filmov

tv

Simulation Methods (FRM Part 1 2023 – Book 2 – Chapter 16)

Показать описание

*AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams*

After completing this reading you should be able to:

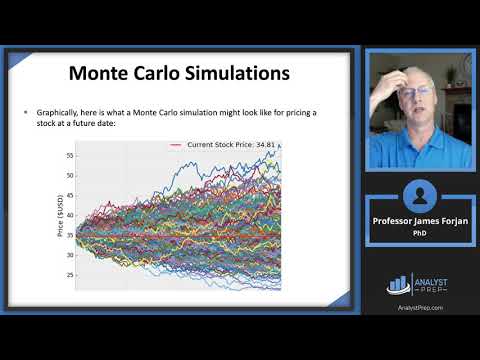

- Describe the basic steps to conduct a Monte Carlo simulation.

- Describe ways to reduce Monte Carlo sampling error.

- Explain how to use antithetic variate technique to reduce Monte Carlo sampling error.

- Explain how to use control variates to reduce Monte Carlo sampling error and when it is effective.

- Describe the benefits of reusing sets of random number draws across Monte Carlo experiments and how to reuse them.

- Describe the bootstrapping method and its advantage over Monte Carlo simulation.

- Describe the pseudo-random number generation method and how a good simulation design alleviates the effects the choice of the seed has on the properties of the generated series.

- Describe situations where the bootstrapping method is ineffective.

- Describe disadvantages of the simulation approach to financial problem solving.

Simulation Methods (FRM Part 1 2023 – Book 2 – Chapter 16)

FRM Part 1 Training for Monte Carlo Simulations

What Is Monte Carlo Simulation?

All About Value at Risk(VaR) | FRM Part 1 2023| Historical Simulation, Delta Normal, Monte Carlo VaR

Simulation Modeling : FRM 1 - GARP

Calculating and Applying VaR (FRM Part 1 2023 – Book 4 – Valuation and Risk Models – Chapter 2)...

FRM Part 1- Monte Carlo Simulation - Value at Risk

Operational Risk: Loss Distribution Approach | FRM Part 1 (Book 4) | Valuation and Risk Models)

Monte Carlo Variance Reduction using Antithetic Variates (FRM Part 1, Quantitative Analysis)

FRM - Three approaches to calculate VAR

Financial Risk Manager Part 1 Training | FRM Part 1 Video Tutorials | Introduction To FRM Part1

VaR and Expected Shortfall using Historical Simulation Approach (FRM Part 1, Book 4, VRM)

Replication Approach vs Bootstrapping Approach (FRM Part 1, Book 4, Valuation & Risk Models)

What is Monte Carlo Simulation?

Machine Learning Models FRM Part 1 | FRM Quantitative Analysis | K - Means | PCA

Bootstrapping | Bootstrap Resampling in Statistics | CFA Level 1 | FRM Part 1 | FRM Part 2

Modeling and Forecasting Trend (FRM Part 1 2023 – Book 2 – Chapter 10)

Historical VAR Calculation in Excel | FRM & CFA Preparation

Non-Parametric Approaches (FRM Part 2 2023 – Book 1 – Chapter 2)

FRM Part II - Non-parametric Approaches

Value at Risk Explained in 5 Minutes

FRM Part 1 Calculate Value at Risk and Expected Shortfall

Machine Learning Models | FRM Level 1 | New Topic | Fintelligents

FRM Part 1 &2 | Mind Maps | CFA | Product - Risk | Series 1

Комментарии

0:22:38

0:22:38

0:19:21

0:19:21

0:03:38

0:03:38

0:23:42

0:23:42

0:25:35

0:25:35

0:20:39

0:20:39

0:04:53

0:04:53

0:16:17

0:16:17

0:13:09

0:13:09

0:10:16

0:10:16

0:19:49

0:19:49

0:16:47

0:16:47

0:12:04

0:12:04

0:04:35

0:04:35

0:46:04

0:46:04

0:18:53

0:18:53

0:21:34

0:21:34

0:13:09

0:13:09

0:22:38

0:22:38

0:59:56

0:59:56

0:05:09

0:05:09

0:01:58

0:01:58

2:52:13

2:52:13

0:15:25

0:15:25