filmov

tv

Net Present Value (NPV) explained

Показать описание

Net Present Value explained in a clear and simple way, in just a few minutes! Two steps: first understanding the idea of present value and future value, and then Net Present Value.

Present Value and Future Value are closely related concepts. An example of Future Value is: How much money will I have one year from now if I invest $100 at an expected 20% annual return? $100 multiplied by 1.2 is $120. An example of Present Value is: How much money do I invest today to achieve $120 one year from now at an expected 20% annual return? $120 divided by 1.2 is $100.

So to get to the future value, you move from left to right: take a present value, and multiply it by 1 plus the rate of return. To get to the present value, you go from right to left: take a future value, and divide it by 1 plus the rate of return.

⏱️TIMESTAMPS⏱️

0:00 Introduction

0:15 Present value and future value

1:49 Future value formula

2:07 Present value formula

2:24 Net Present Value calculation

4:12 NPV outcome

4:39 Evaluating NPV

You can do this for multiple years as well. How much money will I have two years from now if I invest $100 at an expected 20% annual return? $100 multiplied by 1.2 is $120. This $120 in turn multiplied by 1.2 is $144. How much money do I invest today to achieve $144 two years from now at an expected 20% annual return? $144 divided by 1.2 is $120. Then divide the $120 once again by 1.2 to get to $100 today.

The formula for future value is $100 times 1.2 to the power 2, equals $144. In other words, present value times 1 plus the rate of return to the power of the number of years, equals future value.

The formula for present value is $144 divided by 1.2 to the power 2, equals $100. In other words, future value divided by 1 plus the rate of rate of return (to the power of the number of years), equals present value.

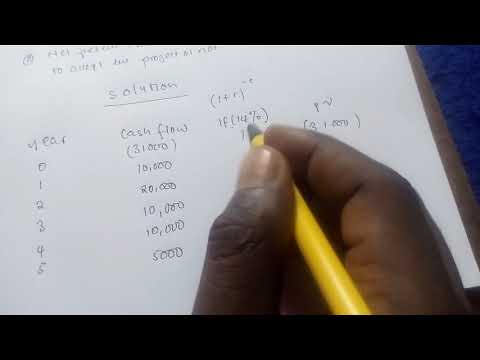

Let’s perform a Net Present Value calculation step-by-step. What is the present value (PV) of all the cash inflows and cash outflows of the following project? The project is expected to provide four years’ worth of benefits of nominally $400 per year, and an investment today of $1000 to launch the project. What is the present value of a $400 benefit that we expect one year from now? Take the nominal amount of $400 and divide it by 1 + the weighted average cost of capital. Weighted average cost of capital (or WACC) is a calculation of a firm's cost of capital in which each category of capital is proportionately weighted. We take a fairly high WACC of 20% in this calculation. 1 + 20% equals 1.2. $400 divided by 1.2 equals $333. The present value of a nominal amount of $400 one year from now is $333 as today’s equivalent.

What is the present value of a $400 benefit that we expect two years from now? To calculate that present value, we need to take the nominal amount of $400 and divide it by 1 + 20%, to the power 2 (as we need to take two steps: from year 2 to year 1, from year 1 to today). This is the same as saying $400 divided by 1.2 * 1.2, or $400 divided by 1.44, which is $278.

Next we calculate the present value of the $400 benefit that we expect three years from now, and the present value of the $400 benefit that we expect four years from now.

We have now translated all cash flows into today’s equivalent. To get to #NPV, you now simply sum the amounts: $333 + $278 + $231 + $193 minus $1000 investment today. The Net Present Value is $35. The word “Net” in the term #NetPresentValue means deducting the investment amount from the present values of the future cash flows. As the net present value of this project is positive, it is worth pursuing. Accept the project proposal, as it creates value for the company. If the net present value of the project would have been negative, it would not be worth pursuing. Reject the project proposal, as it does not create value for the company.

The main idea of Net Present Value (NPV) is very simple: time is money! The net present value method takes the time value of money into account, by translating all future cash flows into today’s money, and then adding up today’s investment and the present values of all future cash flows.

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better #investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Present Value and Future Value are closely related concepts. An example of Future Value is: How much money will I have one year from now if I invest $100 at an expected 20% annual return? $100 multiplied by 1.2 is $120. An example of Present Value is: How much money do I invest today to achieve $120 one year from now at an expected 20% annual return? $120 divided by 1.2 is $100.

