filmov

tv

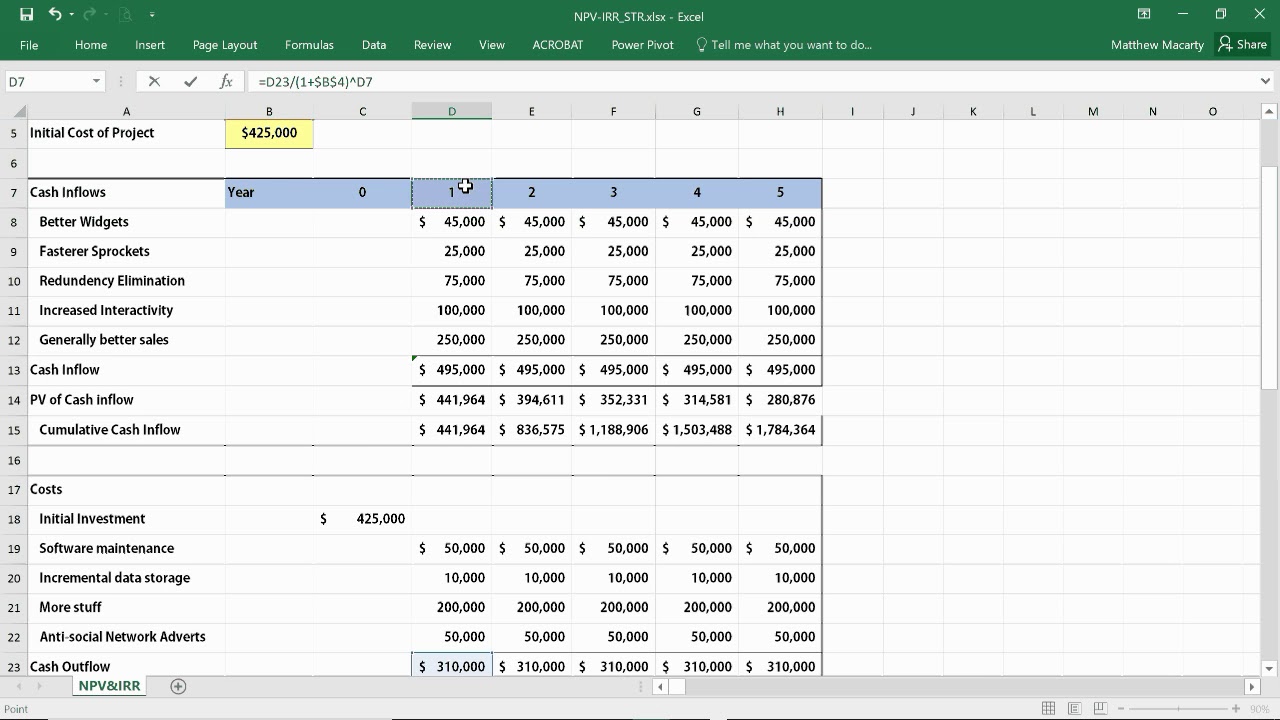

How to Calculate NPV, IRR & ROI in Excel || Net Present Value || Internal Rate of Return

Показать описание

#npv #irr #excel

Please SUBSCRIBE:

Tutorial demonstrating how to calculate NPV, IRR, and ROI for an investment. Demonstrates manual calculation of present values as well as the use of NPV and IRR functions in Excel. The spreadsheet used can be downloaded at:

Capital Budgeting includes the analysis of various projects with financial measurements such as Net Present Value (NPV), Internal Rate of Return (IRR) and Return on Investment (ROI). This video discusses all of these concepts briefly while demonstrating the calculation of them using Excel.

Excel Functions:

NPV

IRR

Please SUBSCRIBE:

Tutorial demonstrating how to calculate NPV, IRR, and ROI for an investment. Demonstrates manual calculation of present values as well as the use of NPV and IRR functions in Excel. The spreadsheet used can be downloaded at:

Capital Budgeting includes the analysis of various projects with financial measurements such as Net Present Value (NPV), Internal Rate of Return (IRR) and Return on Investment (ROI). This video discusses all of these concepts briefly while demonstrating the calculation of them using Excel.

Excel Functions:

NPV

IRR

How to Calculate NPV and IRR in Excel

NPV and IRR explained

Finding NPV and IRR: Using BA II Plus Financial Calculator

Net Present Value - NPV, Profitability Index - PI, & Internal Rate of Return - IRR Using Excel

How to Calculate NPV, IRR & ROI in Excel || Net Present Value || Internal Rate of Return

BA II Plus | Cash Flows 1: Net Present Value (NPV) and IRR Calculations - DCF

🔴 3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

Internal Rate of Return (IRR)

How to calculate the Net Present value (NPV)

How to Calculate NPV and IRR in Excel #finance #exceltutorial

How To Calculate NPV And IRR In Excel

#4 Net Present Value (NPV) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

Net Present Value (NPV) explained

Internal Rate of Return (IRR) - Excel

NPV (Net Present Value) - Excel

How to calculate the internal rate of return (IRR)

How to Calculate NPV (Net Present Value) in Excel

Capital Budgeting Techniques in English - NPV, IRR , Payback Period and PI, accounting

Calculate NPV, BCR and IRR for Cost/Benefit Analysis

CFA® Level I Corporate Finance - NPV and IRR

NPV & IRR Calculator Excel Template | Calculate NPV IRR in Excel!

#5 Internal Rate of Return (IRR) - Investment Decision - Financial Management ~ B.COM / CMA / CA

Computing NPV and IRR on HP 12c

NPV And IRR Explained | BA II Plus

Комментарии

0:04:28

0:04:28

0:06:48

0:06:48

0:02:35

0:02:35

0:18:22

0:18:22

0:08:31

0:08:31

0:02:53

0:02:53

0:03:27

0:03:27

0:04:46

0:04:46

0:07:27

0:07:27

0:00:56

0:00:56

0:04:15

0:04:15

0:18:50

0:18:50

0:05:26

0:05:26

0:00:27

0:00:27

0:01:00

0:01:00

0:10:00

0:10:00

0:02:56

0:02:56

0:29:50

0:29:50

0:09:35

0:09:35

0:08:52

0:08:52

0:03:22

0:03:22

0:13:38

0:13:38

0:03:05

0:03:05

0:08:03

0:08:03