filmov

tv

Practical way To Make 1 Crore *no clickbait*

Показать описание

Join my community to build and monetise your audience:

Build, Launch & Scale your community👇🏼

Business Enquiries👇🏼

Useful Links:

Join me,

Credits:

Editor

Build, Launch & Scale your community👇🏼

Business Enquiries👇🏼

Useful Links:

Join me,

Credits:

Editor

Practical way To Make 1 Crore *no clickbait*

Best Ways To Make $10,000/Month In 2024

The 7 BEST Side Hustles That Make $100+ Per day

Best 5 Side Hustles To Make $500/day

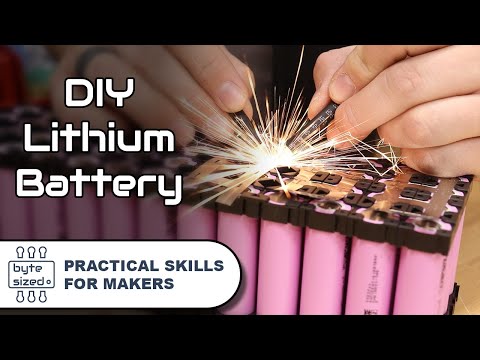

How To Make A Lithium Battery Pack With 18650 Cells | Practical Skills For Makers

The BEST Way to Make Coffee

Shadowing English Speaking Practice American Accent | Easy English Conversation Method

The BEST Ways to Make MILLIONS Right Now in GTA 5 Online! (MAKE FAST MONEY EASY!)

The Best Way to Make Money in GTA Online That NO ONE USES...

The Best Way To Make French Fries At Home (Restaurant-Quality) | Epicurious 101

BEST WAY TO MAKE YOUR JOYSTICK BIGGER AND STRONGER

THE BEST METHOD TO MAKE EGUSI SOUP // PLUS TIPS ON HOW TO MAKE LUMPY EGUSI

BEST CARAMEL SAUCE RECIPE| HOW TO MAKE CARAMEL SAUCE #shorts

How to Make Moka Pot Coffee & Espresso - The BEST Way (Tutorial)

10 best Small Business Ideas for Kids to Make Money

99% People Make This☝️ Common Mistake in English | English Speaking Practice #englishmistakes #learn...

How to make a practical rechargeable lamp

How to make Super SOFT and FLUFFY Brioche Buns. The BEST Homemade Brioche Buns!

My Best Sales Tactic (to Make a TON of Money)

Best Earning App for Students Without Investment | How to Earn Money Online | New Earning App Today

What Is The Best Way to Make a Rabbet Joint | Woodworking

HOW TO MAKE THE BEST LEMONADE IN THE WORLD

The Best Way to Make Homemade Caramel

The Best Way to Make Money in The Sims 4

Комментарии

0:17:12

0:17:12

0:12:43

0:12:43

0:13:58

0:13:58

0:19:53

0:19:53

0:15:44

0:15:44

0:00:35

0:00:35

0:14:59

0:14:59

0:08:22

0:08:22

0:01:07

0:01:07

0:07:24

0:07:24

0:10:10

0:10:10

0:10:02

0:10:02

0:00:34

0:00:34

0:03:29

0:03:29

0:08:09

0:08:09

0:00:35

0:00:35

0:08:08

0:08:08

0:05:11

0:05:11

0:08:12

0:08:12

0:11:25

0:11:25

0:02:19

0:02:19

0:02:07

0:02:07

0:01:22

0:01:22

0:06:35

0:06:35