filmov

tv

STOP Doing This When You Receive Payments in Quickbooks Desktop

Показать описание

This video I show you how to stop doing this when you receive payments in Quickbooks Desktop. I also show you a cool way to bypass Undeposited Funds so you can save time when you receive payments and make deposits.

Stop People Pleasing and Start Doing What's Right For You - Jordan Peterson

Stop Doing What You Do

“Do You Ever Stop Yapping?”☝🏻

At What Age Should You Stop Doing These Things?

STOP DOING MATH (@WTMMP)

Stop Doing '3 Sets of 12' To Build Muscle (I'M BEGGING YOU!)

STOP DOING THIS WHEN MAKING MUSIC ASAP #shorts

STOP Doing THIS While You Run!!!

STOP DOING THIS WHILE PRAYING, AND YOU'LL HEAR GOD || APOSTLE MICHAEL OROKPO

Stop Doing 100 Pushups a Day - I’m Begging You!!

Untold - Stop What You're Doing (James Blake Remix)

10 Things You Can Do To Stop Overthinking

NO STOP WHAT ARE YOU DOING | Markiplier The Boys | Meme

STOP Fighting Your Mind and Do This Instead | Michael A.Singer

9 Habits The Stoics Want You To Stop Doing

STOP DOING THIS

STOP Doing This To Win More Tackles!

Stop doing vs Stop to do - English In A Minute

Stop Doing These Minecraft Mistakes!

How Do You Stop

Stop Doing “3 Sets of 12” To Build Muscle (DO THIS INSTEAD!)

How Do You Stop (7' Edit)

STOP Doing Squats Like This (SAVE YOUR JOINTS!)

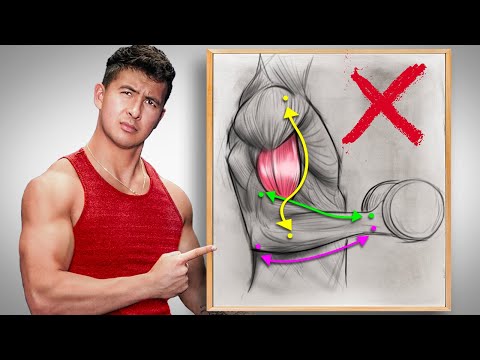

STOP Doing Bicep Curls Like This (5 Mistakes Slowing Your Gains)

Комментарии

0:01:00

0:01:00

0:02:47

0:02:47

0:00:07

0:00:07

0:00:51

0:00:51

0:00:48

0:00:48

0:10:08

0:10:08

0:00:26

0:00:26

0:04:42

0:04:42

0:09:46

0:09:46

0:05:59

0:05:59

0:03:47

0:03:47

0:07:18

0:07:18

0:00:23

0:00:23

0:21:14

0:21:14

0:10:00

0:10:00

0:00:23

0:00:23

0:00:29

0:00:29

0:00:52

0:00:52

0:09:56

0:09:56

0:04:10

0:04:10

0:12:45

0:12:45

0:04:07

0:04:07

0:10:12

0:10:12

0:07:34

0:07:34