filmov

tv

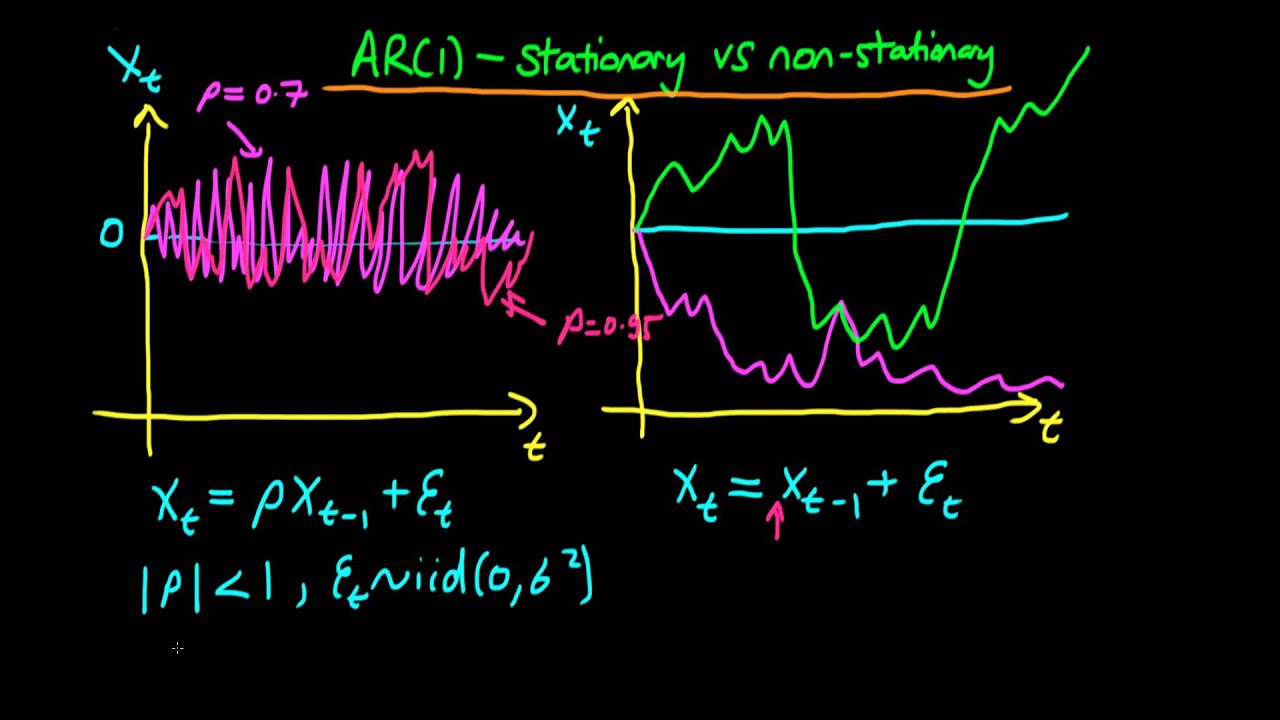

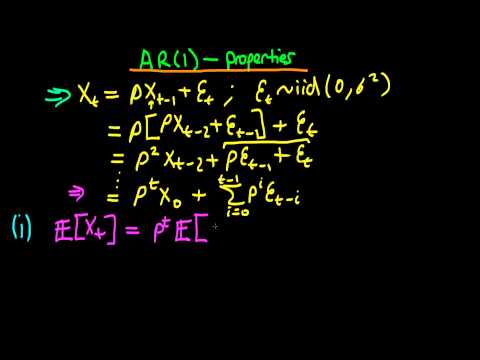

The qualitative difference between stationary and non-stationary AR(1)

Показать описание

This video explains the qualitative difference between stationary and non-stationary AR(1) processes, and provides a simulation at the end in Matlab/Octave to demonstrate the difference.

clear; close all; clc;

n=10000; % Setting the number of time periods equal to 10000.

b=1;

rho=1; %This is the coefficient on the lagged part of x

x=zeros(n,1); % Initialise the vector x

x(1)=0;

for i = 2:n

x(i)=rho*x(i-1)+b*randn();

end

zoom=1.0;

