filmov

tv

Determining inefficient portfolio based on expected return and standard deviation.

Показать описание

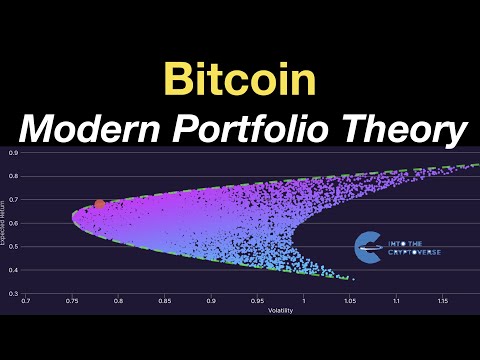

Following information is available about certain portfolios.

PORTFOLIO A B C D E F G H

Expected return (r)% 10 12 15 16 17 18 18 20

Standard Deviation ()% 23 21 25 29 19 32 35 45

Which are inefficient portfolios?

PORTFOLIO A B C D E F G H

Expected return (r)% 10 12 15 16 17 18 18 20

Standard Deviation ()% 23 21 25 29 19 32 35 45

Which are inefficient portfolios?

0:08:50

0:08:50

0:08:46

0:08:46

0:02:54

0:02:54

0:03:06

0:03:06

0:15:26

0:15:26

0:06:19

0:06:19

0:21:35

0:21:35

0:39:10

0:39:10

0:02:34

0:02:34

0:16:49

0:16:49

0:18:53

0:18:53

0:14:08

0:14:08

0:02:35

0:02:35

0:09:47

0:09:47

0:24:03

0:24:03

0:05:02

0:05:02

0:05:56

0:05:56

0:11:50

0:11:50

0:17:17

0:17:17

0:04:27

0:04:27

0:40:29

0:40:29

1:43:39

1:43:39

0:13:53

0:13:53

2:54:54

2:54:54