filmov

tv

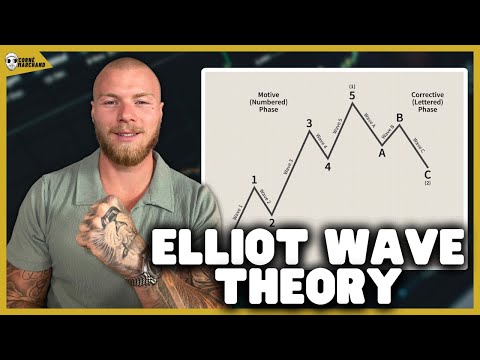

What is The Elliot Wave Theory?

Показать описание

Welcome to the Investors Trading Academy talking glossary of financial terms and events.

Our word of the day is “Elliot Wave Theory”

The ‘Elliot Wave Theory’, is named after Ralph Elliot. Having nothing in particular to fill his days, Elliot turned his attention to the stock market behavior and developed his theorem in later stages of life. Born an accountant, but retired at age 58 after catching a virus from a trip to South America. This is one of the oldest trading strategies, first published in 1938 as a book under the name ‘The Wave Principle’. Until that time, the general concept was that the market behaved in a chaotic manner and there were not many trading strategies if any existed.

Mr. Elliot analyzed around 70 years’ worth of stock prices data in his lifetime. He pointed out that the market was driven by human psychology including emotions, fear and greed, but it did not behave in a chaotic manner. Instead, the data showed that the market moved iteratively. Elliot then developed his based his theory on crowd psychology. It can be tedious to remain in the same mental state or mood, excepting those who have a pathological disorder of course. Thus, he came to a conclusion that group psychology switches back and forth from optimism to pessimism to optimism at varying levels. He applied this theory into the financial market, which strongly suggested that during strong up trends (market optimistic), there are intermittent intervals when the market ‘mood’ changes. At this point, the market participants sell the financial instruments that they have acquired and invest in them back at a cheaper price when the mood reverses again to optimistic. The opposite situation applies to a strong downtrend.

By Barry Norman, Investors Trading Academy - ITA

Our word of the day is “Elliot Wave Theory”

The ‘Elliot Wave Theory’, is named after Ralph Elliot. Having nothing in particular to fill his days, Elliot turned his attention to the stock market behavior and developed his theorem in later stages of life. Born an accountant, but retired at age 58 after catching a virus from a trip to South America. This is one of the oldest trading strategies, first published in 1938 as a book under the name ‘The Wave Principle’. Until that time, the general concept was that the market behaved in a chaotic manner and there were not many trading strategies if any existed.

Mr. Elliot analyzed around 70 years’ worth of stock prices data in his lifetime. He pointed out that the market was driven by human psychology including emotions, fear and greed, but it did not behave in a chaotic manner. Instead, the data showed that the market moved iteratively. Elliot then developed his based his theory on crowd psychology. It can be tedious to remain in the same mental state or mood, excepting those who have a pathological disorder of course. Thus, he came to a conclusion that group psychology switches back and forth from optimism to pessimism to optimism at varying levels. He applied this theory into the financial market, which strongly suggested that during strong up trends (market optimistic), there are intermittent intervals when the market ‘mood’ changes. At this point, the market participants sell the financial instruments that they have acquired and invest in them back at a cheaper price when the mood reverses again to optimistic. The opposite situation applies to a strong downtrend.

By Barry Norman, Investors Trading Academy - ITA

0:16:49

0:16:49

0:05:14

0:05:14

0:13:22

0:13:22

0:10:49

0:10:49

0:16:29

0:16:29

0:04:02

0:04:02

0:10:22

0:10:22

0:35:38

0:35:38

0:00:35

0:00:35

0:13:13

0:13:13

0:36:59

0:36:59

0:06:54

0:06:54

0:02:55

0:02:55

0:01:53

0:01:53

0:04:15

0:04:15

0:20:21

0:20:21

0:15:46

0:15:46

0:04:23

0:04:23

0:44:26

0:44:26

0:08:04

0:08:04

0:08:35

0:08:35

0:11:15

0:11:15

0:15:31

0:15:31

0:10:23

0:10:23