filmov

tv

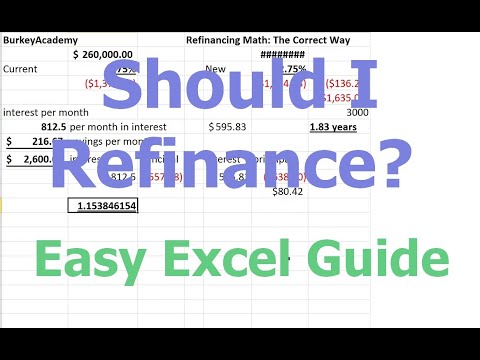

Should I Refinance my Mortgage?

Показать описание

The easiest way to determine if you should refinance. Check out my full analysis on whether refinancing is worth it.

Mortgage interest rates are dropping. They have fallen to 6% after being nearly 8% in October of 2023. With this large drop in interest rates you may be wondering if you should refinance your mortgage.

I use excel to determine if refinancing is worth it. I do this by comparing my current mortgage payment with the new mortgage payment after refinancing. I then calculate a pay-back period by dividing by closing costs by the monthly savings on my mortgage payment. If the payback period is short enough then its worth refinancing.

Only you get to choose what a short enough pay-back period is. I like to see pay-back periods of 3 years of less when refinancing a home.

I also compare the total interest paid on the current mortgage vs the refinanced mortgage.

Pro Tip: If you are used to paying a higher mortgage payment and determine to refinance your mortgage to a lower monthly payment, take the difference and add it to your new mortgage as an optional principal pre-payment. This can reduce the total number of payments and save you tens of thousands of dollars in interest expense.

Mortgage interest rates are dropping. They have fallen to 6% after being nearly 8% in October of 2023. With this large drop in interest rates you may be wondering if you should refinance your mortgage.

I use excel to determine if refinancing is worth it. I do this by comparing my current mortgage payment with the new mortgage payment after refinancing. I then calculate a pay-back period by dividing by closing costs by the monthly savings on my mortgage payment. If the payback period is short enough then its worth refinancing.

Only you get to choose what a short enough pay-back period is. I like to see pay-back periods of 3 years of less when refinancing a home.

I also compare the total interest paid on the current mortgage vs the refinanced mortgage.

Pro Tip: If you are used to paying a higher mortgage payment and determine to refinance your mortgage to a lower monthly payment, take the difference and add it to your new mortgage as an optional principal pre-payment. This can reduce the total number of payments and save you tens of thousands of dollars in interest expense.

0:06:01

0:06:01

0:13:51

0:13:51

0:04:23

0:04:23

0:03:17

0:03:17

0:07:44

0:07:44

0:05:59

0:05:59

0:12:02

0:12:02

0:10:45

0:10:45

0:00:30

0:00:30

0:01:01

0:01:01

0:02:30

0:02:30

0:00:38

0:00:38

0:15:05

0:15:05

0:07:50

0:07:50

0:09:53

0:09:53

0:02:56

0:02:56

0:09:24

0:09:24

0:10:48

0:10:48

0:00:25

0:00:25

0:01:27

0:01:27

0:19:37

0:19:37

0:12:55

0:12:55

0:01:01

0:01:01

0:03:13

0:03:13