filmov

tv

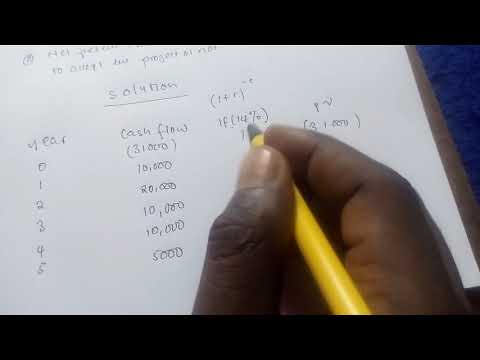

How to Calculate a Project's NPV?

Показать описание

How to Calculate a Project's NPV?

In this video, you will learn what a net present value is and how to calculate it. Estimating the NPV of a project is crucial as it helps to determine whether an investment is worth taking. The process includes 4 steps and we will take time to explain each one of them.

The video is part of our CFA Bootcamp course. You can check out the entire course on Udemy:

It's perfect for those of you who want to prepare for the CFA Level 1 exam!

How to Calculate a Project's NPV?

How to calculate manpower required for a project in Excel

How to calculate Planned Percentage in MS Project

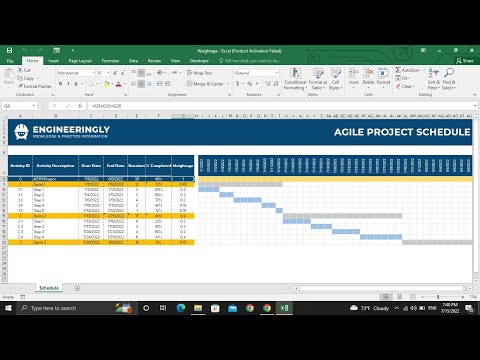

How to Calculate Project Percentage Completed from Weighted Activities in an Agile Project?

How to Estimate Project Costs: A Method for Cost Estimation

Calculate Completion Date of a Project in Excel 2010

Create S-Curve for Planned Target vs Actual Work from MS Project

The Difference Between '% COMPLETE' and 'PHYSICAL % COMPLETE' in Microsoft Proje...

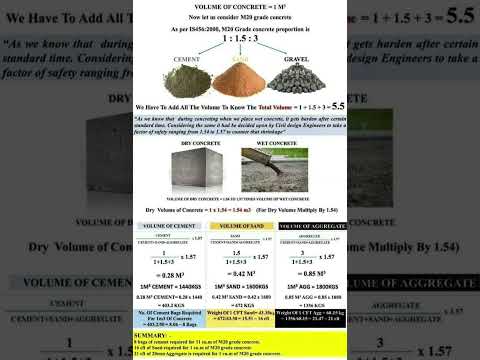

How to #Calculate #Cement #Sand and #Aggregate from #Concrete | #Shorts #Construction

Planned (Scheduled/Baseline) vs Actual (%)Progress/Complete (Summary Level) Microsoft Project 2021

Master Microsoft Project in 20 MINUTES! (FREE COURSE)

How to make S Curve in Microsoft Project | S Curve in Project Management

MS Project Planned Percentage Complete Vs Actual Percentage complete - Updated Improved version

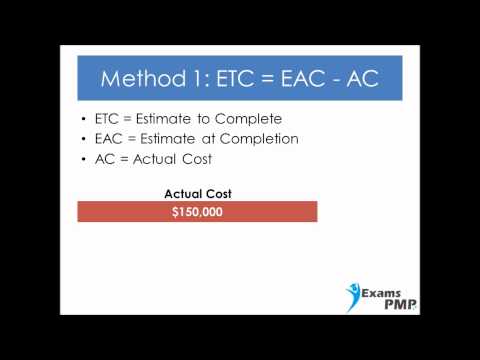

How to Calculate Estimate To Complete ETC

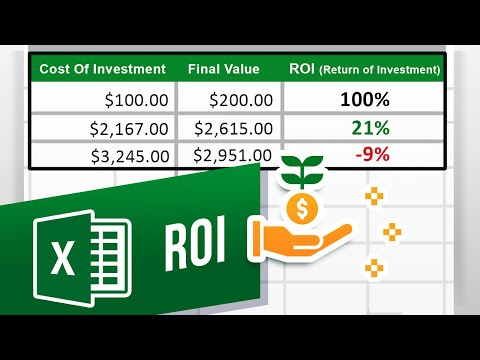

How to Calculate ROI (Return on Investment)

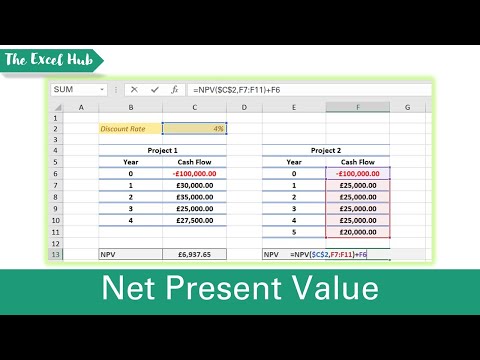

Calculate Net Present Value To Decide Between Two Projects In Excel - NPV Function

How to Calculate Percentage Of Project Completion In Excel

How to Calculate the Project Risk Score?

How to calculate the Net Present value (NPV)

PROJECT BUDGET COST MANAGEMENT EXCEL TEMPLATE EXAMPLE PROJECT

Create S Curve Without Resources from Primavera P6 | By activity weightage calculation and Resources

How to Calculate ROI for IT Projects

How to Calculate IRR in Excel

How to Calculate Earned Value in Project Management

Комментарии

0:05:13

0:05:13

0:01:09

0:01:09

0:07:12

0:07:12

0:03:44

0:03:44

0:11:44

0:11:44

0:02:01

0:02:01

0:08:05

0:08:05

0:14:48

0:14:48

0:00:11

0:00:11

0:16:14

0:16:14

0:18:39

0:18:39

0:12:57

0:12:57

0:15:49

0:15:49

0:02:06

0:02:06

0:01:53

0:01:53

0:03:52

0:03:52

0:03:17

0:03:17

0:04:01

0:04:01

0:07:27

0:07:27

0:00:41

0:00:41

0:15:59

0:15:59

0:02:20

0:02:20

0:02:22

0:02:22

0:04:39

0:04:39