filmov

tv

Over $2K in Car Payments!

Показать описание

Next Steps:

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

Product Links:

Over $2K in Car Payments!

2K in car payments can take away over 200k in buying power! #dallasrealestate

How Dealers turn your Cash down into profit! Car Buying Tips

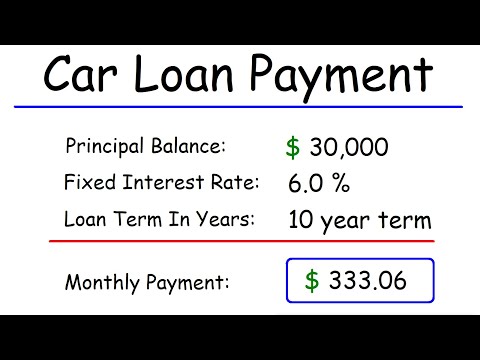

How To Calculate Your Car Loan Payment

Louisiana woman accused of refusing to return $1.2M after bank error

How much $$ my laundromat made this weekend #shorts

My Paycheck Money Budget Routine (Do This When You Get Paid)

The 3 BEST Paying Jobs You SHOULD Consider 💰#shorts

If You Have $5,000 Do These 5 Steps NOW

Questions to NEVER answer on a car lot - Car Buying Tips

I've Got $37,000 In Savings, What Should I Do With It?

How Much MONEY A Small Youtuber MAKES From AD REVENUE

3 Places Only Stupid People Buy Cars

Living Off Dividends - $40,000 per year!! #dividendinvesting

How to Buy a Good Used Car for Only $300

Victor Wembanyama's POV!😳 #shorts

😮How To Buy A Used Car From A Dealership-Ex Salesman Exposes Their Trickery🚗

5 Things You Should NEVER Say | Car Dealers LOVE When you Make THESE MISTAKES

IF YOU HAVE $150 IN THE BANK | DO THIS NOW

How Much Should I Be Spending On Rent?

Biggest NBA Fines for Celebrations!😈 #shorts

How To Get A Car Loan With Bad Credit Or No Credit!

PART 3: Rich Driver vs Poor Driver, FROM 2K TO 7K EARNINGS IN 15 DAYS

Top 3 Things To Invest Your Money In 2023

Комментарии

0:08:39

0:08:39

0:00:06

0:00:06

0:08:28

0:08:28

0:10:44

0:10:44

0:03:49

0:03:49

0:00:40

0:00:40

0:15:31

0:15:31

0:00:32

0:00:32

0:09:40

0:09:40

0:05:07

0:05:07

0:05:00

0:05:00

0:00:31

0:00:31

0:26:39

0:26:39

0:00:51

0:00:51

0:00:57

0:00:57

0:00:33

0:00:33

0:12:34

0:12:34

0:07:11

0:07:11

0:09:24

0:09:24

0:01:34

0:01:34

0:00:23

0:00:23

0:14:22

0:14:22

0:11:48

0:11:48

0:00:25

0:00:25