filmov

tv

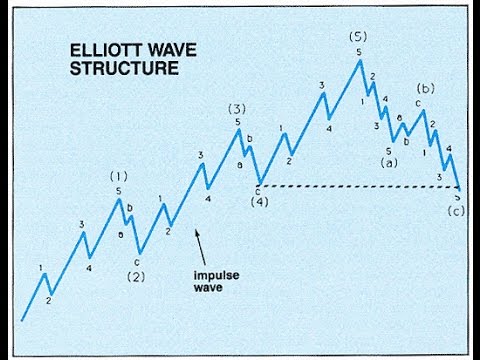

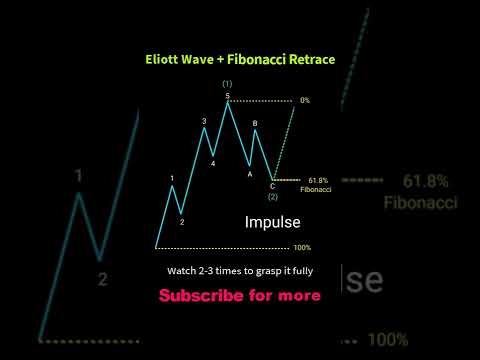

Problems with Elliot Wave Theory

Показать описание

✅ Please like, subscribe & comment if you enjoyed - it helps a lot!

Please note that this is just my opinion but I've found Elliot Wave absolutely phenomenal at predicting market movements once they've already happened, although you normally have to wait a a few years so they can redraw the lines properly... When I was doing work experience in London I heard about a client who went bankrupt following Elliot Wave when the market turned in 2009. Lost the whole of his account racking up short selling costs!

✅ Our channel sponsor for this month are Trade Nation meaning these guys are covering our costs of operation.

📜 Disclaimer 📜

81.7% of retail investors lose money when trading CFDs and spread betting with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Please note that this is just my opinion but I've found Elliot Wave absolutely phenomenal at predicting market movements once they've already happened, although you normally have to wait a a few years so they can redraw the lines properly... When I was doing work experience in London I heard about a client who went bankrupt following Elliot Wave when the market turned in 2009. Lost the whole of his account racking up short selling costs!

✅ Our channel sponsor for this month are Trade Nation meaning these guys are covering our costs of operation.

📜 Disclaimer 📜

81.7% of retail investors lose money when trading CFDs and spread betting with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Problems with Elliot Wave Theory

Why do you think Fibonacci Work? Problems with the Elliot Wave Theory

The World's Simplest Explanation of the Elliott Wave Theory

Elliott Waves - The Myth and Reality by Mr N Ramakrishnan Ramki

The 5 Biggest mistakes you can make when trading with Elliott Wave

Why Analysts Fails in Elliott Wave Theory Analysis? | Practical Application of Elliott Wave Theory

WHEN & HOW To Use ELLIOT WAVE THEORY

What is The Elliott Wave Theory?

What is The Elliot Wave Theory?

My Personal Winning Elliot Wave Theory Trading Strategy And Opinion

2 Rules Of Elliott Wave For Beginners - Wave Theory Trading

The Truth on Elliott Wave Forex Trading Impulsive waves

The Elliott Wave Theory - a fantasy or reality?

Elliot Wave Made Easy #shorts

The ULTIMATE Beginner's Guide to the ELLIOTT WAVE THEORY

I Tested Elliott Wave Theory with $1000 - How to Trade Elliot Wave Like a Pro - EASY STRATEGY

how to use Elliott wave theory in intraday trading strategies | share market price action analysis

How To Apply Elliott Wave Theory! 📈 #shorts

Elliott Wave Price Action Course | Wave Trading Explained (For Beginners)

🌌 Ellliott Wave Trading Strategy + Fibonacci Entry

Elliot wave Theory

Elliott Wave Theory for Beginners | ULTIMATE In-Depth Guide!

Dow Jones - Elliot Wave Theory predicting catastrophic crash in 2026

This Trading Strategy will Change Your LIFE 👀😬 1:8RR

Комментарии

0:04:02

0:04:02

0:02:55

0:02:55

0:16:29

0:16:29

0:07:52

0:07:52

0:15:31

0:15:31

0:52:29

0:52:29

0:12:23

0:12:23

0:01:32

0:01:32

0:01:53

0:01:53

0:11:15

0:11:15

0:00:40

0:00:40

0:00:29

0:00:29

1:03:36

1:03:36

0:00:39

0:00:39

0:35:38

0:35:38

0:10:23

0:10:23

0:00:15

0:00:15

0:00:55

0:00:55

0:10:49

0:10:49

0:00:16

0:00:16

0:02:48

0:02:48

0:36:59

0:36:59

0:11:19

0:11:19

0:00:59

0:00:59