filmov

tv

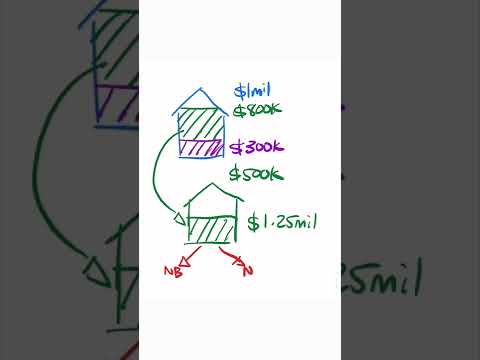

How to use Equity to buy a Property?

Показать описание

Equity Harvesting or Cash out Refinance. We breakdown the jargon and provide an example on how you can refinance your first property to buy a second. Leave a like if you found this topic helpful!

🏠 Looking for a Brisbane Buyers Agent?

🛠️ Find Our Triple Gable Queenslander Renovation episodes here:

🎯 Socials

🎬 Videos

HOUSING BOOM OR MARKET CRASH? | Australian property market 2021:

🔎 Disclaimer

No Legal, Financial & Taxation Advice

The Listener acknowledges and agrees that:

Any information provided by us is provided as general information and for general information purposes only. We have not taken the Listeners’ personal and financial circumstances into account when providing information. We must not and have not provided legal, financial or taxation advice to the Listener. The information provided must be verified by the Listener prior to the Listener acting or relying on the information by an independent professional advisor including a legal, financial, taxation advisor and the Listener’s accountant. The information may not be suitable or applicable to the Listener’s individual circumstances. We do not hold an Australian Financial Services Licence as defined by section 9 of the Corporations Act 2001 (Cth) and we are not authorised to provide financial services to the Listener, and we have not provided financial services to the Listener.

🏠 Looking for a Brisbane Buyers Agent?

🛠️ Find Our Triple Gable Queenslander Renovation episodes here:

🎯 Socials

🎬 Videos

HOUSING BOOM OR MARKET CRASH? | Australian property market 2021:

🔎 Disclaimer

No Legal, Financial & Taxation Advice

The Listener acknowledges and agrees that:

Any information provided by us is provided as general information and for general information purposes only. We have not taken the Listeners’ personal and financial circumstances into account when providing information. We must not and have not provided legal, financial or taxation advice to the Listener. The information provided must be verified by the Listener prior to the Listener acting or relying on the information by an independent professional advisor including a legal, financial, taxation advisor and the Listener’s accountant. The information may not be suitable or applicable to the Listener’s individual circumstances. We do not hold an Australian Financial Services Licence as defined by section 9 of the Corporations Act 2001 (Cth) and we are not authorised to provide financial services to the Listener, and we have not provided financial services to the Listener.

Комментарии

0:10:27

0:10:27

0:03:16

0:03:16

0:07:54

0:07:54

0:16:39

0:16:39

0:06:21

0:06:21

0:08:19

0:08:19

0:14:08

0:14:08

0:05:36

0:05:36

0:11:18

0:11:18

0:05:54

0:05:54

0:06:18

0:06:18

0:01:16

0:01:16

0:19:49

0:19:49

0:10:34

0:10:34

0:07:37

0:07:37

0:12:15

0:12:15

0:08:52

0:08:52

0:07:46

0:07:46

0:09:51

0:09:51

0:19:30

0:19:30

0:51:45

0:51:45

0:09:09

0:09:09

0:38:04

0:38:04

0:06:00

0:06:00