filmov

tv

Non-Parametric Approaches (FRM Part 2 2023 – Book 1 – Chapter 2)

Показать описание

*AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams*

After completing this reading you should be able to:

- Apply the bootstrap historical simulation approach to estimate coherent risk measures.

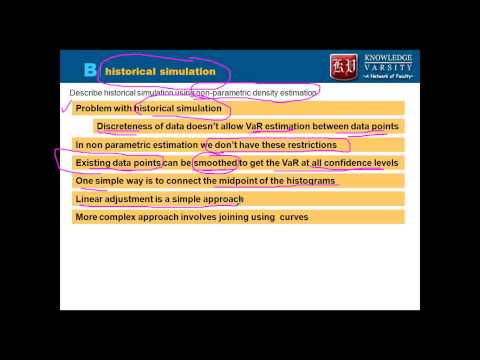

- Describe historical simulation using non-parametric density estimation.

- Compare and contrast the age-weighted, the volatility-weighted, the correlation-weighted, and the filtered historical simulation approaches.

- Identify advantages and disadvantages of non-parametric estimation methods.

FRM Part II - Non-parametric Approaches

Non-Parametric Approaches (FRM Part 2 2023 – Book 1 – Chapter 2)

FRM Part 2 - Market Risk - Non Parametric Approaches (Part 1 of 2)

FRM Part 2, 2023 | Market Risk Chapter 2 | Non Parametric Approach Part 1/2

FRM Part 2 AIM 32 Chapter 4 Non-parametric Approaches Part 1

Parametric Approaches : Extreme Value Theory | FRM Part 2 - Market Risk| GEV and POT Approaches

FRM Part 2 Training 2014 Market Risk Non Parametric Approaches

FRM Part 2 AIM 32 Chapter 4 Non-parametric Approaches Part 2

Value at Risk (VaR): Parametric Method Explained

FRM Part 2 AIM 32 Chapter 4 Non-parametric Approaches Part 3

FRM Part 2 AIM 32 Chapter 4 Non-parametric Approaches Part 4

FRM P2 [M] 2.Non-parametric Approaches

FRM Part 2 Training Parametric Approaches Extreme Values

FRM Part 2 | Crash Course Series - Chapter 4 - Backtesting VaR | Vardeez

Estimating Market Risk Measures FRM Part II 2023

FRM Level 2 - Market Risk Management | List of Important concepts for the Exam

Estimating Market Risk Measures (FRM Part 2 2023 – Book 1 – Chapter 1)

Parametric and Non-Parametric Tests of Independence (2024/2025 CFA® Level I Exam – QM – LM 9)

FRM Level 2 - Credit Decision | Full Chapter Covered | FRM Preparation #frm

Right Order of Preparation for FRM Part 2

10 Tips to Pass FRM Part 2 Exam

FRM - Three approaches to calculate VAR

The Ultimate Comparison: FRM Level 1 and FRM Level 2 | By Ganesh Nayak | Fintelligents

Wrong-way Risk (FRM Part 2 – Book 2 – Chapter 13 – CVA Part B)

Комментарии

0:59:56

0:59:56

0:33:24

0:33:24

0:37:59

0:37:59

0:12:31

0:12:31

0:36:36

0:36:36

0:09:42

0:09:42

0:12:31

0:12:31

0:03:57

0:03:57

0:12:31

0:12:31

0:12:31

0:12:31

![FRM P2 [M]](https://i.ytimg.com/vi/7jzQAS5UwZE/hqdefault.jpg) 1:59:41

1:59:41

0:06:19

0:06:19

0:31:51

0:31:51

0:58:29

0:58:29

0:19:04

0:19:04

0:33:18

0:33:18

0:28:24

0:28:24

1:33:53

1:33:53

0:09:22

0:09:22

0:14:40

0:14:40

0:10:16

0:10:16

0:05:50

0:05:50

0:40:15

0:40:15