FigHandle = figure('Position', [750, 300, 1049*zoom, 895*zoom]);

plot(x, 'LineWidth', 1.4)

ylabel('X(t)')

xlabel('t')

I also include the same in R (Courtesy of Jesse Maurais):

z = rnorm(1000)

gen = function(rho) {

x = numeric(length(z))

x[1] = z[1]

for (i in 2:length(z)) {

x[i] = rho*x[i-1] + z[i]

}

x

}

display = function(rho) {

x = gen(rho)

lines(x)

}

for (it in 1:100) {

display(it/100)

clear; close all; clc;

n=10000; % Setting the number of time periods equal to 10000.

b=1;

rho=1; %This is the coefficient on the lagged part of x

x=zeros(n,1); % Initialise the vector x

x(1)=0;

for i = 2:n

x(i)=rho*x(i-1)+b*randn();

end

zoom=1.0;

FigHandle = figure('Position', [750, 300, 1049*zoom, 895*zoom]);

plot(x, 'LineWidth', 1.4)

ylabel('X(t)')

xlabel('t')

I also include the same in R (Courtesy of Jesse Maurais):

z = rnorm(1000)

gen = function(rho) {

x = numeric(length(z))

x[1] = z[1]

for (i in 2:length(z)) {

x[i] = rho*x[i-1] + z[i]

}

x

}

display = function(rho) {

x = gen(rho)

lines(x)

}

for (it in 1:100) {

display(it/100)

The qualitative difference between stationary and non-stationary AR(1)

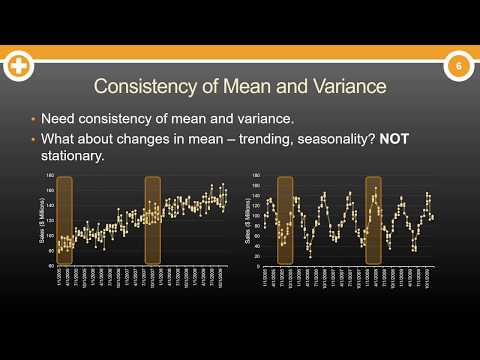

What is Stationarity

Time Series Talk : Stationarity

Time series and first differences

The difference between qualitative data and quantitative data

Stationary in mean

What is a Stationary Random Process?

Stationary Process | Strict Stationarity & Weak Stationarity || Time Series

Stationary series summary

Autoregressive order 1 process - conditions for stationary in mean

Conditions for stationary and weakly dependent series

Wave Reflection -- xmdemo 138

Stationarity & Seasonality| Time Series Forecasting #1|

What is stationarity ? How to make a series stationary? Stationarity in python-codes with example

Paper chromatography

Difference Between Stationary Vs Stationery | Stationary Vs Stationery Explanation, Usage & Exer...

Deterministic vs stochastic trends

Variance stationary processes

[Time Series] Weak Stationarity

Moving Average processes - Stationary and Weakly Dependent

Allen🔥 result celebration 🎉🎉 in front of akash institute😡😡 and PW vidhyapeeth😡😡 #allen #pw #akash...

Noun Poster, Noun chart #shorts #ytshorts #viral

Product Link in the Comments! 🖊️ Multi-Purpose Creative Pen Box 🖊️

Covariance stationary processes

Комментарии

0:07:57

0:07:57

0:05:01

0:05:01

0:10:02

0:10:02

0:08:13

0:08:13

0:00:42

0:00:42

0:05:03

0:05:03

0:04:04

0:04:04

0:11:32

0:11:32

0:04:08

0:04:08

0:03:49

0:03:49

0:04:37

0:04:37

0:01:12

0:01:12

0:09:13

0:09:13

0:07:07

0:07:07

0:00:27

0:00:27

0:27:04

0:27:04

0:05:07

0:05:07

0:04:11

0:04:11

![[Time Series] Weak](https://i.ytimg.com/vi/j6dmZqI0Bpw/hqdefault.jpg) 0:08:20

0:08:20

0:07:08

0:07:08

0:00:15

0:00:15

0:00:36

0:00:36

0:00:13

0:00:13

0:05:31

0:05:31