So to get to the future value, you move from left to right: take a present value, and multiply it by 1 plus the rate of return. To get to the present value, you go from right to left: take a future value, and divide it by 1 plus the rate of return.

⏱️TIMESTAMPS⏱️

0:00 Introduction

0:15 Present value and future value

1:49 Future value formula

2:07 Present value formula

2:24 Net Present Value calculation

4:12 NPV outcome

4:39 Evaluating NPV

You can do this for multiple years as well. How much money will I have two years from now if I invest $100 at an expected 20% annual return? $100 multiplied by 1.2 is $120. This $120 in turn multiplied by 1.2 is $144. How much money do I invest today to achieve $144 two years from now at an expected 20% annual return? $144 divided by 1.2 is $120. Then divide the $120 once again by 1.2 to get to $100 today.

The formula for future value is $100 times 1.2 to the power 2, equals $144. In other words, present value times 1 plus the rate of return to the power of the number of years, equals future value.

The formula for present value is $144 divided by 1.2 to the power 2, equals $100. In other words, future value divided by 1 plus the rate of rate of return (to the power of the number of years), equals present value.

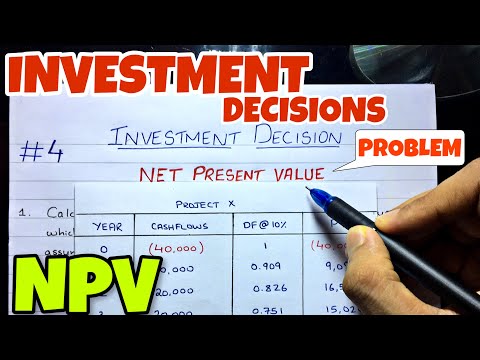

Let’s perform a Net Present Value calculation step-by-step. What is the present value (PV) of all the cash inflows and cash outflows of the following project? The project is expected to provide four years’ worth of benefits of nominally $400 per year, and an investment today of $1000 to launch the project. What is the present value of a $400 benefit that we expect one year from now? Take the nominal amount of $400 and divide it by 1 + the weighted average cost of capital. Weighted average cost of capital (or WACC) is a calculation of a firm's cost of capital in which each category of capital is proportionately weighted. We take a fairly high WACC of 20% in this calculation. 1 + 20% equals 1.2. $400 divided by 1.2 equals $333. The present value of a nominal amount of $400 one year from now is $333 as today’s equivalent.

What is the present value of a $400 benefit that we expect two years from now? To calculate that present value, we need to take the nominal amount of $400 and divide it by 1 + 20%, to the power 2 (as we need to take two steps: from year 2 to year 1, from year 1 to today). This is the same as saying $400 divided by 1.2 * 1.2, or $400 divided by 1.44, which is $278.

Next we calculate the present value of the $400 benefit that we expect three years from now, and the present value of the $400 benefit that we expect four years from now.

We have now translated all cash flows into today’s equivalent. To get to #NPV, you now simply sum the amounts: $333 + $278 + $231 + $193 minus $1000 investment today. The Net Present Value is $35. The word “Net” in the term #NetPresentValue means deducting the investment amount from the present values of the future cash flows. As the net present value of this project is positive, it is worth pursuing. Accept the project proposal, as it creates value for the company. If the net present value of the project would have been negative, it would not be worth pursuing. Reject the project proposal, as it does not create value for the company.

The main idea of Net Present Value (NPV) is very simple: time is money! The net present value method takes the time value of money into account, by translating all future cash flows into today’s money, and then adding up today’s investment and the present values of all future cash flows.

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better #investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:05:26

0:05:26

0:06:35

0:06:35

0:05:13

0:05:13

0:03:05

0:03:05

0:03:45

0:03:45

0:07:27

0:07:27

0:03:12

0:03:12

0:03:56

0:03:56

0:06:33

0:06:33

0:16:39

0:16:39

0:18:22

0:18:22

0:06:48

0:06:48

0:09:53

0:09:53

0:02:56

0:02:56

0:18:50

0:18:50

0:04:34

0:04:34

0:03:50

0:03:50

0:04:45

0:04:45

0:13:47

0:13:47

0:09:01

0:09:01

0:10:09

0:10:09

0:06:45

0:06:45

0:06:18

0:06:18

0:05:02

0:05:02