filmov

tv

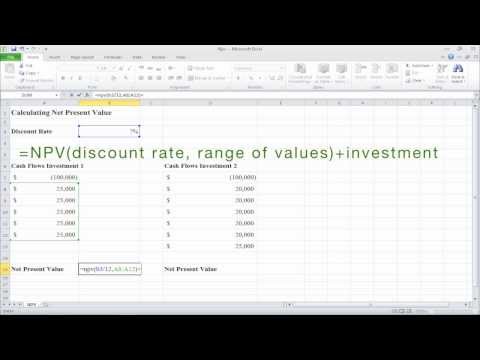

How to Calculate Net Present Value

Показать описание

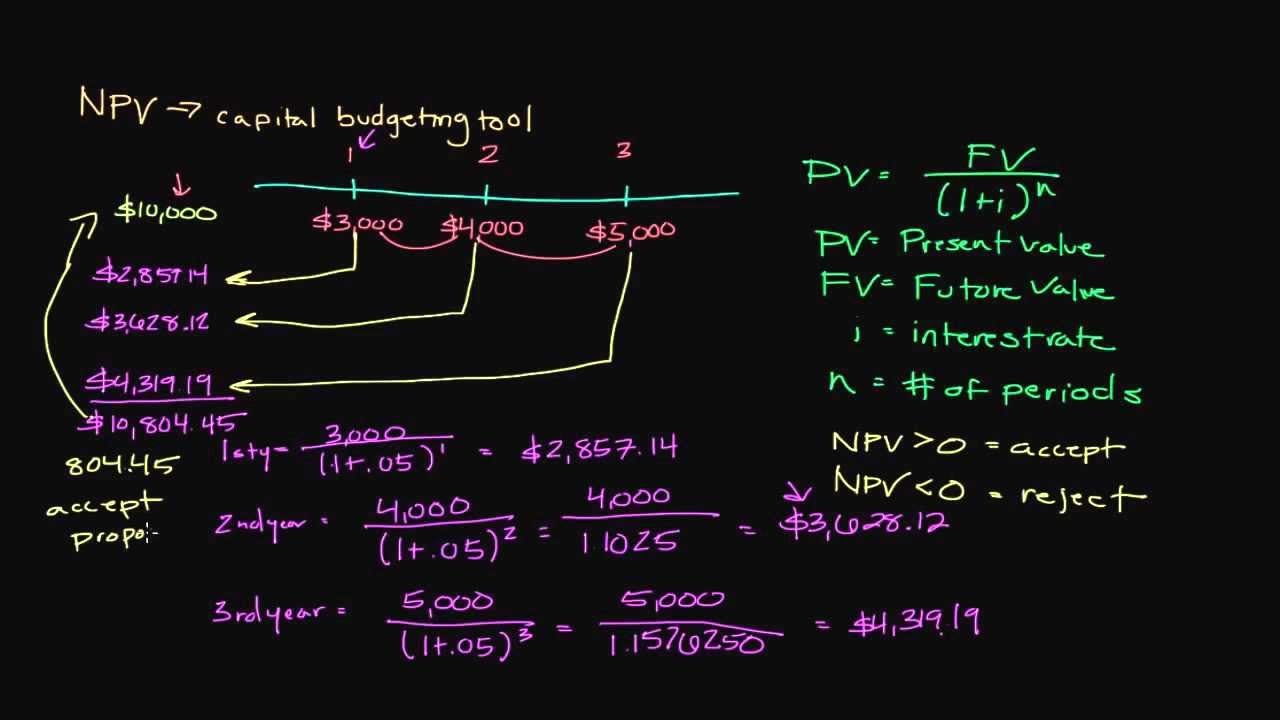

Net Present Value, commonly referred to as NPV, is a capital budgeting tool used in corporate finance and is designed to help firms assess the financial feasibility of various capital expenditures. Based largely on the time value of money, NPV compares the value of the initial investment to the cash flow generated over a number of years. An NPV greater than 0 supports the acceptance of the project, while an NPV less than 0 supports the rejection of the project.

Over the course of this video we'll walk through how to calculate NPV using the present value formula. Although the process is rather simple once you understand the basics, calculating NPV can be rather time consuming. To ensure accuracy make sure that you are organized when writing out your calculations as one number can certainly affect your results.

Net Present Value (NPV) explained

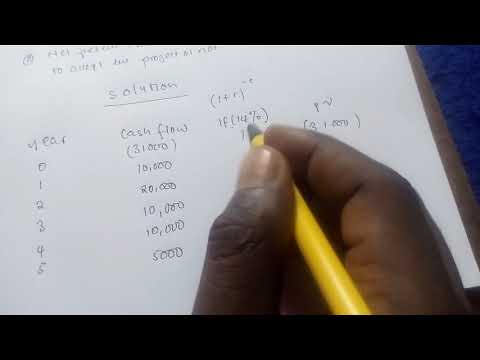

How to Calculate a Project's NPV?

How to Calculate NPV (Net Present Value) in Excel

How to calculate the Net Present value (NPV)

Net Present Value - NPV, Profitability Index - PI, & Internal Rate of Return - IRR Using Excel

How to Calculate NPV and IRR in Excel

Net Present Value (NPV) in Excel Explained | Should You Accept the Project?

How to Calculate Net Present Value

Net Present Value (NPV) Calculation Example Using Table | Non-constant (uneven) cash flows

How to Calculate Net Present Value in Excel

How to Calculate Net Present Value

Net Present Value Explained in Five Minutes

#4 Net Present Value (NPV) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

Investment Appraisal Net Present Value (NPV) | A-Level & IB Business

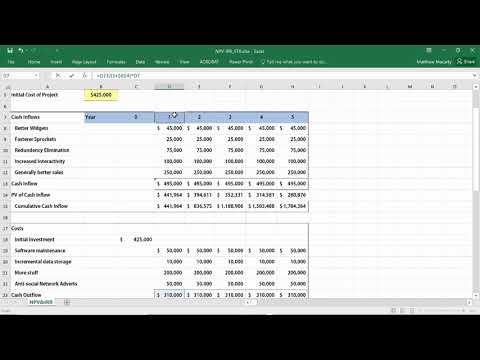

How to Calculate NPV, IRR & ROI in Excel || Net Present Value || Internal Rate of Return

NPV and IRR explained

How to Calculate Net Present Value (Npv) in Excel

HP 10BII Financial Calculator NPV Calculation

Net Present Value (NPV) - Basics, Formula, Calculations in Excel (Step by Step)

Calculating NPV and IRR in Excel: A Step-by-Step Tutorial

BA II Plus | Cash Flows 1: Net Present Value (NPV) and IRR Calculations - DCF

Net Present Value (NPV)

Using the BAII Plus to Calculate Net Present Value

Net Present Value (NPV): How to Do NPV Analysis

Комментарии

0:05:26

0:05:26

0:05:13

0:05:13

0:02:56

0:02:56

0:07:27

0:07:27

0:18:22

0:18:22

0:04:28

0:04:28

0:03:56

0:03:56

0:01:55

0:01:55

0:09:01

0:09:01

0:03:15

0:03:15

0:16:01

0:16:01

0:04:34

0:04:34

0:18:50

0:18:50

0:06:18

0:06:18

0:08:31

0:08:31

0:06:48

0:06:48

0:02:16

0:02:16

0:01:53

0:01:53

0:25:14

0:25:14

0:12:20

0:12:20

0:02:53

0:02:53

0:07:28

0:07:28

0:08:12

0:08:12

0:03:12

0:03:12