filmov

tv

Calculating and Applying VaR (FRM Part 1 2023 – Book 4 – Valuation and Risk Models – Chapter 2)

Показать описание

*AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams*

After completing this reading, you should be able to:

- Explain and give examples of linear and non-linear derivatives.

- Describe and calculate VaR for linear derivatives.

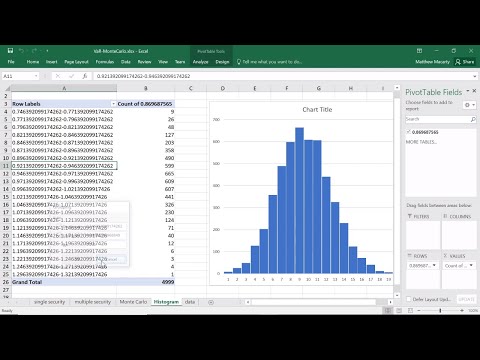

- Describe and explain the historical simulation approach for computing VaR and ES.

- Describe the delta-normal approach for calculating VaR for non-linear derivatives.

- Describe the limitations of the delta-normal method.

- Explain the full revaluation method for computing VaR.

- Compare delta-normal and full revaluation approaches for computing VaR.

- Explain structured Monte Carlo, stress testing, and scenario analysis methods for computing VaR, and identify strengths and weaknesses of each approach.

- Describe the implications of correlation breakdown for scenario analysis.

- Describe Worst-Case Scenario (WCS) analysis and compare WCS to VaR.

Calculating and Applying VaR (FRM Part 1 2023 – Book 4 – Valuation and Risk Models – Chapter 2)...

All About Value at Risk(VaR) | FRM Part 1 2023| Historical Simulation, Delta Normal, Monte Carlo VaR

Understanding Basic concept of Value at Risk (VaR) - Simplified

Var Revision (Mind Map preparation) | FRM

Value at Risk VaR Revision FRM Part I 2023

Historical VAR Calculation in Excel | FRM & CFA Preparation

VaR and Expected Shortfall using Historical Simulation Approach (FRM Part 1, Book 4, VRM)

Value at Risk (VAR) | Risk Management | CA Final SFM

7. Value At Risk (VAR) Models

FRM - Delta Normal Approach to Value at Risk (VaR)

Lognormal value at risk (VaR, FRM T5-01)

Value at Risk (VaR) In Python: Historical Method

Parametric Method: Value at Risk (VaR) In Excel

Historical Method: Value at Risk (VaR) In Excel

Marginal Incremental and Component VaR (Solved Example)(FRM Part 2, Book 5, Investment & Risk Mg...

Value At Risk (VaR) Explained | How to apply to day-trading and swing trading

VAR calculation using Historical Simulation Method

FRM - Value at Risk (VaR) of Linear Derivatives

FRM - Three approaches to calculate VAR

FRM Part 2 | Crash Course Series - Chapter 4 - Backtesting VaR | Vardeez

Monte Carlo Simulation of Value at Risk (VaR) in Excel

Monte Carlo Method: Value at Risk (VaR) In Excel

Value at Risk (VaR) Modeling by Historical Simulation Method - Full Series - Lecture 1

Value at Risk (VaR) In Python: Parametric Method

Комментарии

0:20:39

0:20:39

0:23:42

0:23:42

0:48:01

0:48:01

2:03:27

2:03:27

0:39:54

0:39:54

0:13:09

0:13:09

0:16:47

0:16:47

0:12:53

0:12:53

1:21:15

1:21:15

0:15:41

0:15:41

0:26:41

0:26:41

0:12:31

0:12:31

0:07:23

0:07:23

0:05:01

0:05:01

0:18:44

0:18:44

0:13:00

0:13:00

0:10:08

0:10:08

0:13:19

0:13:19

0:10:16

0:10:16

0:31:51

0:31:51

0:07:15

0:07:15

0:10:13

0:10:13

0:43:18

0:43:18

0:14:41

0:14:41