filmov

tv

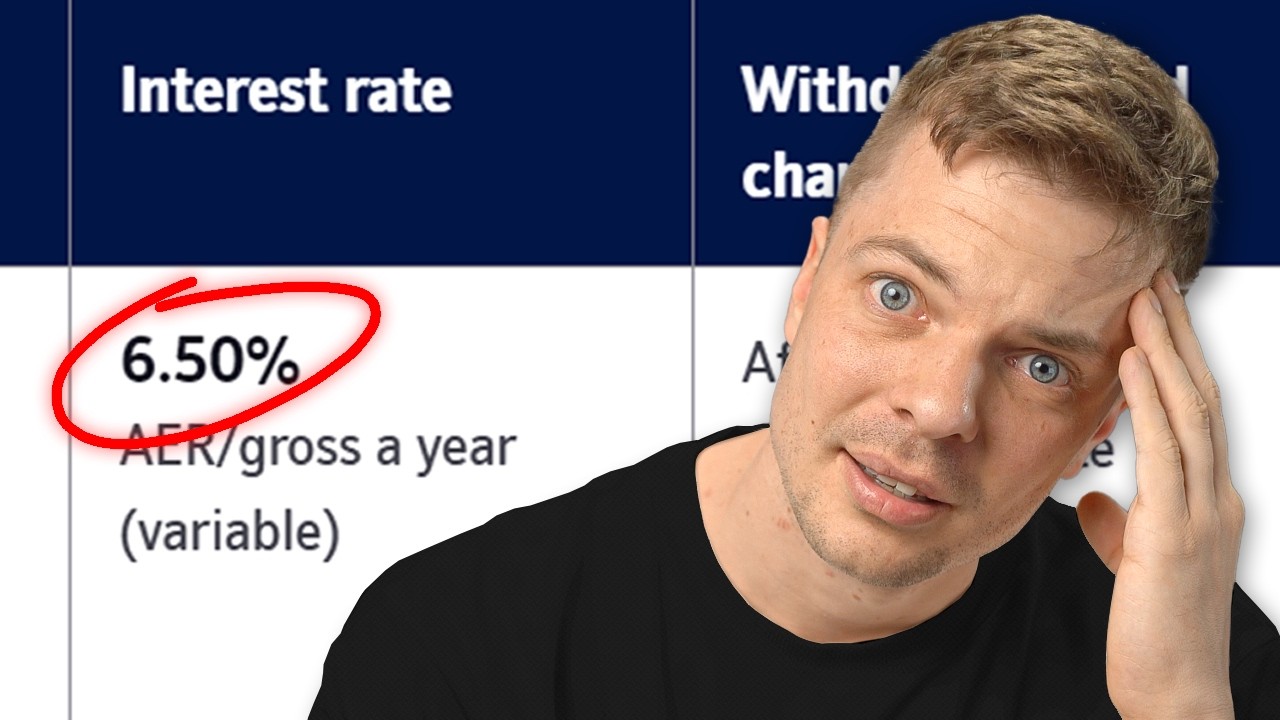

Should You Use a Cash ISA?

Показать описание

Cash ISAs are the most popular among the range of Individual Savings Accounts. They hold more than £300 billion, growing at a rate of £30 billion a year, but most people are using them for the wrong reasons

Here is the tax email

The brokers I use: 📈

Trading 212

If you do not get your free share after depositing £1. Use promo code DAMIEN, you will find it in the section with the three lines in the bottom right corner of the app.

InvestEngine

Get a Welcome Bonus of up to £50 when you invest at least £100 with InvestEngine

Vanguard

This is not an affiliate link

Financial education resources:

DISCLAIMER: Some of these links may be affiliate links. If you purchase a product or service using one of these links, I will receive a small commission from the seller. There will be no additional charge for you. Free shares can be fractional.

This video does not represent financial advice, and I am not a financial advisor. When investing, your capital is at risk. Investments can rise and fall and you may get back less than you invested. Past performance is no guarantee of future results.

Timestamps:

00:00 - £280 Billion

00:39 - 69% of wealth

02:25 - Cash ISA popularity

03:14 - Nominal value

04:20 - Taxation

06:50 - When to use ISA instead of a savings account

08:05 - Savings problem

09:50 - Financial education

10:47 - Uses for a Cash ISA

11:01 - Inflation

Here is the tax email

The brokers I use: 📈

Trading 212

If you do not get your free share after depositing £1. Use promo code DAMIEN, you will find it in the section with the three lines in the bottom right corner of the app.

InvestEngine

Get a Welcome Bonus of up to £50 when you invest at least £100 with InvestEngine

Vanguard

This is not an affiliate link

Financial education resources:

DISCLAIMER: Some of these links may be affiliate links. If you purchase a product or service using one of these links, I will receive a small commission from the seller. There will be no additional charge for you. Free shares can be fractional.

This video does not represent financial advice, and I am not a financial advisor. When investing, your capital is at risk. Investments can rise and fall and you may get back less than you invested. Past performance is no guarantee of future results.

Timestamps:

00:00 - £280 Billion

00:39 - 69% of wealth

02:25 - Cash ISA popularity

03:14 - Nominal value

04:20 - Taxation

06:50 - When to use ISA instead of a savings account

08:05 - Savings problem

09:50 - Financial education

10:47 - Uses for a Cash ISA

11:01 - Inflation

Комментарии

0:07:50

0:07:50

0:08:57

0:08:57

0:00:56

0:00:56

0:04:31

0:04:31

0:04:17

0:04:17

0:12:58

0:12:58

0:05:42

0:05:42

0:06:03

0:06:03

0:03:01

0:03:01

0:18:25

0:18:25

0:14:13

0:14:13

0:16:54

0:16:54

0:00:38

0:00:38

0:06:15

0:06:15

0:12:49

0:12:49

0:06:37

0:06:37

0:09:04

0:09:04

0:03:35

0:03:35

0:03:09

0:03:09

0:00:33

0:00:33

0:00:59

0:00:59

0:13:04

0:13:04

0:01:00

0:01:00

0:01:00

0:01:00