filmov

tv

What is The Elliott Wave Theory?

Показать описание

Our word of the day is “Elliott Wave Theory”

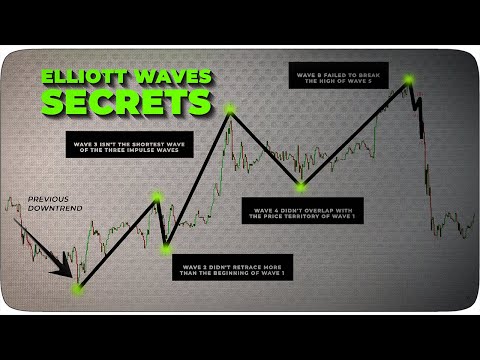

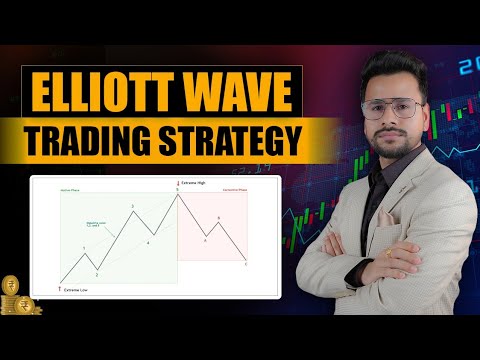

“The Wave Principle” was developed by Ralph Nelson Elliott’s, it is a discovery that social, or crowd, behavior trends and reverses in recognizable patterns. Using stock market data for the Dow Jones Industrial Average as his main research tool, Elliott discovered that the ever-changing path of stock market prices reveals a structural design that in turn reflects a basic harmony found in nature. From this discovery, he developed a rational system of market analysis.

Elliott Wave Principle measures investor psychology, which is the real engine behind the stock markets. When people are optimistic about the future of a given issue, they bid the price up.

Elliott isolated thirteen “waves,” or patterns of directional movement, that recur in markets and are repetitive in form, but are not necessarily repetitive in time or amplitude. He named, defined and illustrated the patterns. He then described how these structures link together to form larger versions of the same patterns, how those in turn are the building blocks for patterns of the next larger size, and so on. His descriptions constitute a set of empirically derived rules and guidelines for interpreting market action.

By Barry Norman, Investors Trading Academy

“The Wave Principle” was developed by Ralph Nelson Elliott’s, it is a discovery that social, or crowd, behavior trends and reverses in recognizable patterns. Using stock market data for the Dow Jones Industrial Average as his main research tool, Elliott discovered that the ever-changing path of stock market prices reveals a structural design that in turn reflects a basic harmony found in nature. From this discovery, he developed a rational system of market analysis.

Elliott Wave Principle measures investor psychology, which is the real engine behind the stock markets. When people are optimistic about the future of a given issue, they bid the price up.

Elliott isolated thirteen “waves,” or patterns of directional movement, that recur in markets and are repetitive in form, but are not necessarily repetitive in time or amplitude. He named, defined and illustrated the patterns. He then described how these structures link together to form larger versions of the same patterns, how those in turn are the building blocks for patterns of the next larger size, and so on. His descriptions constitute a set of empirically derived rules and guidelines for interpreting market action.

By Barry Norman, Investors Trading Academy

0:16:29

0:16:29

0:16:49

0:16:49

0:05:14

0:05:14

0:13:22

0:13:22

0:10:49

0:10:49

0:35:38

0:35:38

0:13:13

0:13:13

0:04:02

0:04:02

0:06:17

0:06:17

0:04:15

0:04:15

0:10:22

0:10:22

0:36:59

0:36:59

0:12:51

0:12:51

0:15:46

0:15:46

0:08:35

0:08:35

0:44:26

0:44:26

1:14:11

1:14:11

0:21:54

0:21:54

0:29:23

0:29:23

0:20:21

0:20:21

![Elliott Wave [LuxAlgo]](https://i.ytimg.com/vi/jZUadwHMtLQ/hqdefault.jpg) 0:08:41

0:08:41

0:16:13

0:16:13

0:07:43

0:07:43

0:04:23

0:04:23