filmov

tv

Why You Should NOT Refinance Your Mortgage

Показать описание

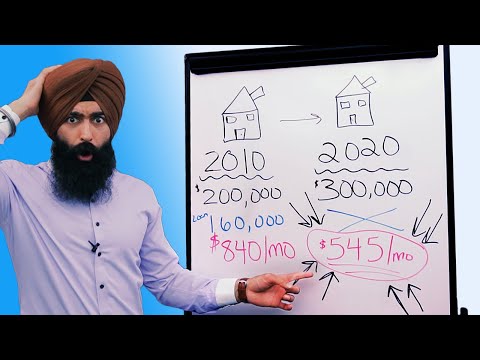

Looking to pull cash out from your home or get rid of mortgage insurance and considering refinancing your mortgage? What should you consider when doing a refinance? When does it make sense to do a refinance? Should you be worried about mortgage insurance (pmi)? In this video, we discuss when you should potentially consider refinancing and when it doesn't make since to consider a mortgage refinance.

🎙- The Educated Home Buyer Podcast -

Connect with me 👇

Jeb Smith (huntington beach Realtor/orange county real estate)

DRE 01407449

Coldwell Banker Realty

#housingmarket #housing #interestrates

🎙- The Educated Home Buyer Podcast -

Connect with me 👇

Jeb Smith (huntington beach Realtor/orange county real estate)

DRE 01407449

Coldwell Banker Realty

#housingmarket #housing #interestrates

Why You Should NOT Refinance Your Mortgage

Why You SHOULD NOT Refinance Your Mortgage! Pros and cons of refinancing your house.

3 Reasons Why You Should NOT Refinance Right NOW!

When Does Refinancing Your Mortgage Make Sense?

Reddit Q&A: Why Banks Want You To Refinance So Bad and Why They Won't Admit It 😲

Why You Should NOT Do a Mortgage Refinance: FIVE Costly Pitfalls

Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage

FOUR Reasons NOT To Do a Mortgage Refinance: Costly Mistakes

How to know when it’s the right time to refinance!

Reasons Why You Should Not Refinance

When should you not refinance your home?

Do NOT Refinance Your Mortgage

When NOT to Refinance

What it means to 'refinance' your home 🏡✅

Do not refinance your home before watching this

DO NOT Refinance Your Mortgage Until You Watch This [HIDDEN LENDER SECRETS]

Car Refinancing Tips | What To Do AND NOT DO Refinancing Your Car Loan

6 Times When Refinancing Makes Sense! When Should You Refinance Your Mortgage

Why to NOT Refinance

DO NOT Refinance Your House Until You Watch This!

Why to 'NEVER EVER' Refinance a Mortgage!?

Why You Should NOT WAIT To Refinance Your Mortgage | Refinance Home Mortgage

When is it Worth Refinancing?

Top 5 Reasons Why People Refinance Their Mortgage (Should You?)

Комментарии

0:12:55

0:12:55

0:11:51

0:11:51

0:05:05

0:05:05

0:06:01

0:06:01

0:03:24

0:03:24

0:09:25

0:09:25

0:13:40

0:13:40

0:07:13

0:07:13

0:01:27

0:01:27

0:00:43

0:00:43

0:04:07

0:04:07

0:28:38

0:28:38

0:02:37

0:02:37

0:00:38

0:00:38

0:00:51

0:00:51

0:09:33

0:09:33

0:01:13

0:01:13

0:12:02

0:12:02

0:05:39

0:05:39

0:06:28

0:06:28

0:11:59

0:11:59

0:04:12

0:04:12

0:04:35

0:04:35

0:04:52

0:04:52