filmov

tv

Cash Value Life Insurance

Показать описание

Cash value life insurance is a type of permanent life insurance that combines a death benefit with a savings or investment component. When you pay your premiums, a portion goes towards the death benefit, which is paid out to your beneficiaries if you pass away. The rest goes into a cash value account that accumulates over time and earns interest. You can access the money in the cash value account while you are alive through loans or withdrawals.

One of the main advantages of cash value life insurance is that it provides both protection and a way to save for the future. The death benefit can provide financial security for your loved ones, while the cash value component can be used as a source of funds for various goals, such as saving for retirement, paying for education, or covering unexpected expenses.

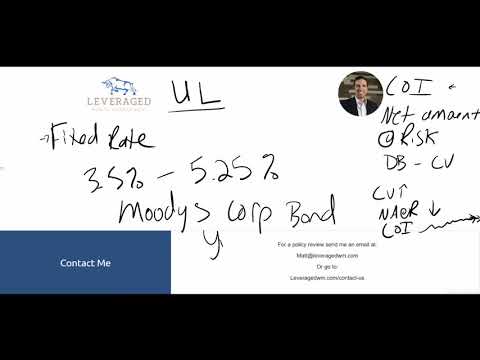

There are different types of cash value life insurance, including whole life, universal life, and variable life. Each type has its own features and risks, so it's important to carefully consider your options and speak with a financial professional before deciding which one is right for you.

Visit our website to learn more:

Listen to the Alliance Group Podcast!

Follow Alliance Group on Facebook, Instagram, TikTok, and more!

#AllianceGroup #lbam #LivingBenefits #shorts

Traditional life insurance only pays out if you die - that's really "death insurance", isn't it?

Modern Living Benefits life insurance policies also pay out while you're still alive if you get sick or injured... at no extra cost.

It's not more expensive, it's just more expansive.

The information contained in this video is not provided by a licensed attorney and it does not constitute legal advice. If you desire legal advice tailored to your specific estate planning needs, please consult a licensed attorney in your area.

The information contained in this video provides a general overview of different types of life insurance. Please contact your local life insurance agent to determine the best life insurance solutions for your specific financial and family needs.

One of the main advantages of cash value life insurance is that it provides both protection and a way to save for the future. The death benefit can provide financial security for your loved ones, while the cash value component can be used as a source of funds for various goals, such as saving for retirement, paying for education, or covering unexpected expenses.

There are different types of cash value life insurance, including whole life, universal life, and variable life. Each type has its own features and risks, so it's important to carefully consider your options and speak with a financial professional before deciding which one is right for you.

Visit our website to learn more:

Listen to the Alliance Group Podcast!

Follow Alliance Group on Facebook, Instagram, TikTok, and more!

#AllianceGroup #lbam #LivingBenefits #shorts

Traditional life insurance only pays out if you die - that's really "death insurance", isn't it?

Modern Living Benefits life insurance policies also pay out while you're still alive if you get sick or injured... at no extra cost.

It's not more expensive, it's just more expansive.

The information contained in this video is not provided by a licensed attorney and it does not constitute legal advice. If you desire legal advice tailored to your specific estate planning needs, please consult a licensed attorney in your area.

The information contained in this video provides a general overview of different types of life insurance. Please contact your local life insurance agent to determine the best life insurance solutions for your specific financial and family needs.

Комментарии

0:12:49

0:12:49

0:02:46

0:02:46

0:07:41

0:07:41

0:09:07

0:09:07

0:02:00

0:02:00

0:10:54

0:10:54

0:00:57

0:00:57

0:00:57

0:00:57

0:57:54

0:57:54

0:20:13

0:20:13

0:04:28

0:04:28

0:06:38

0:06:38

0:05:29

0:05:29

0:08:18

0:08:18

0:09:23

0:09:23

0:22:57

0:22:57

0:07:51

0:07:51

0:11:23

0:11:23

0:07:10

0:07:10

0:14:23

0:14:23

0:01:00

0:01:00

0:08:06

0:08:06

0:17:34

0:17:34

0:07:08

0:07:08