) 413-3938

Visit us on Social Media! Your Weinberg Lending Team 👍

Like & Follow for Mortgage Tips Each Week 👇

#MortgageAdvisor #CTLender #TopLender #MortgageStrategies #FinancialStrategies

#CashOutRefi #DebtConsolidation #Mortgage

Weinberg Mortgage | Rob Weinberg Lending Team

Expert Home Buying | Refinance | Wealth Building Videos:

Robert Weinberg | Your Mortgage Advisor & Financial Coach:

I empower people to take control of their Financial Future through expert Mortgage and Financial Strategies. My hope is for you to implement these tips I’ve learned over my extensive Mortgage career to create wealth in your own life. I’m giving you all of the tools and resources I personally use to help my clients achieve a brighter financial future.

Please Subscribe to my Channel for more! Like and Share

To Call or Text my Office Directly: (860) 413-3938

Visit us on Social Media! Your Weinberg Lending Team 👍

Like & Follow for Mortgage Tips Each Week 👇

#MortgageAdvisor #CTLender #TopLender #MortgageStrategies #FinancialStrategies

Комментарии

0:06:01

0:06:01

0:13:51

0:13:51

0:07:44

0:07:44

0:03:17

0:03:17

0:10:45

0:10:45

0:04:23

0:04:23

0:12:02

0:12:02

0:05:59

0:05:59

0:10:09

0:10:09

0:15:33

0:15:33

0:32:31

0:32:31

0:07:50

0:07:50

0:03:56

0:03:56

0:04:40

0:04:40

0:04:35

0:04:35

0:09:24

0:09:24

0:01:01

0:01:01

0:13:40

0:13:40

0:10:48

0:10:48

0:13:45

0:13:45

0:12:55

0:12:55

0:03:13

0:03:13

0:14:02

0:14:02

0:09:45

0:09:45