filmov

tv

Efficient vs Inefficient Portfolios

Показать описание

This video discusses the difference between an efficient portfolio and an inefficient portfolio.

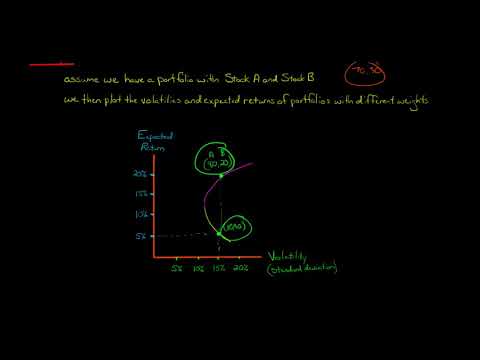

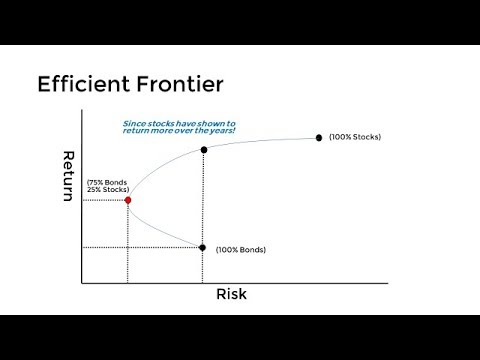

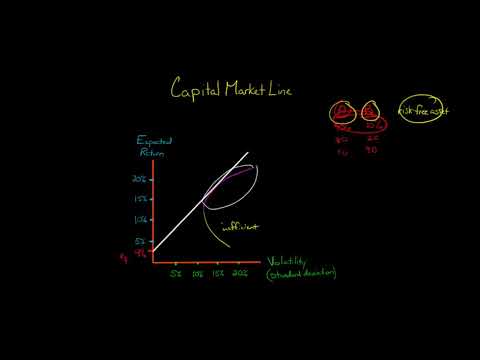

A portfolio is inefficient if there is another portfolio that has a higher expected return without having higher risk (volatility). For example, let's say Portfolio A has an expected return of 29% and Portfolio B has an expected return of 27%, and that both Portfolio A and Portfolio B have a volatility of 20%. In this example, Portfolio B is inefficient because there is another portfolio with a higher expected return that does not have higher risk (Portfolio A).

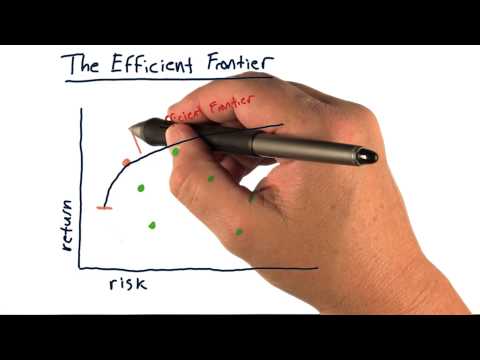

If a portfolio is efficient, this means you could not find another portfolio with a higher expected return and the same or lower volatility.

A rational investor would always rule out inefficient portfolios; if they can earn a higher return without bearing additional risk, they will do so.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

A portfolio is inefficient if there is another portfolio that has a higher expected return without having higher risk (volatility). For example, let's say Portfolio A has an expected return of 29% and Portfolio B has an expected return of 27%, and that both Portfolio A and Portfolio B have a volatility of 20%. In this example, Portfolio B is inefficient because there is another portfolio with a higher expected return that does not have higher risk (Portfolio A).

If a portfolio is efficient, this means you could not find another portfolio with a higher expected return and the same or lower volatility.

A rational investor would always rule out inefficient portfolios; if they can earn a higher return without bearing additional risk, they will do so.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:06:20

0:06:20

0:03:39

0:03:39

0:03:05

0:03:05

0:02:54

0:02:54

0:04:50

0:04:50

0:05:45

0:05:45

0:03:49

0:03:49

0:18:53

0:18:53

0:21:35

0:21:35

0:09:01

0:09:01

0:00:40

0:00:40

0:03:06

0:03:06

0:00:12

0:00:12

0:02:35

0:02:35

0:09:30

0:09:30

0:01:40

0:01:40

0:11:16

0:11:16

0:04:51

0:04:51

0:08:36

0:08:36

0:11:57

0:11:57

0:07:02

0:07:02

0:05:11

0:05:11

0:08:50

0:08:50

0:08:47

0:08:47