filmov

tv

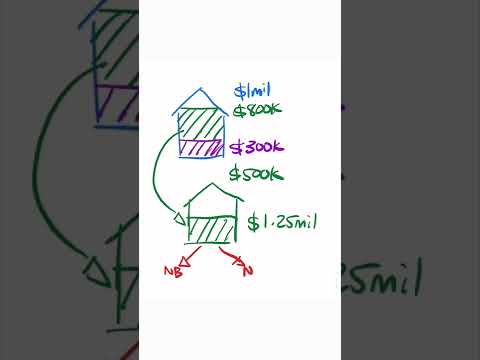

How to use the equity in your home to buy an investment property

Показать описание

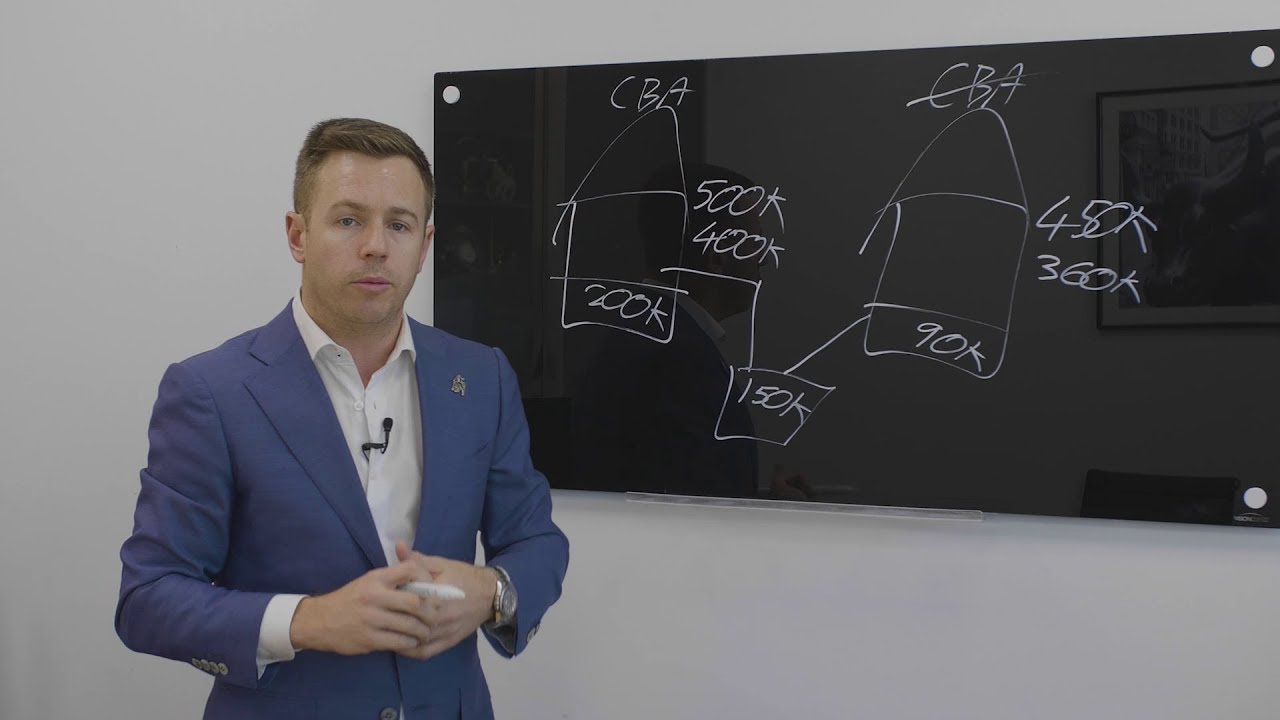

Tim Graham, Reventon COO, talks about how to use the equity in your home to make buying an investment property a reality.

Want to know how you can grow your property portfolio for as little as $15 a day?

▶ Follow us here ➡️

▶ Contact us ➡️ 1300 039 376

Level 9/420 St Kilda Rd, Melbourne VIC 3004

#usetheequityinyourhome

#howtobuyaninvestmentproperty #howtouseequityinyourhome #realestateinvestment #propertyinvestment

Want to know how you can grow your property portfolio for as little as $15 a day?

▶ Follow us here ➡️

▶ Contact us ➡️ 1300 039 376

Level 9/420 St Kilda Rd, Melbourne VIC 3004

#usetheequityinyourhome

#howtobuyaninvestmentproperty #howtouseequityinyourhome #realestateinvestment #propertyinvestment

How to use the equity in your home to buy an investment property

How to Get Equity Out Of Your Home - 4 WAYS! | What is Home Equity | What is Equity

How To Use Equity From Your House To Buy Multiple Properties | Whiteboard Finance

How To Use Equity To Buy Investment Property | Property Investing | Mortgage Finance / Refinance

What Is Equity In A Home

What is Equity

What Should I Do With My Home's Equity?

The Best Way to Use Home Equity | Morris Invest

Financial Accounting- learning the basics - Assets = Liabilities + Owner's Equity transactions ...

How to use your EQUITY to buy another home (step-by-step)

HOW TO use Equity to buy Property in Australia | Personal Finance - Real Estate Investing Australia

STARTUP EQUITY - Who Gets What and Why? How does it work?

How to use Equity to buy a Property?

HOW TO use Equity to buy Property in Australia

How To Use Your Equity To Buy Another Property

What is home equity and how can you access it?

Home Equity Explained 2024 | The BEST Way To Use Home Equity

Home Equity Line of Credit - Dave Ramsey Rant

Home Equity 101: Everything You Need to Know

Can You Use Your Equity To Buy Another House?

What Is A Home Equity Loan? | The Red Desk

The ULTIMATE HELOC Guide - Home Equity Line of Credit Explained

Can I Use My Home Equity To Buy Real Estate?

How To Distribute Startup Equity (The Smart Way)

Комментарии

0:03:16

0:03:16

0:07:54

0:07:54

0:10:27

0:10:27

0:08:19

0:08:19

0:06:21

0:06:21

0:05:35

0:05:35

0:05:36

0:05:36

0:06:18

0:06:18

0:45:08

0:45:08

0:16:39

0:16:39

0:14:08

0:14:08

0:15:47

0:15:47

0:05:54

0:05:54

0:08:42

0:08:42

0:01:16

0:01:16

0:01:39

0:01:39

0:09:51

0:09:51

0:07:46

0:07:46

0:06:14

0:06:14

0:12:15

0:12:15

0:06:00

0:06:00

0:15:44

0:15:44

0:07:37

0:07:37

0:04:17

0:04:17