filmov

tv

When Does Refinancing Your Mortgage Make Sense?

Показать описание

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

When Does Refinancing Your Mortgage Make Sense?

Mortgage 101: How to Refinance a Mortgage

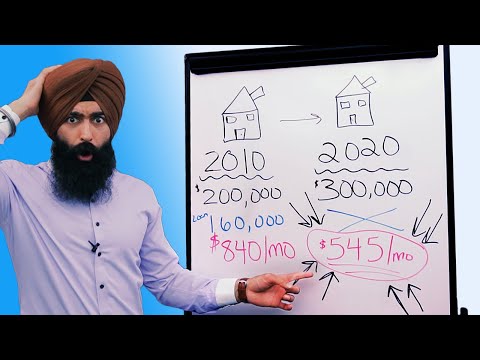

Refinance 101 - Mortgage Refinance Explained

Property refinancing for beginners

When to refinance a mortgage

6 Times When Refinancing Makes Sense! When Should You Refinance Your Mortgage

When Does Refinancing Your Mortgage Make Sense?

When is it Worth Refinancing?

Looking to refinance your mortgage? 🏡❗Avoid these TOP 3 MISTAKES❗ #homefinancing #homefinance

Is Refinancing Your Mortgage Worth It?

Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage

When Does Refinancing Make Sense?

Refinancing Explained: What to Know and Expect (Australia)

Mortgage Refinance Explained - When Should You REFINANCE?

Why You Should NOT Refinance Your Mortgage

Mortgage refinancing explained: What to know and when to do it

Is Refinancing a Mortgage 'Starting Over?'

When Does Refinancing Your Mortgage Make Sense?

Mortgage Refinance Explained - Refinance 101

REFINANCING BREAKDOWN Step-by-step guide | Property Investment UK

Is Refinancing Your Mortgage Worth It? Refinancing Your Home 101 🏠

Does Refinancing Your Mortgage Impact Your Credit Scores? | Intelligent Finance Guide

Why you should refinance your home loan 🏡

Paying extra on your mortgage VS refinancing

Комментарии

0:06:01

0:06:01

0:04:23

0:04:23

0:13:51

0:13:51

0:07:50

0:07:50

0:03:07

0:03:07

0:12:02

0:12:02

0:04:45

0:04:45

0:04:35

0:04:35

0:00:51

0:00:51

0:03:13

0:03:13

0:13:40

0:13:40

0:04:00

0:04:00

0:02:27

0:02:27

0:15:33

0:15:33

0:12:55

0:12:55

0:04:36

0:04:36

0:03:56

0:03:56

0:06:44

0:06:44

0:13:02

0:13:02

0:08:08

0:08:08

0:06:37

0:06:37

0:01:40

0:01:40

0:02:56

0:02:56

0:01:58

0:01:58