filmov

tv

How to Calculate NPV with Taxes

Показать описание

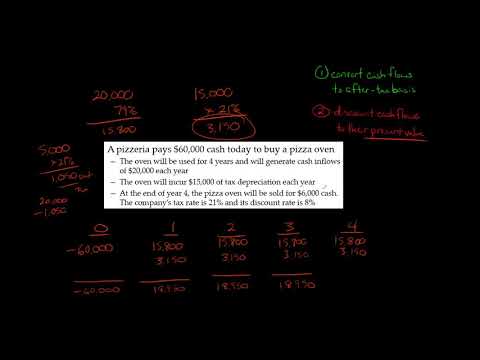

Income taxes affect a company's cash flows and should therefore be taken into consideration when calculating the Net Present Value (NPV) of a project. For example, depreciation is a non-cash expense, but it serves as a tax deduction that reduces a company's tax liability by its marginal tax rate. To account for taxes, you can first convert all cash flows to after-tax cash flows and then discount the after-tax cash flows to their present value.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:02:56

0:02:56

0:07:27

0:07:27

0:04:28

0:04:28

0:05:26

0:05:26

0:05:13

0:05:13

0:03:56

0:03:56

0:18:50

0:18:50

0:18:22

0:18:22

0:01:49

0:01:49

0:01:53

0:01:53

0:01:00

0:01:00

0:07:43

0:07:43

0:00:33

0:00:33

0:02:35

0:02:35

0:00:37

0:00:37

0:09:01

0:09:01

0:03:12

0:03:12

0:03:15

0:03:15

0:06:48

0:06:48

0:02:53

0:02:53

0:00:32

0:00:32

0:16:01

0:16:01

0:05:42

0:05:42

0:00:44

0:00:44